The Asia Pacific polyurethane market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Governments of various countries across the region are focusing on the nation's infrastructure development. National, state, and local governments in each country are spending high amounts of capital to meet these needs for good reason. The Secretariat for Infrastructure in the Planning Commission is involved in initiating policies that would ensure the time-bound creation of top-class infrastructure in the country. This infrastructure planning mainly focuses on power, dams, bridges, roads, and urban infrastructure development. The nation's infrastructure push comprises projects related to roads, ports, railways, and airports; projects in agriculture and renewable energy; and industrial and social infrastructure. Rigid polyurethane foams are known as the high-performance closed-cell plastics adopted in end-use industries, such as packaging, transportation, and industrial insulations and appliances, due to their structural stability, which further assists manufacturers to design thermally insulating products. Rigid foams possess higher mechanical strength, sound insulation properties, and thermal resistance. Therefore, they can be used in extreme weather conditions and harsh environments. The building and construction industry is major end user of rigid and sprays polyurethane foam. Due to various benefits such energy efficiency, versatility, high performance, thermal/mechanical performance, and environment-friendly nature, rigid polyurethane foam insulation is applied in a building.

In case of COVID-19, in Asia Pacific, especially India, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of polyurethane manufacturing activities. Downfall of other chemical and materials manufacturing sectors has negatively impacted the demand for polyurethane during the early months of 2020. Moreover, decline in the overall resin and polymer manufacturing activities has led to discontinuation of polyurethane manufacturing projects, thereby reducing the demand for polyurethane. Similar trend was witnessed in other Asia Pacific countries, i.e., Japan, China and Australia. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the Asia Pacific Polyurethane provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 25,293.66 Million |

