The APAC Pharmaceutical Isolator Market is sub-segmented into five major countries: China, Japan, India, Australia, South Korea, and the Rest of APAC. The market in the region is largely held by countries such as China and Japan. In the Asia Pacific, China is the largest market for biopharmaceutical pharmaceutical isolator market. The growth of the market is primarily attributed to the established pharmaceutical market, increasing R&D expenditures by the pharmaceutical and biopharmaceutical companies, and favorable regulatory policies. China has the world’s second-largest pharmaceutical market. The excessive population in China, coupled with the rise of various communicable and non-communicable diseases, are majorly driving the growth of the pharmaceutical companies in China and making it a prime market in the Asia Pacific region. For instance, the outbreak of the Coronavirus in China led to the launch of several drugs to counter the coronavirus (Covid-19). It has increased contract manufacturing in the country, leading to the growth of the market. Burgeoning adoption of automation in pharmaceutical isolator and escalating pharmaceutical and biotechnological industries are the major factor driving the growth of the APAC pharmaceutical isolator market

In case of COVID-19, APAC is highly affected specially India. The APAC biopharmaceutical industry has been disturbed for few months of 2020 during the outbreak of the COVID-19 pandemic. However, with the rising demand for products to treat the COVID-19 infection, the biopharmaceutical, and pharmaceutical companies in the countries such as India and China have increased their production of APIs as the countries are the largest exporters to western companies. For instance, Wockhardt Ltd is in talks with the Indian government to offer its sterile development facility for the covid-19 vaccines that will be developed in the country, as well as with some firms whose vaccines are currently in phase I/II trials globally. Moreover, on 07 May 2020, Ajinomoto Bio-Pharma Services, a leading provider of biopharmaceutical contract development and manufacturing services with sites in Belgium, United States, Japan, and India, announced it has entered into a manufacturing services agreement with CytoDyn Inc., a late-stage biotechnology company, for the supply of the investigational new drug, leronlimab (PRO 140), which is currently being used in clinical trial protocols for Mild-to-Moderately Ill and Severely Ill COVID-19 patients. The countries are experiencing growth in biologics production also; there is growth in the contract manufacturing for biopharmaceutical and pharmaceutical products. For instance, in January 2020, STA Pharmaceutical Co., Ltd. (WuXi AppTec) has expanded its oligonucleotide API manufacturing in China. Similarly, companies have engaged in the production of vaccines and have sent them to clinical trials. For instance, in Japan, Gilead's Remdesivier and Fujifilm's antiviral Avigan are in Phase III clinical trials. Thus, with the growing production by the biopharmaceutical industry, the pharmaceutical isolators market is likely to have vital growth opportunities in the following years.

Strategic insights for the Asia Pacific Pharmaceutical Isolator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

