According to a report by the Bureau of Transportation Statistics, China is one of the dominant markets for producing passenger cars and commercial vehicles. The rising vehicle production resulted in the adoption of automation in the automotive industry. Automation and the use of industrial robots increase the operational efficiency and productivity in automotive assembly plants. Industrial robots increase the productivity of manufacturing operations and positively impact industrial competitiveness. Further, there is an inverse relationship between industrial robot density and work hours, i.e., an increase in industrial robot density results in decreased work hours. According to the report published by the International Federation of Robotics in 2022, the total annual robot installations worldwide reached 517,385 units in 2021, a rise of 31% compared to 2020. The automotive industry registered ~119,000 units of annual robot installations worldwide, accounting for 23% of total robot installations in 2021, significantly driven by the component supplier segment. According to a press release by the International Federation of Robotics in 2023, robot density in South Korea was estimated at 2,867 industrial robots per 10,000 employees, whereas in China, robot installations in the automotive industry reached 61,598 units in 2021, accounting for 52% of global robot installation share. Industrial robots perform diverse operations, from material handling, assembly, and welding to finishing and palletizing applications. Robotic components are subjected to extensive movement, high heat, high speed, and friction, thus requiring periodic inspection and servicing. The automotive industry requires optimized robotics lubricants that are tolerant to extreme temperatures, can minimize downtime, and help achieve long service intervals. Thus, the increasing demand for robots in the automotive industry is driving the Asia Pacific robotics lubricants market.

According to the report by the International Federation of Robotics Statistical Department 2022, Asia marks the presence of 206 (25%) out of the global 828 classified professional service robot producers. In 2021, 74% of 380,911 units of globally deployed robots were installed in Asia. Moreover, a significant demand for robots from the electronics sector was witnessed in the region, accounting for 123,800 installations in 2021, a rise of 22% compared to 2020. The automotive industry accounted for 72,600 robotic installations, whereas the metal & machinery sector registered 36,400 robotic installations in 2021. The robotic installations in Asia and Australia cumulatively accounted for 33% growth compared to 2020, reaching 354,500 units of robotic installations in 2021. The region is home to major robot manufacturers and suppliers, namely, ABB Ltd, Asic Robotics AG, Stellantis NV, Denso Wave Inc, Fanuc Corporation, Hirata Corporation, Janome Corporation, Mitsubishi Electric Corporation, Stäubli International AG, Toshiba Infrastructure Systems & Solutions Corporation, Yamaha Motor Co Ltd, and Yaskawa Electric Corp, among others. Robots are used in various applications such as loading, receiving, assembly, packaging, handling, sorting, component employment, inspection, and other automation. High-speed and continuous operations of robots lead to wear and tear of components, which require service intervals and maintenance schedules. The service and maintenance involve the lubrication of robotic components such as joints, reducers, bearings, and gears with robotic oils and greases. Asia Pacific also marks the presence of major robotic lubricant producers such as Idemitsu Kosan Co Ltd, Anand Engineers Pvt Ltd, BP plc, Kuka Robotics Australia Pty Ltd, ASV Multichemie Pvt Ltd, and Shell International BV, among others. Thus, growing robotic installations, as well as the presence of robot manufacturers, are expected to boost the demand for robotics lubricants in the region during the forecast period.

Strategic insights for the Asia Pacific Robotics Lubricants provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Robotics Lubricants refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Robotics Lubricants Strategic Insights

Asia Pacific Robotics Lubricants Report Scope

Report Attribute

Details

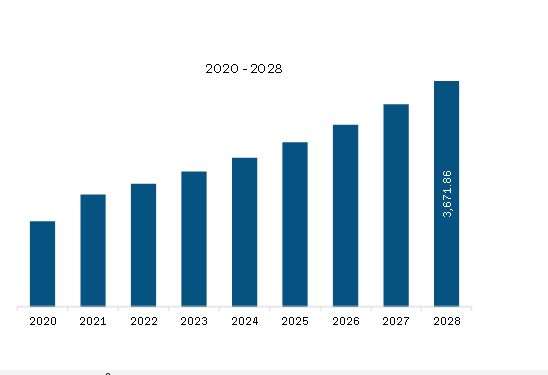

Market size in 2022

US$ 1,995.89 Million

Market Size by 2028

US$ 3,671.86 Million

Global CAGR (2022 - 2028)

