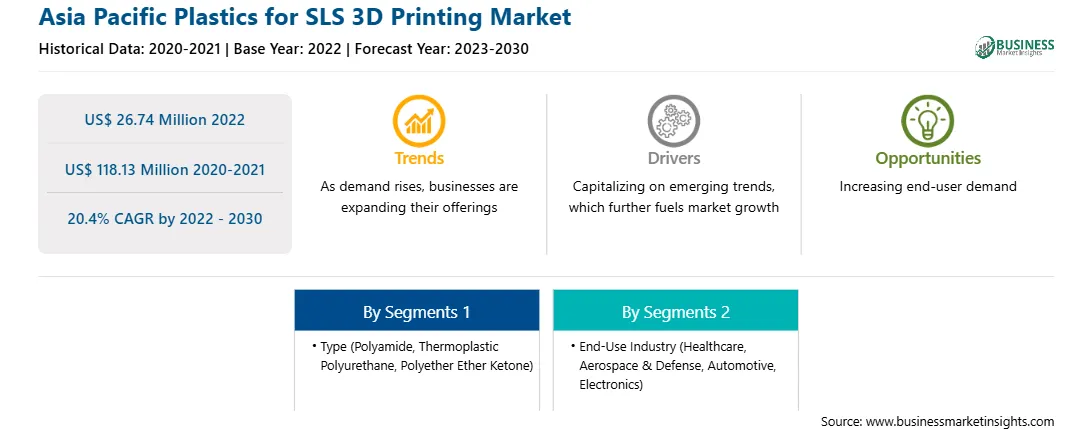

The Asia Pacific plastics for SLS 3D printing market was valued at US$ 26.74 million in 2022 and is expected to reach US$ 118.13 million by 2030; it is estimated to record a CAGR of 20.4% from 2022 to 2030.

In the healthcare industry, there is a rise in the production of patient-specific implants and prosthetics. For instance, in orthopedics, SLS has been used to manufacture customized hip and knee implants tailored to a patient's unique anatomy. Such implants improve comfort and reduce the risk of complications, leading to enhanced patient outcomes. In the dental field, SLS 3D printing has become indispensable for creating highly accurate models, crowns, bridges, and dentures. For instance, dental laboratories are adopting SLS technology to meet the growing demand for precision dental restorations, offering patients better-fitting and more durable solutions. Additionally, SLS is being employed for surgical planning and training. Hospitals and medical institutions use SLS-printed anatomical models to simulate and practice complex surgeries. Surgeons can refine their techniques, minimizing risks during actual procedures. This has become particularly relevant for intricate surgeries, such as neurosurgery or craniofacial reconstructions. Furthermore, SLS technology is widely used in the field of pharmaceuticals, which includes the increasing use of SLS to create personalized drug delivery systems, allowing for patient-specific medications with precise dosages. This has the potential to revolutionize medication effectiveness and patient care. In the prosthetics sector, SLS-printed components are contributing to enhanced functionality and comfort for amputees. Prosthetic limbs are becoming lighter and more customizable, offering a better quality of life for individuals in need of these devices. Hence, the increasing utilization from the healthcare sector is likely to offer several opportunities for the global plastic for SLS 3D printing market during the forecast period.

Asia Pacific is home to some of the world's largest manufacturing economies, such as China, Japan, and South Korea. These countries are investing heavily in advanced manufacturing technologies such as SLS 3D printing. The region also has the presence of additive manufacturing and SLS 3D printing companies. In 2021, Sindoh, the South Korea-based specialist of both 2D and 3D printers, introduced Sindoh S100, an industrial polymer 3D printer based on SLS technology. Sindoh S100 is a 3D printer that features Bluesint PA12 technology to 3D print with up to 100% recycled powder. Further, the rapidly growing manufacturing sector and rising application in the end-use industries are boosting the demand for SLS 3D printing. SLS 3D printing is used to produce lightweight and durable components for aircraft and spacecraft. SLS 3D printing is also used to produce prototypes and functional components for vehicles. Asia Pacific is home to major automotive companies, including Toyota Motor Corporation, Tata Motors Ltd, Hyundai Motor Company, Nissan Motor Co Ltd, and Honda Motor Co Ltd. According to a report published by the China Passenger Car Association, in 2022, Tesla Inc. delivered 83,135 made-in-China electric vehicles, indicating growth in sales of electric vehicles from 2021. As per the International Organization of Motor Vehicle Manufacturers report, in 2021, motor vehicle production in Asia Pacific was estimated to be ~46.73 million units. Furthermore, passenger car production in the region increased from 35.82 million in 2020 to 38.15 million in 2021. Therefore, the presence of major SLS 3D printing companies and the developing automotive industry in the region are expected to boost the growth of the plastics for SLS printing market during the forecast period.

Strategic insights for the Asia Pacific Plastics for SLS 3D Printing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 26.74 Million |

| Market Size by 2030 | US$ 118.13 Million |

| Global CAGR (2022 - 2030) | 20.4% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Plastics for SLS 3D Printing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific plastics for SLS 3D printing market is segmented based on type, end-use industry, and country.

Based on type, the Asia Pacific plastics for SLS 3D printing market is categorized into polyamide, thermoplastic polyurethane (TPU), polyether ether ketone (PEEK), and others. The polyamide segment held the largest Asia Pacific plastics for SLS 3D printing market share in 2022.

In terms of end-use industry, the Asia Pacific plastics for SLS 3D printing market is segmented into healthcare, aerospace & defense, automotive, electronics, and others. The electronics segment held the largest Asia Pacific plastics for SLS 3D printing market share in 2022.

Based on country, the Asia Pacific plastics for SLS 3D printing market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific plastics for SLS 3D printing market in 2022.

3D Systems Corp, BASF SE, Evonik Industries AG, Arkema SA, Ensinger GmbH, Stratasys Ltd, and EOS GmbH are some of the leading companies operating in the Asia Pacific plastics for SLS 3D printing market.

1. 3D Systems Corp

2. Arkema SA

3. BASF SE

4. Ensinger GmbH

5. EOS GmbH

6. Evonik Industries AG

7. Stratasys Ltd

The Asia Pacific Plastics for SLS 3D Printing Market is valued at US$ 26.74 Million in 2022, it is projected to reach US$ 118.13 Million by 2030.

As per our report Asia Pacific Plastics for SLS 3D Printing Market, the market size is valued at US$ 26.74 Million in 2022, projecting it to reach US$ 118.13 Million by 2030. This translates to a CAGR of approximately 20.4% during the forecast period.

The Asia Pacific Plastics for SLS 3D Printing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Plastics for SLS 3D Printing Market report:

The Asia Pacific Plastics for SLS 3D Printing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Plastics for SLS 3D Printing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Plastics for SLS 3D Printing Market value chain can benefit from the information contained in a comprehensive market report.