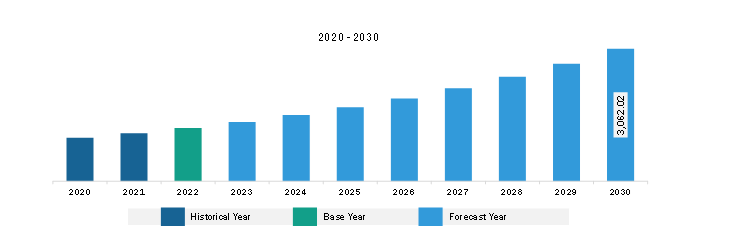

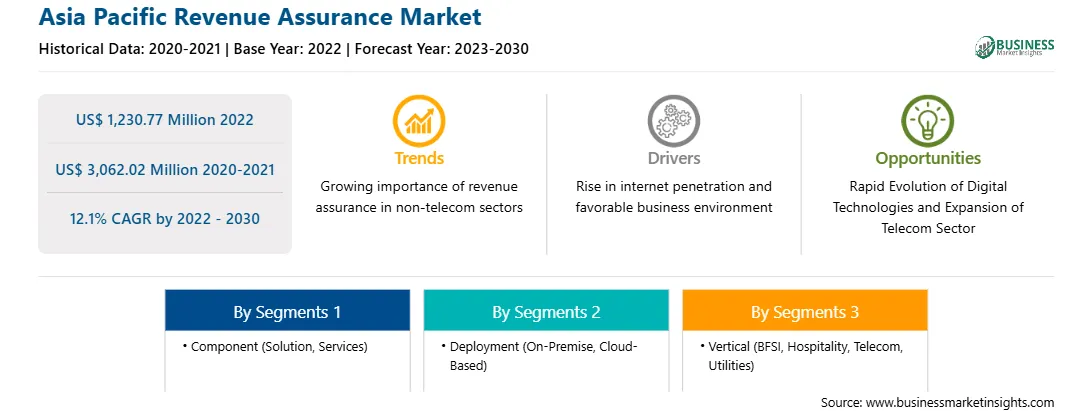

The Asia Pacific revenue assurance market was valued at US$ 1,230.77 million in 2022 and is expected to reach US$ 3,062.02 million by 2030; it is estimated to record a CAGR of 12.1% from 2022 to 2030. Rapid Evolution of Digital Technologies Boosts Asia Pacific Revenue Assurance Market

Technological advancements have revolutionized various industries, and the revenue assurance market is no exception. With the rapid evolution of digital technologies such as machine learning and artificial intelligence, the revenue assurance market has been presented with new opportunities to enhance its effectiveness and drive business growth. Technology is crucial in revenue assurance as it provides innovative tools and solutions to monitor, analyze, and optimize revenue streams. It enables businesses to streamline processes, identify revenue leakages, and ensure compliance with regulatory standards. Embracing technological advancements in revenue assurance can lead to improved operational efficiency, increased revenue generation, and enhanced customer satisfaction.

Predictive analytics leverages historical and real-time data to forecast future revenue patterns, identify potential revenue leakages, and mitigate risks. By employing advanced algorithms and machine learning techniques, revenue assurance teams can predict revenue trends, identify potential areas of revenue loss, and implement preventive measures before issues arise. This proactive approach helps businesses optimize revenue streams and minimize financial risks. Furthermore, blockchain technology offers a transparent and secure platform for revenue assurance. By leveraging blockchain's decentralized ledger system, businesses can ensure the integrity and immutability of revenue-related data. This technology enables secure and tamper-proof recording of transactions, simplifies revenue reconciliation processes, and enhances stakeholder trust. Blockchain facilitates faster settlement processes, reducing revenue leakage caused by delayed payments or disputes.

Technological advancements, particularly in big data and machine learning (ML), are revolutionizing the revenue assurance market. These advancements empower businesses to manage and optimize their revenue streams effectively, leading to increased profitability and operational efficiency. Big data analytics allow organizations to gather and analyze vast amounts of data from various sources, including customer transactions, billing systems, and network operations. Using advanced analytics techniques, businesses can gain valuable insights into their revenue generation processes, identify potential revenue leakages, and proactively address them. This proactive approach helps minimize financial losses and ensures accurate billing and revenue recognition.

