Geographically, several countries have laid-down their roadmaps and plans to decommission nuclear facilities. For instance, in Asia, Japan is expected to shut down its 6 nuclear power plants by 2030, and South Korea has announced its plans to decommission 6 of 24 reactors by mid-2020. These figures showcase the demand for decommissioning services, which is anticipated to propel the nuclear decommissioning services market over the years. APAC also consists of a notable number of nuclear facilities, mainly in Japan and South Korea. The Japanese government has expressed its plans to phase out 40–50% of its nuclear facilities over the next decade. China and India, on the other hand, are still maturing in the field of nuclear decommissioning, which holds a promising future for several nuclear decommissioning services market players in the countries and internationally.

Strategic insights for the Asia Pacific Nuclear Decommissioning Service provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

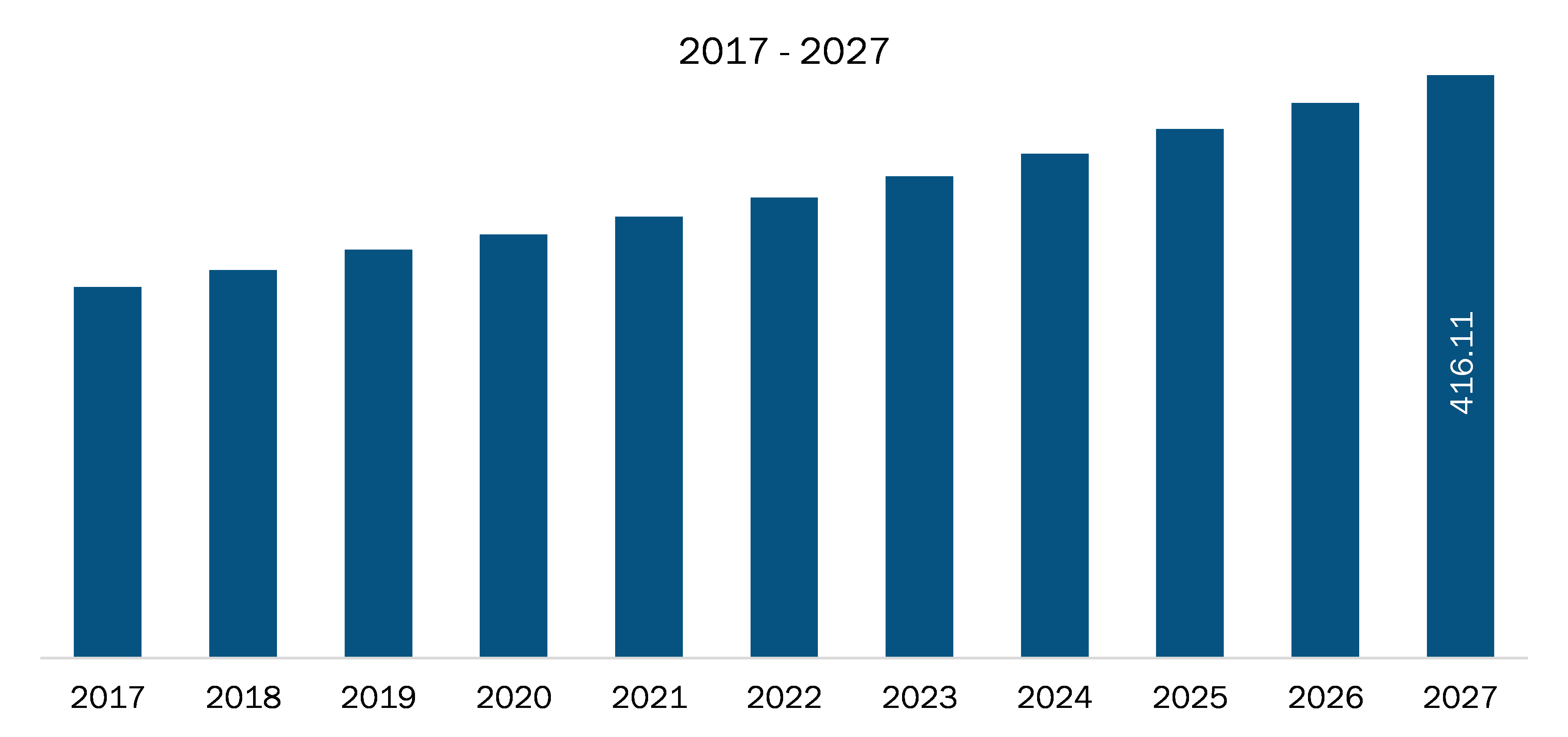

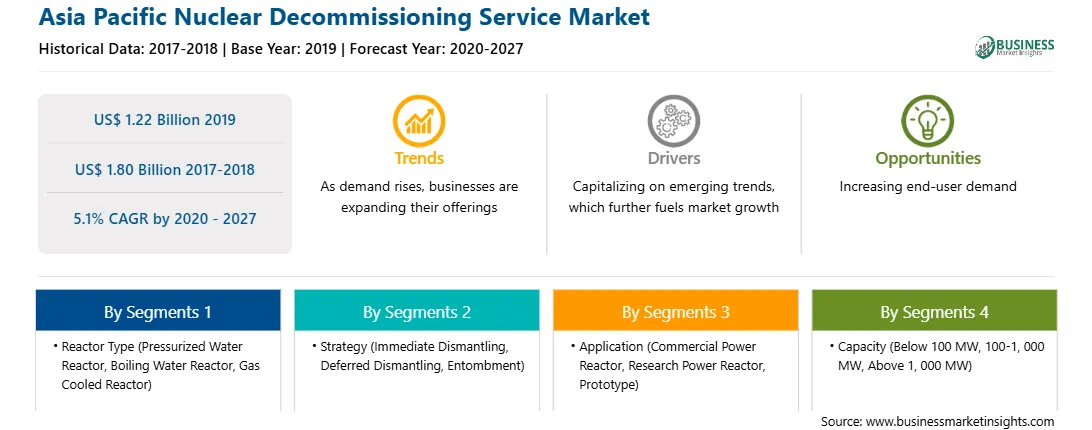

| Market size in 2019 | US$ 1.22 Billion |

| Market Size by 2027 | US$ 1.80 Billion |

| Global CAGR (2020 - 2027) | 5.1% |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Reactor Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Nuclear Decommissioning Service refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The nuclear decommissioning service market in Asia-Pacific was valued US$ 1.22 billion in 2019 and is projected to reach US$ 1.80 billion by 2027; it is expected to grow at a CAGR of 5.1% from 2020 to 2027. Nuclear Regulatory Commission (NRC) and International Atomic Energy Agency (IAEA), among others, are the governing authorities that are increasingly emphasizing decommissioning to reduce the risk of radioactive emission from nuclear reactor sites. This factor is anticipated to drive the growth of the nuclear decommissioning services market globally. According to IEA, a total of 411 nuclear power plants are set to be decommissioned by 2040, comprising 295 commercial power plants and 116 research reactors.