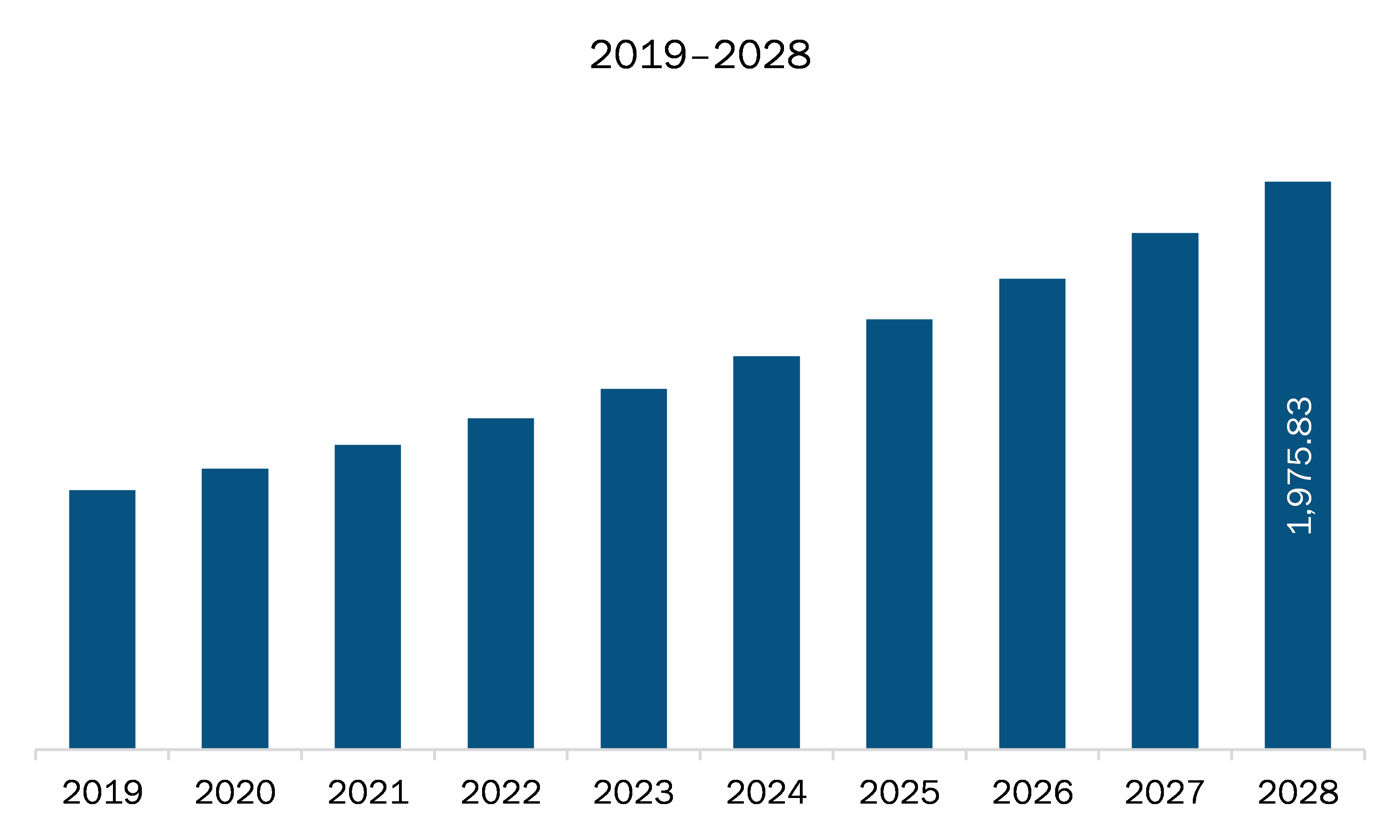

| Market size in 2021 | US$ 1,060.82 Million |

| Market Size by 2028 | US$ 1,975.83 Million |

| Global CAGR (2021 - 2028) | 9.3% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Pharmaceutical Isolator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC pharmaceutical isolator market is expected to grow from US$ 1,060.82 million in 2021 to US$ 1,975.83 million by 2028; it is estimated to grow at a CAGR of 9.3% from 2021 to 2028. Several big and small pharmaceutical companies are engaged in the development and manufacturing of new and novel molecules for life-threatening conditions. Pharmaceutical isolator systems have been regarded as a key technology in the drug discovery process. Thus, the adoption of pharmaceutical isolators is increasing to ensure contamination-free manufacturing and product handling. The pharmaceutical isolator provides safety to an operator from the exposure of harmful drugs, eliminates the possibilities of cross-contamination, and maintains the standard of drug quality. In the pharmaceutical industry, it is extremely important to maintain immense caution during the product manufacturing process. Different types of isolators are available in the pharmaceutical market that provide an optimum level of sterility in the product manufacturing process. The handling of pharmaceuticals with high potency ingredients, such as hormones and antibiotics. Biologic drugs need a greater level of precautions. Pharma and biotech companies have substantially invested in pharmaceutical isolator techniques in the past decade. Growing investments by pharmaceutical and biotechnology companies and extensive drug pipelines for the treatment of various chronic diseases, such as cancer, cardiovascular disorders, metabolic disorders, immunological disorders, and neurological disorders, are the prominent drivers for the growth of the APAC pharmaceutical isolator market.

In terms of type, the open isolator segment accounted for the largest share of the APAC pharmaceutical isolator market in 2020. In terms of pressure, the positive pressure segment held a larger market share of the APAC pharmaceutical isolator market in 2020. In terms of configuration, the floor standing segment held a larger market share of the APAC pharmaceutical isolator market in 2020. In terms of application, the aseptic isolators segment held a larger market share of the APAC pharmaceutical isolator market in 2020. Further, the pharmaceutical and biotechnology companies segment held a larger share of the APAC pharmaceutical isolator market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC pharmaceutical isolator market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Azbil Telstar, Bioquell (Ecolab Solution), Comecer, Fedegari Autoclavi S.p.A., Gelman Singapore, Getinge AB, Hosokawa Micron Group, Nuaire Inc., and Schematic Engineering Industries.

The Asia Pacific Pharmaceutical Isolator Market is valued at US$ 1,060.82 Million in 2021, it is projected to reach US$ 1,975.83 Million by 2028.

As per our report Asia Pacific Pharmaceutical Isolator Market, the market size is valued at US$ 1,060.82 Million in 2021, projecting it to reach US$ 1,975.83 Million by 2028. This translates to a CAGR of approximately 9.3% during the forecast period.

The Asia Pacific Pharmaceutical Isolator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Pharmaceutical Isolator Market report:

The Asia Pacific Pharmaceutical Isolator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Pharmaceutical Isolator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Pharmaceutical Isolator Market value chain can benefit from the information contained in a comprehensive market report.