The Asia Pacific photoresist process chemicals market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. Adoption of IoT and connected devices has been on a steady rise since the last decade. The COVID-19 pandemic-induced lockdowns have further augmented the adoption of IoT in order to facilitate remote working. Many enterprises have been utilizing IoT in their organizations. The lockdown has led to new participants for the IoT sector. According to a survey conducted by Eclipse Foundation, 40% of the respondents have adopted IoT in their organizations and 22% plan to deploy it within the next year. Barriers to IoT adoption have come down significantly with the increase in industry competition. This has resulted in competitive pricing for IoT devices and fueled innovation. The number of IoT connected devices was 3.6 billion in 2019 and it has grown to over 11 billion in 2019. IoT devices depend on sensors and integrated circuits (ICs) to function. Hence, they all require semiconductors with high density and highly integrated circuit patterns. This is enabled through lithography using photoresist chemicals. The IoT market represents a significant growth opportunity for semiconductors, allowing them to maintain an average 3–4% annual growth. The demand for semiconductors from smartphones has begun to saturate. IoT devices will increase the demand for memory, sensors, ICs, microcontrollers, and connectivity.

In case of COVID-19, in Asia Pacific, especially India, witnessed an unprecedented rise in number of coronavirus cases, which led to the discontinuation of photoresist process chemicals manufacturing activities. Downfall of other chemical and materials manufacturing sectors has subsequently impacted the demand for photoresist process chemicals during the early months of 2020. Moreover, decline in the overall semiconductor manufacturing activities has led to discontinuation of photoresist process chemicals manufacturing projects, thereby reducing the demand for photoresist process chemicals. Similar trend was witnessed in other Asia Pacific countries, i.e., Japan, China and Australia. However, the countries are likely to overcome thus drop in demand with the economic activities regaining their pace, especially in the beginning of the 2021.

Strategic insights for the Asia Pacific Photoresist Process Chemicals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

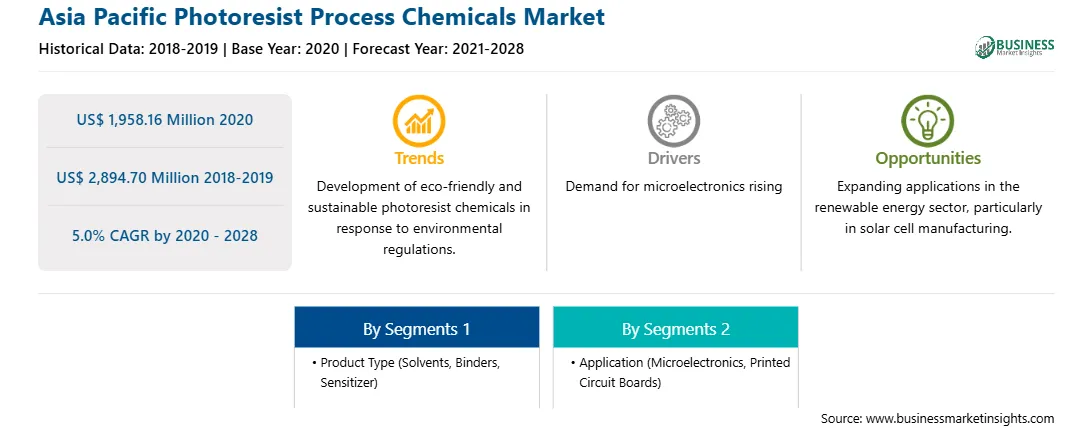

| Market size in 2020 | US$ 1,958.16 Million |

| Market Size by 2028 | US$ 2,894.70 Million |

| Global CAGR (2020 - 2028) | 5.0% |

| Historical Data | 2018-2019 |

| Forecast period | 2021-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Photoresist Process Chemicals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The photoresist process chemicals market in Asia Pacific is expected to grow from US$ 1,958.16 million in 2020 to US$ 2,894.70 million by 2028; it is estimated to grow at a CAGR of 5.0% from 2020 to 2028. 5G is the fifth-generation technology in cellular networks and the upcoming and upgraded version of the existing 4G technology. It provides a network that connects virtually everything including devices, objects, and machines. 5G will deliver higher peak data speeds, low latency, and a substantial network capacity. Although only a few devices have been available in the market that support 5G connectivity, the deployment of 5G networks has witnessed tremendous growth in 2019. At these growth rates, soon most nations will have access to 5G. Although it is a few years away, the biggest hurdles we face are telecom networks rolling it out for their customers, as 5G takes consumes more power, and a better battery technology. This poses a challenge for semiconductor manufacturers to design products suitable for 5G network as well as a new avenue of great opportunity. Chipmakers are taking up the challenge to innovate to the next generation of product scaling, and the evolution of photoresists and lithography process would play a key role in the performance of the semiconductors and their applications.

Based on product type, the solvents segment accounted for the largest share of the Asia Pacific photoresist process chemicals market in 2019. Based on application, the microelectronics segment held a larger market share of the Asia Pacific photoresist process chemicals market in 2019. Microelectronics is basically a field in electronics that used tiny, or micro, components to produce electronics. As demand for small as well as less expensive devices grows, this field continues to expand. Microelectronic devices, including transistors, capacitors, and resistors, comes within an active chip, needs some protection from the environment, also both electrical & mechanical connections to the surrounding components. Hence, photoresist solvent, sensitizers, polymers, and other chemicals are used for this purpose. While making a transistor photoresist polymer is utilized. The photoresist polymer is usually a very thin coating of polymer employed to the wafer surface which further react with light to create areas that are soluble in different solvents. A photoresist is utilized over the layer of the resistor composition, and then a desired pattern in the photoresist is created, where the pattern further leaves certain regions of the resistor composition layer uncovered by the photoresist. The resistor composition layer that is uncovered mainly by the photoresist is etched under some conditions, which are effective to leave a mass of loosely bound resistor particles particularly at regions of the resistor composition which are not fully covered by photoresist.

A few major primary and secondary sources referred to for preparing this report on the Asia Pacific photoresist process chemicals market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Tokyo Ohka Kogyo Co., Ltd., Tokuyama Corporation, Dupont, Enf Technology Co., Ltd., Sumitomo Chemical Co., Ltd. and Prolyx Microelectronics Private Limited.

The Asia Pacific Photoresist Process Chemicals Market is valued at US$ 1,958.16 Million in 2020, it is projected to reach US$ 2,894.70 Million by 2028.

As per our report Asia Pacific Photoresist Process Chemicals Market, the market size is valued at US$ 1,958.16 Million in 2020, projecting it to reach US$ 2,894.70 Million by 2028. This translates to a CAGR of approximately 5.0% during the forecast period.

The Asia Pacific Photoresist Process Chemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Photoresist Process Chemicals Market report:

The Asia Pacific Photoresist Process Chemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Photoresist Process Chemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Photoresist Process Chemicals Market value chain can benefit from the information contained in a comprehensive market report.