Asia Pacific consists of five major countries namely China, Japan, India, Australia, and South Korea. The market is also evaluated for the rest of countries in Asia Pacific. Japan holds the largest share of the Asia Pacific ocular drug delivery market. In Japan, a substantial increase or the higher increase in incidences of normal-tension glaucoma (NTG), which is a form of glaucoma, is found. The prevalence of glaucoma is majorly observed in the elderly population; until 2017, nearly four million people were registered for glaucoma in Japan. The country has improved its glaucoma treatment regimen. The improvement has introduced new antiglaucoma ophthalmic solutions and minimally invasive glaucoma surgeries for patients across the country. Similarly, the country has a considerable number of patients with a dry eye disease (DED), various studies were conducted in the country for dry eye disease. The results of the studies showed that the prevalence of the DED among the Japanese I relatively higher. The annual health plan cost was estimated at nearly US$ 323 for every patient in the country. Additionally, the country has rising numbers of diabetes patients, which is another leading cause of diabetic retinopathy. Among Japan's total population, nearly 7.7% of people living with diabetes are approximately 7.2 million adults in the country. The country is facing a decreasing number of ophthalmologists in the country. However, the country is among the important country in terms of the developments for the healthcare infrastructure.

The 2019 novel coronavirus (2019-nCoV), officially named COVID-19 by the WHO, has spread to more than 170 countries, including China prompting the WHO to declare the disease as a global pandemic. COVID-19 has had a tremendous impact on eye care delivery across the Asia Pacific region. In Bangladesh, all routine elective eye surgeries were postponed. Only emergency eye treatment was conducted only at outpatient departments. Moreover, patients were allowed to go to hospital only in the case of emergency. Similarly in India, outreach eye health services stopped largely thus impacting the rural communities. All elective surgeries were postponed. Non-cataract conditions like diabetic retinopathy and glaucoma patients affected due to break in follow-ups. Additionally, COVID-19 is having a tremendous impact on eye care in the Maldives. Due to the lock down people are not able to travel from one place to the other. Air and sea transport is at standstill and people from the outlying islands are not able to visit the nearest centre for eye care. A few centers in the capital Male are offering online consultations to patients. However, this has its limitations and healthcare professionals cannot do refractions online and a detailed anterior segment and posterior segment examinations is also not possible. Thus, COVID 19 is having a significant impact on the quality and quantity of eye care in the Maldives.

Strategic insights for the Asia Pacific Ocular Drug Delivery provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 3,234.93 Million |

| Market Size by 2028 | US$ 5,608.56 Million |

| Global CAGR (2021 - 2028) | 8.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Technology

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Ocular Drug Delivery refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

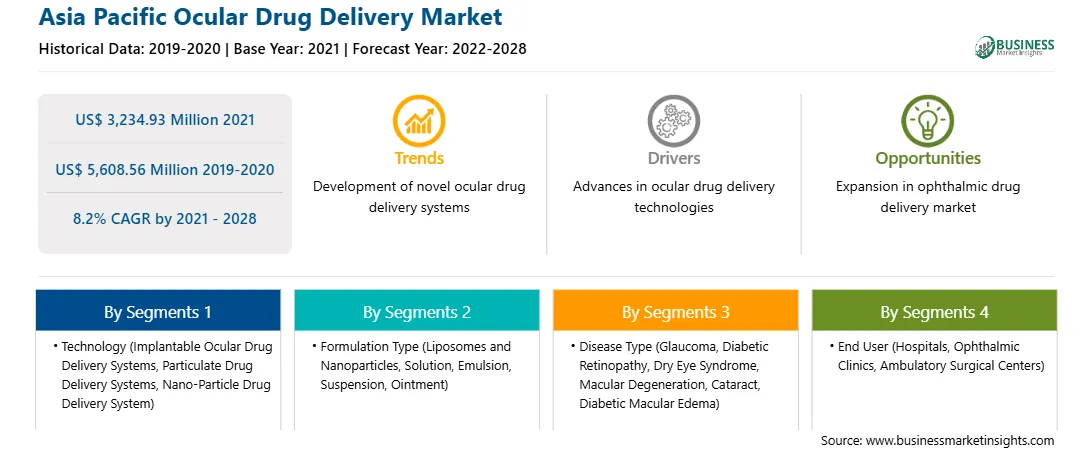

The ocular drug delivery market in Asia Pacific is expected to grow US$ 5,608.56 million by 2028 from US$ 3,234.93 million in 2021. The market is estimated to grow at a CAGR of 8.2% from 2021 to 2028. Cataract, glaucoma, age-related macular degeneration, diabetic retinopathy, and unaddressed refractive error are among the leading causes of blindness or low vision. Most of the population have or had some eye disorder in their lifetime. As per the World Health Organization (WHO) report "Blindness and vision impairment" published in February 2021, around 2.2 billion people worldwide have a near or distance vision impairment. It has also estimated that the leading cause of vision loss or low vision is cataract (94 million) and uncorrected refractive errors (88.4 million). Further, the other common causes of vision loss are glaucoma (7.7 million), corneal opacities (4.2 million), diabetic retinopathy (3.9 million), and trachoma (2 million). Thus, the Burgeoning prevalence of eye disorders is likely to enhance the growth of the market.

Asia Pacific ocular drug delivery market is segmented based on technology, formulation type, disease type, end user. Based on technology, implantable ocular drug delivery systems segment accounted for the highest share in 2021. Based on formulation type, solution segment accounted for the highest share in 2021. Based on disease type, cataract segment accounted for the highest share in 2021. Based on end user hospitals segment accounted for the highest share in 2021.

A few major primary and secondary sources referred to for preparing this report on ocular drug delivery market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AbbVie Inc.; Bausch Health Companies Inc.; Novartis AG; Clearside Biomedical, Inc.; and Taiwan Liposome Company, Ltd. among others.

The Asia Pacific Ocular Drug Delivery Market is valued at US$ 3,234.93 Million in 2021, it is projected to reach US$ 5,608.56 Million by 2028.

As per our report Asia Pacific Ocular Drug Delivery Market, the market size is valued at US$ 3,234.93 Million in 2021, projecting it to reach US$ 5,608.56 Million by 2028. This translates to a CAGR of approximately 8.2% during the forecast period.

The Asia Pacific Ocular Drug Delivery Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Ocular Drug Delivery Market report:

The Asia Pacific Ocular Drug Delivery Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Ocular Drug Delivery Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Ocular Drug Delivery Market value chain can benefit from the information contained in a comprehensive market report.