Machine learning (ML) plays a crucial role in revenue assurance by automating complex data analysis tasks and detecting anomalies or deviations in revenue patterns. ML algorithms can analyze historical data, identify trends, and predict potential revenue risks. This enables businesses to take preventive measures and implement proactive strategies to mitigate revenue losses. For this, various countries and global players are focused on infusing AI technology into their workflow. Various countries are on track to becoming the premier artificial intelligence (AI) hub by 2030. In addition, as per the International Trade Administration report, the AI global funding doubled to US$ 66.8 billion in 2021 compared to 2020. This signifies the immense potential and opportunities that AI brings to the business landscape globally and highlights the growth across several industries with AI-driven innovation and developmentAsia Pacific Revenue Assurance Market Overview

The Asia Pacific market is segmented into Australia, Japan, China, South Korea, India, and the Rest of Asia Pacific. It is experiencing substantial growth in the revenue assurance market. Rapidly growing economies in the region have surged the demand for telecommunication services and financial products. This complexity necessitates robust revenue assurance solutions to prevent revenue leakage and maintain financial integrity. In addition, to satisfy digital demands and habits, consumers have increased their use of digital services such as eCommerce, digital financial services, and videoconferencing. Businesses are also purchasing ICT solutions such as Big Data, cloud computing, and security to support their remote workers. In the digital age, connectivity is necessary for both individuals to stay in touch and businesses to carry on with their activities.

In July 2023, Telecom operators in APAC are estimated to invest US$ 259 billion on networks between 2023 and 2030, with most of it on 5G deployments, according to the GSMA's Mobile Economy Asia Pacific 2023 report. Furthermore, the growing adoption of 5G technology, cloud-based services, digital transactions, and complex financial products increases the need for advanced revenue assurance tools to ensure accurate billing and compliance. Moreover, businesses across industries are increasingly recognizing the value of investing in robust revenue assurance solutions to protect their financial health and ensure accurate billing. Thus, the APAC revenue assurance market is poised for strong growth, fueled by rapid digitalization, stringent regulations, and growing awareness of revenue leakage risks.

Asia Pacific Revenue Assurance Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Revenue Assurance provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Revenue Assurance refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Revenue Assurance Strategic Insights

Asia Pacific Revenue Assurance Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,230.77 Million

Market Size by 2030

US$ 3,062.02 Million

Global CAGR (2022 - 2030)

12.1%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Component

By Deployment

By Vertical

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Revenue Assurance Regional Insights

Asia Pacific Revenue Assurance Market Segmentation

The Asia Pacific revenue assurance market is categorized into components, deployment, organization size, vertical, and country.

Based on component, the Asia Pacific revenue assurance market is bifurcated into solution and services. The solution segment held a larger market share in 2022.

Based on deployment, the Asia Pacific revenue assurance market is bifurcated into on-premises and cloud-based. The cloud-based segment held a larger market share in 2022.

Based on organization size, the Asia Pacific revenue assurance market is bifurcated into SMEs and large enterprises. The large enterprises segment held a larger market share in 2022.

Based on vertical, the Asia Pacific revenue assurance market is categorized into BFSI, hospitality, telecom, utilities, and others. The telecom segment held the largest market share in 2022.

By country, the Asia Pacific revenue assurance market is segmented into Australia, China, India, Japan, South Korea, New Zealand, and the Rest of Asia Pacific. China dominated the Asia Pacific revenue assurance market share in 2022.

Nokia Corp, Tata Consultancy Services Ltd, Amdocs, Subex, Araxxe SAS, Panamax Inc, Adapt IT Holding Proprietary Ltd, and Latro Services Inc are some of the leading companies operating in the Asia Pacific revenue assurance market.

1. Nokia Corp

2. Tata Consultancy Services Ltd

3. Amdocs

4. Subex Ltd

5. Araxxe SAS

6. Panamax Inc

7. Adapt IT Holdings Proprietary Ltd

8. LATRO Services Inc

The Asia Pacific Revenue Assurance Market is valued at US$ 1,230.77 Million in 2022, it is projected to reach US$ 3,062.02 Million by 2030.

As per our report Asia Pacific Revenue Assurance Market, the market size is valued at US$ 1,230.77 Million in 2022, projecting it to reach US$ 3,062.02 Million by 2030. This translates to a CAGR of approximately 12.1% during the forecast period.

The Asia Pacific Revenue Assurance Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Revenue Assurance Market report:

The Asia Pacific Revenue Assurance Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Revenue Assurance Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Revenue Assurance Market value chain can benefit from the information contained in a comprehensive market report.