Market Introduction

Packaging robots are the technologies used to automate the packaging operations across different industries such as consumer goods, consumer electronics, pharmaceuticals, e-commerce, food & beverage, chemicals, and personal care products sector. These robots are designed primarily for packaging operations such as material handling, moving or packing goods, sealing & labelling, and other tasks in order to sustain consistency, quality, and accuracy in packaging operations. There are primarily four different types of packaging robotic technologies used across different industries for packaging automation. This includes articulated robots, Cartesian robots, SCARA robots, and delta robots which are also called parallel link robots

Strategic insights for the Asia Pacific Packaging Robots provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Packaging Robots refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Packaging Robots Strategic Insights

Asia Pacific Packaging Robots Report Scope

Report Attribute

Details

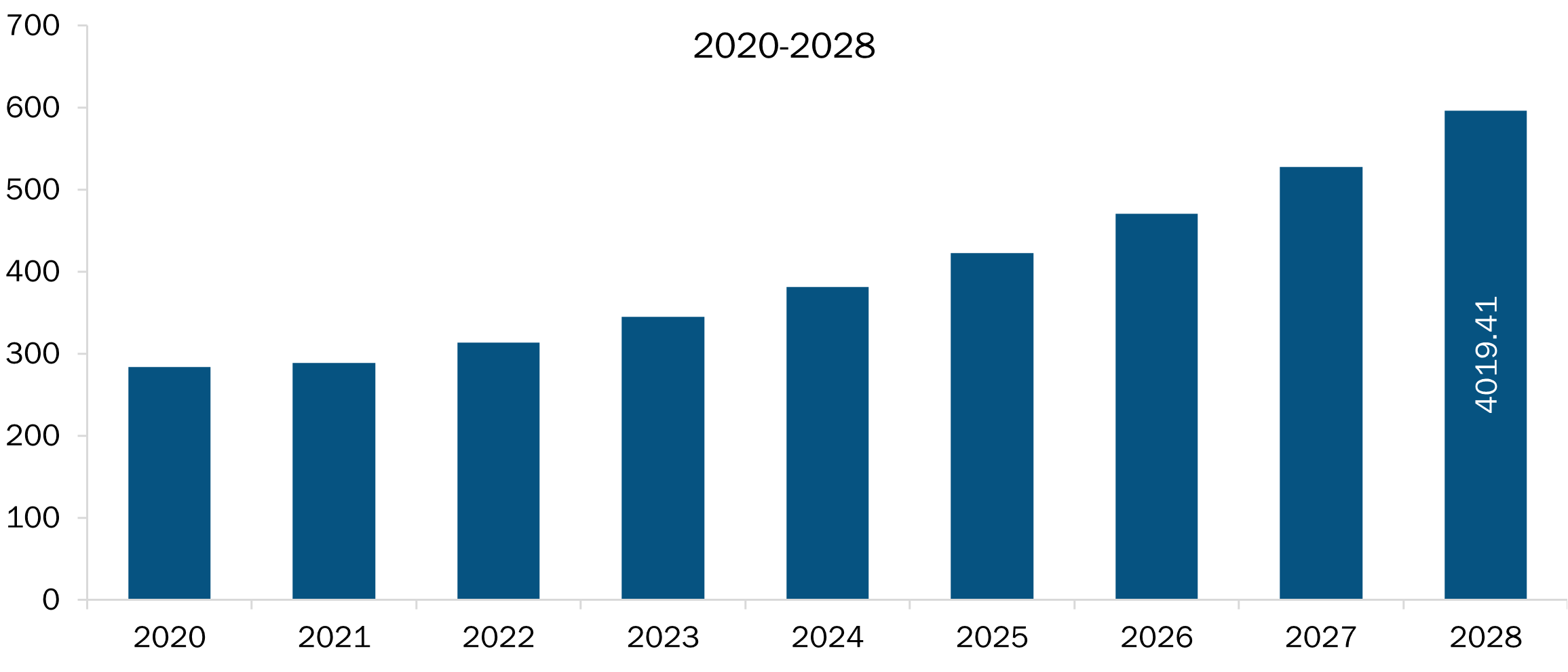

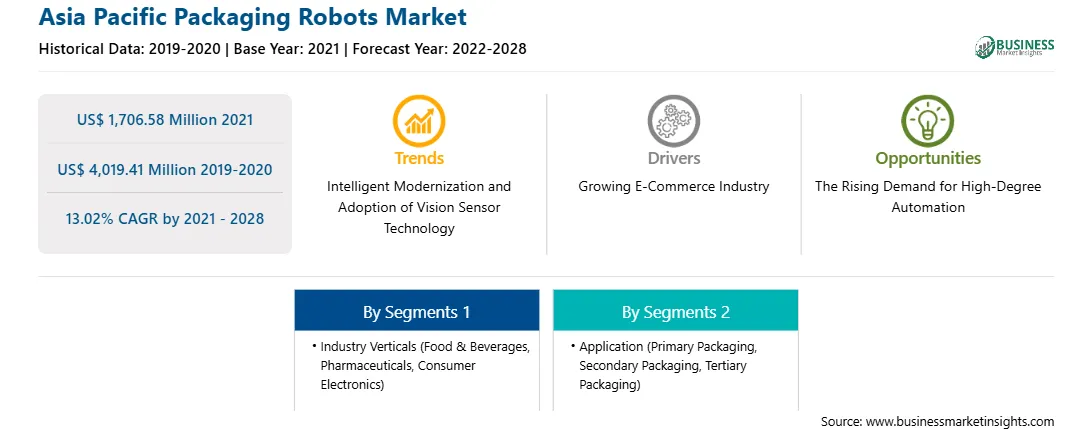

Market size in 2021

US$ 1,706.58 Million

Market Size by 2028

US$ 4,019.41 Million

Global CAGR (2021 - 2028)

13.02%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Industry Verticals

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Packaging Robots Regional Insights

Market Overview and Dynamics

The Asia Pacific packaging robots market is expected to reach US$ 4,019.41 million by 2028 from US$ 1,706.58 million in 2021; it is estimated to grow at a CAGR of 13.02% from 2021 to 2028. Major factors driving the growth of the market are the increased demand for high degree automation and intelligent modernization, and the adoption of vision sensor technology. However, the high deployment cost of packaging robots hampers the market growth.

Packaging is a critical procedure in manufacturing facilities, especially those that produce goods for the consumer market. The installation of a robotic packaging system increases flexibility and improves the packaging line's overall production. Furthermore, packaging robots can work in different temperatures and require significantly less floor area than people. Increased demand for various items forces enterprises to improve production efficiency and implement better operations management. Implementing robotic automation in packaging units can help achieve overall equipment efficiency (OEE), which is necessary for long-term production efficiency. Robotic installation in packaging lines improves the high-speed efficiency of product selection, packing, and palletization by reducing physical dexterity. Additionally, due to rising demand, many investments have been recorded in robotics. According to the surveys, the demand for robots was fueled by investments in new production capabilities and the modernization of industrial premises. Factors such as the development of energy-efficient packaging systems and fierce competition in all major manufacturing markets have made it possible to invest in packaging robot technology around the