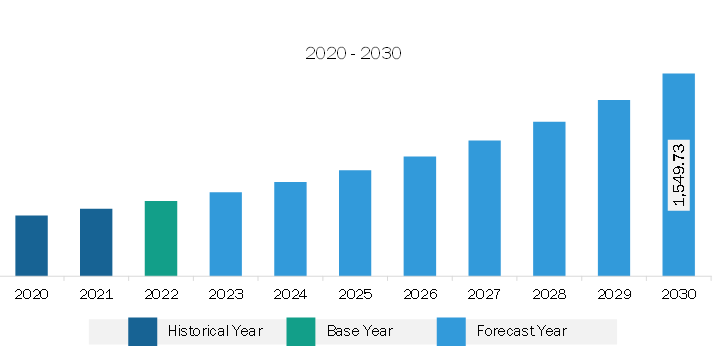

The Asia Pacific non-dairy yogurt market was valued at US$ 576.00 million in 2022 and is expected to reach US$ 1,549.73 million by 2030; it is estimated to grow at a CAGR of 13.2% from 2022 to 2030.

Strategic Development Initiatives by Manufacturers Fuels the Asia Pacific Non-Dairy Yogurt Market

Non-dairy yogurt manufacturers are making significant investments in product innovations to attract a large group of consumers. The manufacturers offer certified organic, non-GMO, gluten-free, clean-label, and allergen-free products to cater to emerging customer requirements. Moreover, as consumers have become health-conscious, they prefer low-calorie and low-fat products. Therefore, manufacturers of plant-based dairy offer unsweetened and low-sugar products. In February 2021, Halsa Foods launched zero-sugar oat milk yogurt in a 24 oz family size. The product contains only 90 calories per serving and has no added sugar. Also, in 2023, Yoghurt brand Coyo Pty Ltd has launched a new range of plant-based frozen yoghurt made with real fruit, and using coconut as its yoghurt base, in place of dairy.

Further, manufacturers are also launching products by incorporating different flavors and functional nutrients. In December 2020, Danone SA launched the Silk Kids Almond Milk Yogurt Alternative plant-based yogurts, specially formulated for kids. The product comprises fava beans protein, almond milk, live & active culture, and organic coconut oil. It is fortified with vitamin D and calcium to satisfy the children's nutrition. The yogurt substitute is dairy-free, lactose-free, gluten-free, and peanut-free. It is available in three flavors-apple cinnamon, strawberry, and mixed berry. Product innovation strategy offers a competitive edge to the players operating in the market and boosts their profitability, which propels the Asia Pacific non-dairy yogurt market growth.

Asia Pacific Non-Dairy Yogurt Market Overview

The non-dairy yogurt market in the Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. A few factors contributing to the demand for non-dairy yogurt in the region are a surge in health-conscious consumers in emerging countries and the rising trend of consuming plant-based dairy products. Non-dairy yogurts contain low-fat, low-calorie, and low-cholesterol content, appealing to health-conscious and lactose-intolerant customers. Moreover, a few people are vegan, while an increasing number of people are adopting "flexitarian" dietary patterns. Thus, this shift in customer preferences boosts the demand for dairy alternatives such as non-dairy yogurt.

In recent years, the consumption of non-dairy yogurt has steadily increased due to the growing number of lactose-intolerant people and health concerns regarding antibiotics and growth hormones often found in cows milk. The research conducted by Rakuten in 2021 showed that 87% of consumers in China had tried plant-based milk, 50% had tried other dairy substitutes, 42% had tried plant-based meat, and 32% had tried vegan egg replacements. Furthermore, the same research found that 3% of respondents only consume plant-based foods.

The non-dairy yogurt market in the Asia Pacific is significantly growing due to changing lifestyles of consumers and an increase in the consumption of clean-label products, organic, and gluten-free products. The market in the region is also undergoing a remarkable transformation due to increased urbanization, diet diversification, and the legalization of foreign direct investment in the food sector. Hence, manufacturers are adopting strategies for the development and expansion of their businesses. In 2020 Invigorate Foods announced its plan to invest US$ 8.4 million (INR 60 crores) in the next three years in plant, equipment, and other capital goods required for manufacturing soymilk products in India. Further, in 2019, The Blue Diamond announced its expansion into the non-dairy yogurt alternative category with almond breeze and almond milk yogurt alternatives. Similarly, food wholesaler and manufacturer Kokubu Food launched Japan's first almond-based yogurt in April 2020. Such developments by manufacturers boost the demand for non-dairy yogurt in Asia Pacific.

Asia Pacific Non-Dairy Yogurt Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Non-Dairy Yogurt provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 576.00 Million |

| Market Size by 2030 | US$ 1,549.73 Million |

| Global CAGR (2022 - 2030) | 13.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Source

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Non-Dairy Yogurt refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. The Hain Celestial Group Inc

2. Danone SA

3. COYO Pty Ltd

4. Valio Ltd

5. Oatly Group AB

The Asia Pacific Non-Dairy Yogurt Market is valued at US$ 576.00 Million in 2022, it is projected to reach US$ 1,549.73 Million by 2030.

As per our report Asia Pacific Non-Dairy Yogurt Market, the market size is valued at US$ 576.00 Million in 2022, projecting it to reach US$ 1,549.73 Million by 2030. This translates to a CAGR of approximately 13.2% during the forecast period.

The Asia Pacific Non-Dairy Yogurt Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Non-Dairy Yogurt Market report:

The Asia Pacific Non-Dairy Yogurt Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Non-Dairy Yogurt Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Non-Dairy Yogurt Market value chain can benefit from the information contained in a comprehensive market report.