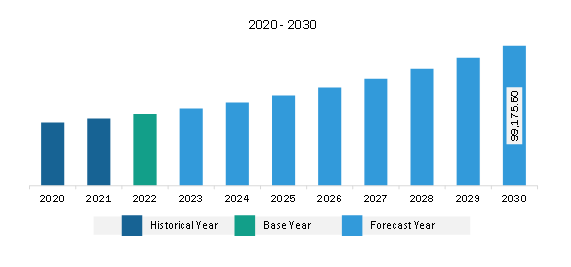

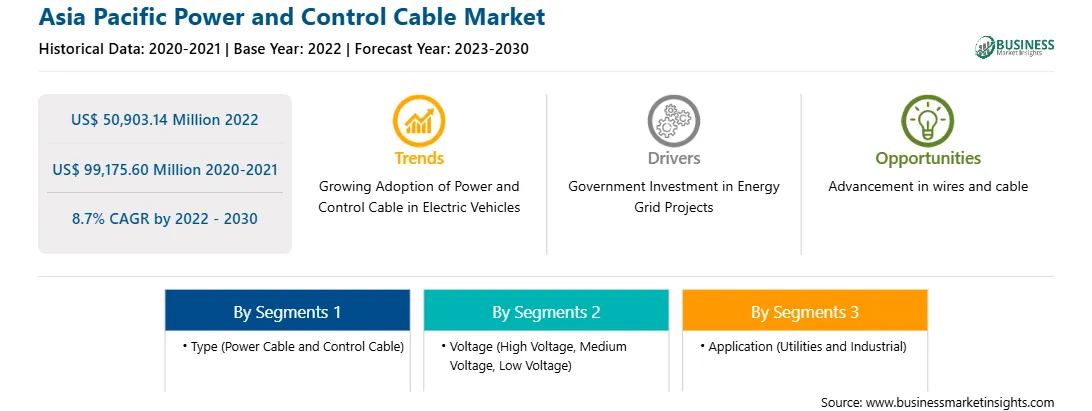

The Asia Pacific power and control cable market was valued at US$ 50,903.14 million in 2022 and is expected to reach US$ 99,175.60 million by 2030; it is estimated to grow at a CAGR of 8.7% from 2022 to 2030.

Government Norms on Developing Transmission & Distribution Sector Fuels the Asia Pacific Power and Control Cable Market

Several governments across the world are taking initiatives regarding the development of transmission and distribution sector. For instance, in 2023, a collaborative agreement of US$ 5.3 billion was announced by the federal and state governments of Australia to support eight vital transmission systems and renewable energy zone projects. This investment was a part of the country's Rewiring the Nation policy, which is focused on spending US$ 11 billion to modernize the country's electricity grid and infrastructure. Also, in 2022, India announced plans to spend US$ 17.1 billion by 2026-2027 to establish interstate transmission networks (ISTS) for the evacuation of renewable energy, and another US$ 2.8 billion till 2030. Government initiatives regarding the transmission & distribution sector drive the power and control cable market growth.

Asia Pacific Power and Control Cable Market Overview

Per data from IEA, APAC is the largest producer and consumer of electricity. The region hosts several of the world's largest manufacturing hubs and industrial sites. Countries such as China and India are the two most populous countries of the world and thus consume considerably more electricity than smaller nations. China's power generation capability has supported the country's industrial and overall growth over the past two decades. Power consumption has risen more than 6-fold between 2000 and 2021, making the country's power generation capacity the largest in the world and contributing to about a third of the world's electricity generated. In 2021, China began construction on 33 gigawatts of coal-based power generation, and in 2022, approved 8.63 gigawatts of additional coal plants. However, China's zero-COVID policy weighed heavily on its economic activity in 2022, and uncertainty remains over the pace of its electricity demand growth. IEA estimated electricity demand to have risen by 2.6% in 2022, substantially below the pre-pandemic average of over 5% from 2015 to 2019. While such factors hampered the demand for power cable, sustained growth of the industrial sector contributed to the country's power and control cable market.

In India, the transmission system has expanded over the years to distribute power from generating stations to load centers through intrastate and interstate transmission systems. The transmission system links the distribution system with the generating stations, and thus plays a key role in the power supply to the consumers. In April 2023, the Government of India announced plans to expand from 4,25,500 circuit kilometers (ckm) (existing as of May 31, 2020) to 4,54,200 ckm by 2024-2025, resulting in an addition of ~28,700 ckm under the Gati Shakti Master Plan. The addition was proposed in the Interstate Transmission System (ISTS) network and for 220kV and above voltage levels. Similarly, in February 2023, state-owned Power Grid Corporation was awarded five interstate electricity transmission projects through a tariff-based competitive bidding route, which will be completed on the build, own, operate, and transfer (BOOT) basis. In December 2022, the country announced plans worth US$ 29.6 billion to build transmission lines and connect renewable generation, aiming to triple its renewable energy capacity by 2030. All such factors are anticipated to boost the demand for various power and control cables in the country during the forecast period.

Japan and South Korea are two of the leading countries in automotive manufacturing. Automotive manufacturing accounts for 89% of Japan's manufacturing sector. Additionally, both countries have been rapidly adopting EVs, leading to a growth of associated industries and infrastructure. For instance, in August 2022, the Ministry of Economy, Trade and Industry of Japan estimated the requirement for an investment of more than US$ 24 billion to develop a competitive manufacturing base for batteries that can be used in electric vehicles (EVs) and energy storage systems. In South Korea, to promote the adoption of EVs, the government is providing subsidies to the citizens to purchase EVs. In February 2023, the government announced its plan to raise the number of subsidized EVs by 34%, from 160,000 units in 2022 to 215,000 cars in 2023. Further, according to the Ministry of Environment and Industry statistics, full subsidy support will be provided to vehicles priced at less than US$ 46,462 in South Korea. The rise in demand for EVs is encouraging the establishment of charging infrastructure across both countries, thus promoting the need for power cables. Thus, the expansion of the automotive sector is boosting the demand for power and control cables.

Asia Pacific Power and Control Cable Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Power and Control Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 50,903.14 Million |

| Market Size by 2030 | US$ 99,175.60 Million |

| Global CAGR (2022 - 2030) | 8.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Power and Control Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Belden Inc

2. Furukawa Electric Co Ltd

3. HENGTONG GROUP CO., LTD.

4. LEONI AG

5. Nexans SA

6. Prysmian SpA

7. Sumitomo Electric Industries Ltd

The Asia Pacific Power and Control Cable Market is valued at US$ 50,903.14 Million in 2022, it is projected to reach US$ 99,175.60 Million by 2030.

As per our report Asia Pacific Power and Control Cable Market, the market size is valued at US$ 50,903.14 Million in 2022, projecting it to reach US$ 99,175.60 Million by 2030. This translates to a CAGR of approximately 8.7% during the forecast period.

The Asia Pacific Power and Control Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Power and Control Cable Market report:

The Asia Pacific Power and Control Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Power and Control Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Power and Control Cable Market value chain can benefit from the information contained in a comprehensive market report.