The Asia Pacific operating tables market is a highly fragmented market with the presence of considerable regional and local players providing numerous solutions for companies investing in the market arena. The types of electric operating tables continue to increase, including five-section eccentric columns, built-in kidney bridges, C-arm carbon fiber catheter operating tables, etc., These types are convenient and safe, comprehensive functions, high control precision, and long service life. The power control source is used to operate various settings, such as table movement, table tilt, and height adjustment. It helps simplify the task of an operation without distracting the surgeon's attention. This feature can be used for electric operating tables. With the help of the remote control to assist the operation of the electric actuator, the movement of a table can be easily controlled. For example, the KME-1204 sliding top electric OT from Koinaa Medical Equipments is suitable for various surgeries, such as general surgery; cardiovascular surgery; neurology, gynecology, urology, proctology, and traumatic surgery; plastic surgery; and laparoscopy. The table is equipped with remote control for easy height adjustment; side tilt; longitudinal sliding; and trendelenburg, flexion, and reflex positioning. Also, the nonreflecting surface is antibacterial and easy to clean. Owing to the plenty of power, smooth and quiet movement, multiple value-added features, and unlimited customization options (such as customized positioning), companies continue to add value to the electric adjustment of advanced operating tables. Therefore, it is expected that during the forecast period, a significant shift toward powered surgical tables will become a trend owing to the benefits offered by powered surgical tables.

In Asia Pacific, India reported a huge number of COVID-19 cases, which led to the discontinuation of several business operations, including operating table manufacturing activities. Several measures have been implemented to contain the spread of COVID-19, resulting in significant operational disruption for many companies, including the operating table manufacturing industry. Staff quarantine, supply-chain failures, and reductions in demand have generated serious complications for companies. Also, there has been a significant drop in in-patient and outpatient for private hospital chains. To relieve healthcare systems, many clinics have been postponing non-critical surgical procedures like orthopedic and neuromuscular conditions. To avoid overburdening hospitals already struggling to deal with the rising pandemic pressure, doctors are delaying surgeries till the COVID-19 peak is past. Moreover, medical device companies are starting to forecast large sales declines in their business segments because people are staying at home. All these factors tend to affect the Asia Pacific operating tables market negatively.

Strategic insights for the Asia Pacific Operating Tables provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