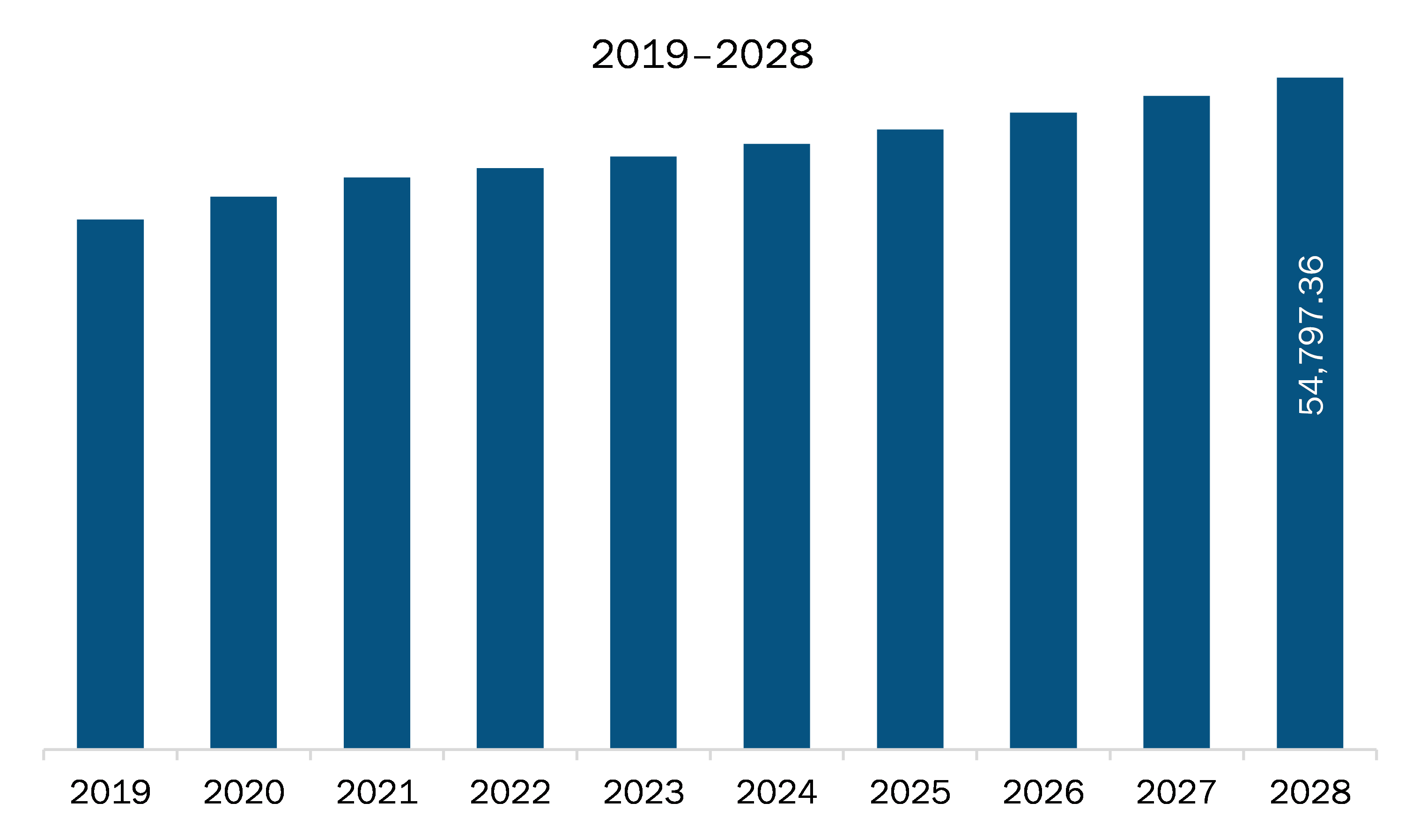

| Market Size by 2028 | US$ 54,797.36 Million |

| Global CAGR (2021 - 2028) | 11.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Polyurethane refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The polyurethane market in Asia Pacific is expected to grow from US$ 25,293.66 million in 2021 to US$ 54,797.36 million by 2028; it is estimated to grow at a CAGR of 11.7% from 2021 to 2028. Trace levels of a chemical used to make polyurethane foam can volatilize in hot conditions may sometimes be encountered in parked cars. Substances mostly involved include amines, phenols, and aldehydes. These are not believed to present health risks. Rather, automakers are further concerned that fogging as well as VOC odors generate consumer complaints, particularly in Asia. OEMs nowadays require Tier companies to disclose the level of dozens of chemicals in parts also materials, employing the Asia Pacific Automotive Declarable Substance List (GADSL) along with the International Material Data System (IMDS). Polyurethane Foam Association Members are exploring material including process changes which can reduce emissions from foam, including less-emissive amine catalysts & surfactants, reduction of VOC precursors, and the application of “scavengers” to react and bind with VOC pre-cursors. All these factors are further influencing the polyurethane market in this region.

Based on product, the flexible foam segment accounted for the largest share of the Asia Pacific polyurethane market in 2020. Based on application, the furniture and appliances segment accounted for the largest share of the Asia Pacific polyurethane market in 2020.

A few major primary and secondary sources referred to for preparing this report on the Asia Pacific polyurethane market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Covestro AG, the Dow Chemical Company, Lubrizol Corporation, DIC Corporation, BASF SE, Mitsui Chemicals, Inc., Recticel NV, Huntsman Corporation, and Tosoh Corporation.

The Asia Pacific Polyurethane Market is valued at US$ 25,293.66 Million in 2021, it is projected to reach US$ 54,797.36 Million by 2028.

As per our report Asia Pacific Polyurethane Market, the market size is valued at US$ 25,293.66 Million in 2021, projecting it to reach US$ 54,797.36 Million by 2028. This translates to a CAGR of approximately 11.7% during the forecast period.

The Asia Pacific Polyurethane Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Polyurethane Market report:

The Asia Pacific Polyurethane Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Polyurethane Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Polyurethane Market value chain can benefit from the information contained in a comprehensive market report.