globe. Furthermore, it improves equipment efficiency while lowering operating costs and providing exceptional returns on investment. As a result, the value-added benefits of robotic automation are contributing to the growth of the robot automation market. Moreover, since robotic packaging is commonly employed across various industries, such as food & beverages and pharmaceuticals, the growth of the end-user industries would augment the packaging robot market in the future.

Several economies in Asia Pacific witnessed a sharp decline in their GDP in 2020 due to the sudden closedown of all economic activities across all countries. Asia Pacific is the manufacturing hub of automobiles, consumer electronic products, and semiconductors. The disruptions in supply chain negatively impacted many companies in the region. Consequently, the robot shipments showed the sharpest decline of all times in 2020. China and India are the most badly affected economies in the region due to the large population and overwhelming pressure on the healthcare system. South Korea and Singapore also imposed several lockdowns to contain the virus spread. However, the long-term impact of the COVID-19 pandemic on the region would propel the demand for robots in manufacturing facilities, which is expected to provide positive outlook for the packaging robot players during the forecast period.

Key Market Segments

Based on industry verticals, the Asia Pacific packaging robots market is segmented into food & beverages, pharmaceuticals, consumer electronics, and others. The food & beverages segment held the largest market share in 2021. However, the pharmaceuticals segment is anticipated to register the highest CAGR during the forecast period.

Based on application, the Asia Pacific packaging robots market is segmented into primary packaging, secondary packaging, and tertiary packaging. In 2021, the primary packaging segment held the largest market share. However, the secondary packaging segment is expected to register the highest CAGR from 2021 to 2028.

Major Sources and Companies Listed

Mitsubishi Electric Corporation, Fanuc Corporation, and Krones AG are among the key players operating in the Asia Pacific packaging robots market.

Reasons to buy the report

ASIA PACIFIC PACKAGING ROBOTS MARKET SEGMENTATION

By Industry Verticals

By Application

By Country

Company Profiles

The Asia Pacific Packaging Robots Market is valued at US$ 1,706.58 Million in 2021, it is projected to reach US$ 4,019.41 Million by 2028.

As per our report Asia Pacific Packaging Robots Market, the market size is valued at US$ 1,706.58 Million in 2021, projecting it to reach US$ 4,019.41 Million by 2028. This translates to a CAGR of approximately 13.02% during the forecast period.

The Asia Pacific Packaging Robots Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Packaging Robots Market report:

The Asia Pacific Packaging Robots Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Packaging Robots Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Packaging Robots Market value chain can benefit from the information contained in a comprehensive market report.