10.7%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Base Oil

By Product Type

By End Use Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Robotics Lubricants Regional Insights

Asia Pacific Robotics Lubricants Market Segmentation

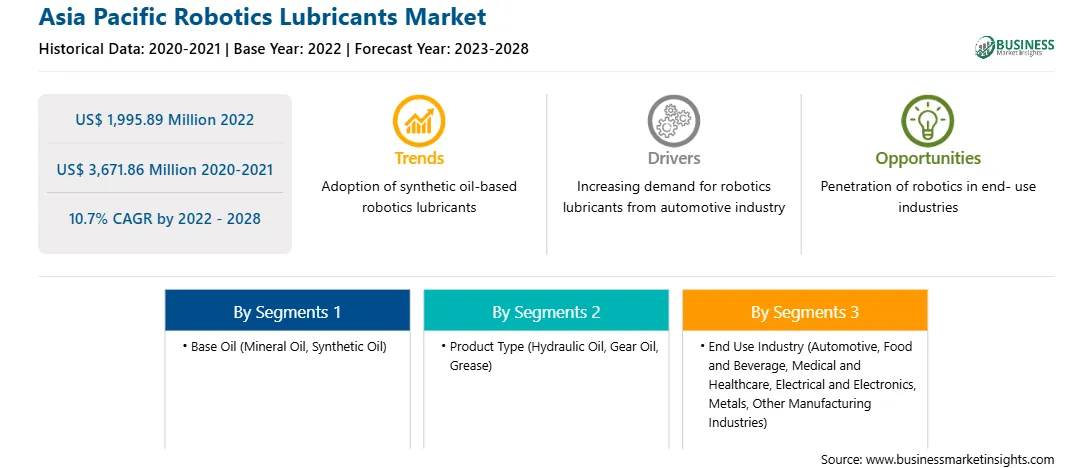

The Asia Pacific Robotics lubricants market is segmented into base oil, product type, end use industry, and country.

Based on base oil, the Asia Pacific robotics lubricants market is segmented into mineral oil, synthetic oil, and others. In 2022, the mineral oil segment registered a largest share in the Asia Pacific robotics lubricants market.

Based on product type, the Asia Pacific robotics lubricants market is segmented into hydraulic oil, gear oil, and grease. In 2022, the grease segment registered a largest share in the Asia Pacific robotics lubricants market.

Based on end use industry, the Asia Pacific robotics lubricants market is segmented into automotive, food and beverage, medical and healthcare, electrical and electronics, metals, and other manufacturing industries. In 2022, the automotive segment registered a largest share in the Asia Pacific robotics lubricants market.

Based on country, the Asia Pacific robotics lubricants market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. In 2022, China segment registered a largest share in the Asia Pacific robotics lubricants market.

Anand Engineer Pvt Ltd, ASV Multichemie Pvt Ltd, BP Plc, Fuchs Petrolub SE, Idemitsu Kosan Co Ltd, Kluber Lubrication GmbH & Co KG, Schaeffler Austria GmbH, and Shell Plc are the leading companies operating in the Asia Pacific robotics lubricants market.

The Asia Pacific Robotics Lubricants Market is valued at US$ 1,995.89 Million in 2022, it is projected to reach US$ 3,671.86 Million by 2028.

As per our report Asia Pacific Robotics Lubricants Market, the market size is valued at US$ 1,995.89 Million in 2022, projecting it to reach US$ 3,671.86 Million by 2028. This translates to a CAGR of approximately 10.7% during the forecast period.

The Asia Pacific Robotics Lubricants Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Robotics Lubricants Market report:

The Asia Pacific Robotics Lubricants Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Robotics Lubricants Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Robotics Lubricants Market value chain can benefit from the information contained in a comprehensive market report.