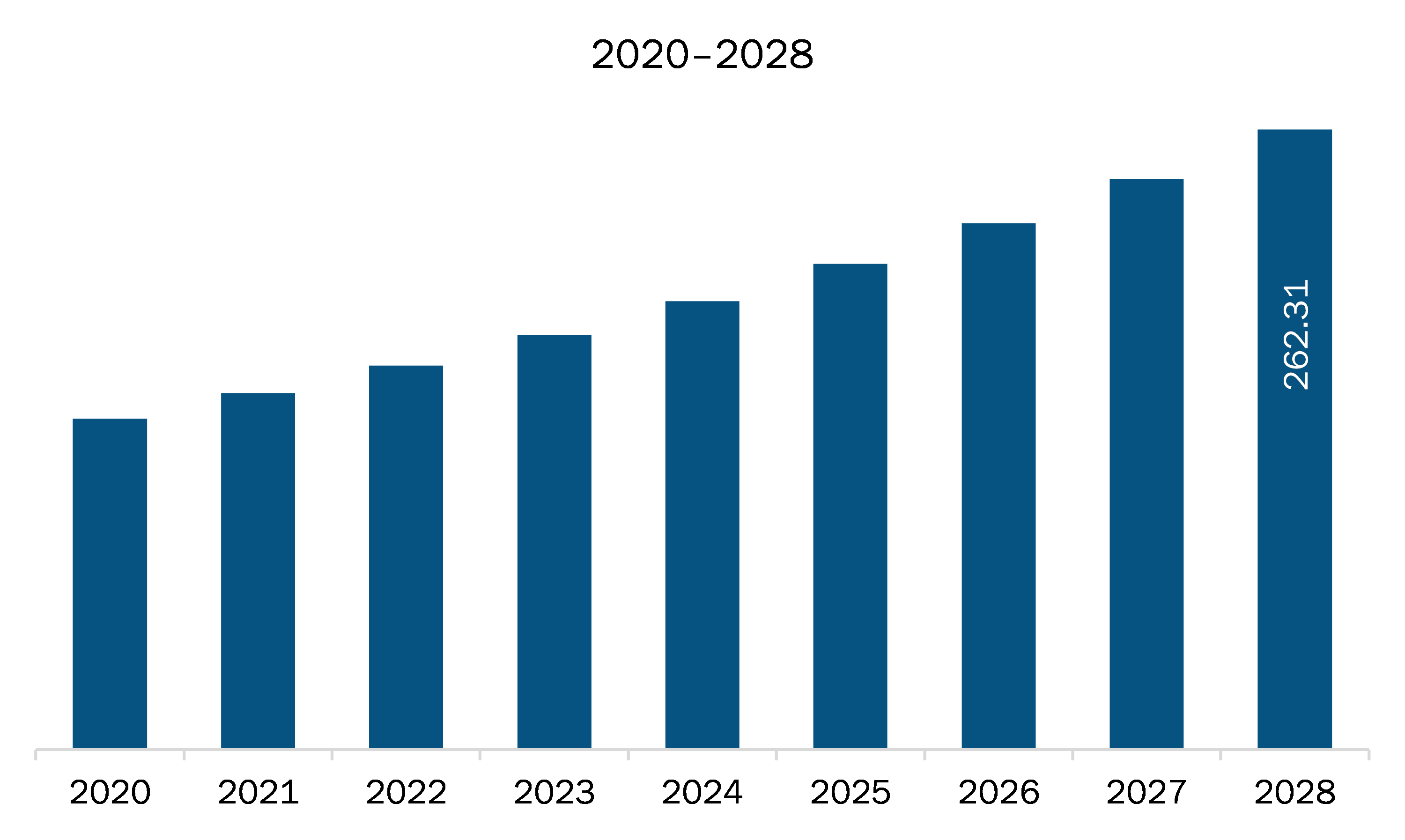

| Market size in 2021 | US$ 204.27 Million |

| Market Size by 2028 | US$ 262.31 Million |

| Global CAGR (2021 - 2028) | 3.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Operating Tables refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The operating tables market in Asia Pacific is expected to grow from US$ 204.27 million in 2021 to US$ 262.31 million by 2028; it is estimated to grow at a CAGR of 3.6% from 2021 to 2028. The hospital industry across the region is growing at a rapid pace. Although the average hospital stays for a single patient has been slightly decreased from 7 days to 5–6 days in the last couple of decades, the total number of hospital admissions has increased in the last 5–6 years. According to the Department of Industrial Policy and Promotion (DIPP), the hospital and diagnostic centers in India have attracted Foreign Direct Investments (FDIs) worth US$ 6 billion in the last couple of decades. According to the Ministry of Health and Family Welfare, the Government of India, India and Cuba signed a Memorandum of Understanding (MoU) to increase cooperation in the areas of health and medicine. Furthermore, a de-merger between Fortis Healthcare and Manipal Hospitals Enterprises has been carried out to raise US$ 602.41 million, which can be further invested to expand hospital infrastructure in Manipal Hospital Enterprise. The operating tables industry in India is booming owing to a few factors such as rising government and private sector investments, increasing geriatric population, and surging hospital count.

Based on product type, the general surgery tables segment accounted for the largest share of the Asia Pacific operating tables market in 2021. Based on technology, the non-powered segment accounted for the largest share of the Asia Pacific operating tables market in 2021. Based on end user, the hospitals segment accounted for the largest share of the Asia Pacific operating tables market in 2021.

A few major primary and secondary sources referred to for preparing this report on the Asia Pacific operating tables market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report include Skytron, LLC; STERIS Plc; AGA Sanitätsartikel GmbH; ALVO; Getinge AB; Mizuho Medical Co, Ltd.; Merivaara; Stryker Corporation; Denyers International and Hill Rom Holding Inc.

The Asia Pacific Operating Tables Market is valued at US$ 204.27 Million in 2021, it is projected to reach US$ 262.31 Million by 2028.

As per our report Asia Pacific Operating Tables Market, the market size is valued at US$ 204.27 Million in 2021, projecting it to reach US$ 262.31 Million by 2028. This translates to a CAGR of approximately 3.6% during the forecast period.

The Asia Pacific Operating Tables Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Operating Tables Market report:

The Asia Pacific Operating Tables Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Operating Tables Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Operating Tables Market value chain can benefit from the information contained in a comprehensive market report.