In terms of reactor type, the pressurized water reactor segment accounted for the largest share of the Asia-Pacific nuclear decommissioning service market in 2019. Whereas, by application, the commercial reactor segment held a larger market share of the nuclear decommissioning service market in 2019. Further, based on country, the China held the largest share of the Asia-Pacific market.

A few major primary and secondary sources referred to for preparing this report on the nuclear decommissioning service market in Asia-Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AECOM, Ansaldo Energia S.p.A., Babcock International Group PLC, Bechtel Corporation, EnergySolutions, GE Hitachi Nuclear Energy (GEH), Orano, Studsvik AB, Fluor Corporation, and Korea Hydro & Nuclear Power Co. Ltd..

The Asia Pacific Nuclear Decommissioning Service Market is valued at US$ 1.22 Billion in 2019, it is projected to reach US$ 1.80 Billion by 2027.

As per our report Asia Pacific Nuclear Decommissioning Service Market, the market size is valued at US$ 1.22 Billion in 2019, projecting it to reach US$ 1.80 Billion by 2027. This translates to a CAGR of approximately 5.1% during the forecast period.

The Asia Pacific Nuclear Decommissioning Service Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Nuclear Decommissioning Service Market report:

The Asia Pacific Nuclear Decommissioning Service Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Nuclear Decommissioning Service Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Nuclear Decommissioning Service Market value chain can benefit from the information contained in a comprehensive market report.