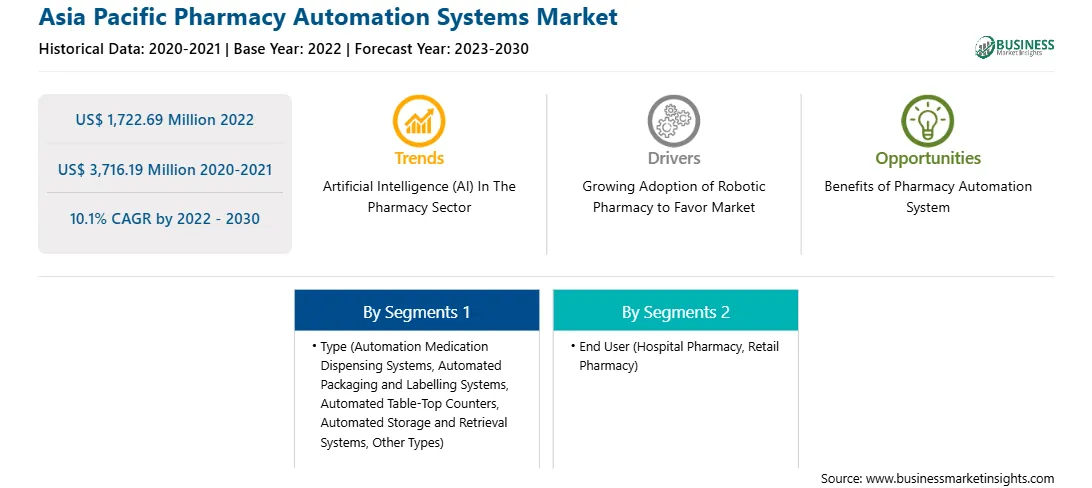

The Asia Pacific pharmacy automation systems market was valued at US$ 1,722.69 million in 2022 and is expected to reach US$ 3,716.19 million by 2030; it is estimated to grow at a CAGR of 10.1% from 2022 to 2030.

Increasing Aging Population Fuels the Asia Pacific Pharmacy Automation Systems Market

The aging population is a key to advancements in the healthcare sector. Thus, the growing aging population is anticipated to serve vital growth opportunities for the pharmacy. According to the United Nations' World Population Prospects 2022 report, the elderly population is projected to increase from 10% of the total population in 2022 to 16% of the total population by 2050. The rapidly growing aging population indicates that there will be exponential demand for care and medicines. Older people live with one or more chronic medical conditions, such as arthritis, diabetes, Alzheimer's, or Parkinson's; the treatments of these conditions require regular refilling of medicines. Also, there is growth in life expectancy worldwide, leading to the need for more digital and automated systems for adult care.

The development of automatic medicine dispensers has served beneficially in developed regions. Advanced features such as an LED display, a motor controller, and an alarm system help people with medication reminders. Automated pharmacy systems would enable them to keep track of their medicine and stocks better. Further, the implementation of automated pharmacy systems has been proven to trigger medication adherence in adults. With such features, the adoption of automated pharmacy systems is expected to grow in developing countries such as Japan, India, South Korea, and China in the coming years.

Asia Pacific Pharmacy Automation Systems Market Overview

The pharmacy automation systems market in Asia Pacific is analyzed on the basis of China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. The region is estimated to be the fastest-growing market for pharmacy automation systems in 2022. The market growth in the region is attributed to international players entering into the healthcare markets in the region and the increasing geriatric population. China has seen a significant rise in automated pharmaceutical dispensing, especially during the COVID-19 pandemic. In 2021, the Hospital of Changsha in China's Hunan province was the first to install robotic pharmacy dispensing systems to enhance drug dispensing. In addition, automation technologies are widely used in the healthcare industry, leveraging demand for automated pharmacy systems. China is the largest exporter of active pharmaceutical ingredients to Western countries, requiring automation for the packaging and labeling of the products to be shipped. Production sites and warehouses have automated pharmacy systems installed in the manufacturing site. Companies in the pharmacy automation systems market are collaborating with pharma businesses to build automated facility centers in the country. Livzon Pharmaceutical Group Inc. has partnered with Swisslog Holding AG; under this partnership agreement, Swisslog Holding AG designed the Livzon Pharmaceutical Group Inc. manufacturing site with automation.

Asia Pacific Pharmacy Automation Systems Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Pharmacy Automation Systems provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,722.69 Million |

| Market Size by 2030 | US$ 3,716.19 Million |

| Global CAGR (2022 - 2030) | 10.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Pharmacy Automation Systems refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Pharmacy Automation Systems Market Segmentation

The Asia Pacific pharmacy automation systems market is segmented based on type, end user, and country.

Based on type, the Asia Pacific pharmacy automation systems market is segmented into automation medication dispensing systems (product type and operation), automated packaging and labelling systems, automated table-top counters, automated storage and retrieval systems, and other types. The automation medication dispensing systems segment held the largest market share in 2022.

Based on end user, the Asia Pacific pharmacy automation systems market is segmented into hospital pharmacy, retail pharmacy, and others. The hospital pharmacy segment held the largest market share in 2022.

Based on country, the Asia Pacific pharmacy automation systems market is segmented into China, India, Japan, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific pharmacy automation systems market share in 2022.

McKesson Corp, Becton Dickinson and Co, Capsa Solutions LLC, Omnicell Inc, Oracle Corp, YUYAMA Manufacturing Co Ltd, Veradigm LLC, and Swisslog Healthcare AG are some of the leading companies operating in the Asia Pacific pharmacy automation systems market.

1. McKesson Corp

2. Becton Dickinson and Co

3. Capsa Solutions LLC

4. Omnicell Inc

5. Oracle Corp

6. Veradigm LLC

7. YUYAMA Manufacturing Co Ltd

8. Swisslog Healthcare AG

The Asia Pacific Pharmacy Automation Systems Market is valued at US$ 1,722.69 Million in 2022, it is projected to reach US$ 3,716.19 Million by 2030.

As per our report Asia Pacific Pharmacy Automation Systems Market, the market size is valued at US$ 1,722.69 Million in 2022, projecting it to reach US$ 3,716.19 Million by 2030. This translates to a CAGR of approximately 10.1% during the forecast period.

The Asia Pacific Pharmacy Automation Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Pharmacy Automation Systems Market report:

The Asia Pacific Pharmacy Automation Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Pharmacy Automation Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Pharmacy Automation Systems Market value chain can benefit from the information contained in a comprehensive market report.