The increasing prevalence of cancer and the proliferation of the biotechnology industry in developing regions are boosting the APAC market. However, complications associated with the manufacturing and approvals of next-generation antibodies are expected to restrict the market growth during the forecast period.

The rising support from governments, continuously changing disease profiles, increase in public-private partnerships, and surge in funding activities are widely enhancing the performance of biotechnology industries in Asia Pacific, which create enormous opportunities in this region. In addition, developing APAC countries serve lucrative prospects due to the continuously growing population, including geriatric populations. The heavy investments have also encouraged the adoption of advanced technologies in the healthcare sector. According to the Organization for Economic Co-operation and Development (OECD), China was the frontrunner in R&D expenditure in 2019.

Furthermore, the governments in this region offer tax incentives, cheaper land, incubators, and direct investments to encourage local biotechnology companies to expand their abilities and capacities, which, in turn, is expected to create opportunities for next-generation antibodies over the next few years. Asian countries are focusing more on using genomics, proteomics, next-generation sequencing, CRISPR technologies, and biomarkers for diagnostic and therapeutic applications. Therefore, such enhancements in the biotechnology industry are likely to bolster the demand for next-generation antibodies in the coming years.

Countries in Asia Pacific are encountering challenges due to rising incidences of COVID-19. The COVID-19 pandemic has put a significant strain on the health systems of many countries around the world. Testing capacity in many APAC nations was limited and of low quality in the initial days of the pandemic, leading to a surge in COVID-19 cases. However, several countries, such as South Korea, Japan, and Singapore, were efficiently contained the situation through robust tracking and testing. India had the second-highest number of cases only after the US.

The pandemic created an extraordinary emergency that particularly affected the supply chain. Along with the enormous demand for effective diagnostics and therapeutics for its treatment, the supply chain disruptions have put the healthcare research industry in a critical situation in this region. However, many market players now realized the importance of antibody testing for COVID-19, which is expected to raise the demand for custom antibodies during the forecast period.

It is important to note that during this pandemic, within the region, Japan emerged as a popular hub for antibody testing product manufacturers. Japanese companies, such as Roche Holding AG unit, Fujifilm, Eli Lilly, and Regeneron, have actively developed antibody tests for COVID 19 diagnosis. For instance, in May 2021, India gave an emergency use permit for a COVID-19 antibody-drug cocktail generated by Roche and Regeneron, developing drugs to battle a massive second wave of infections. The treatment involves two antibodies, Casirivimab and Imdevimab, synthetically manufactured copies of antibodies that the body produces after an illness. Many biopharmaceutical and clinical research organizations companies target Asian countries, such as China & India, for drug discovery and development.

Similarly, in July 2021, Roche announced that Japan's Ministry of Health, Labour and Welfare (MHLW) approved Ronapreve (casirivimab and imdevimab) to treat patients with mild to moderate COVID-19 via intravenous infusion. In addition, in December 2020, CEPI, the Coalition for Epidemic Preparedness Innovations, announced a collaboration with South Korea-based SK bioscience to advance the development of a next-generation vaccine against SARS-CoV-2, the virus that causes COVID-19. The presence of less stringent regulations for antibody development and production, vast genome pool, and developing healthcare infrastructure is expected to increase the uptake of the next-generation antibody in coming years.

Strategic insights for the Asia Pacific Next-generation Antibody provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 999.49 Million |

| Market Size by 2028 | US$ 2,312.68 Million |

| Global CAGR (2021 - 2028) | 12.7% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Therapeutic Area

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Next-generation Antibody refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

By Therapeutic Area

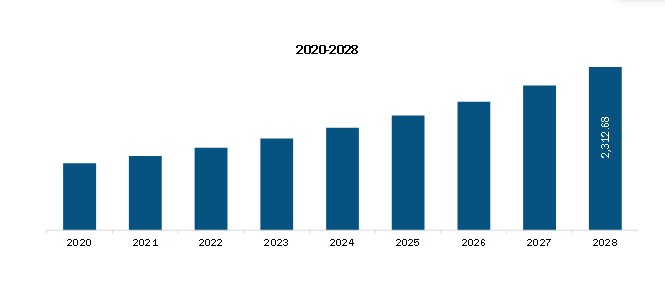

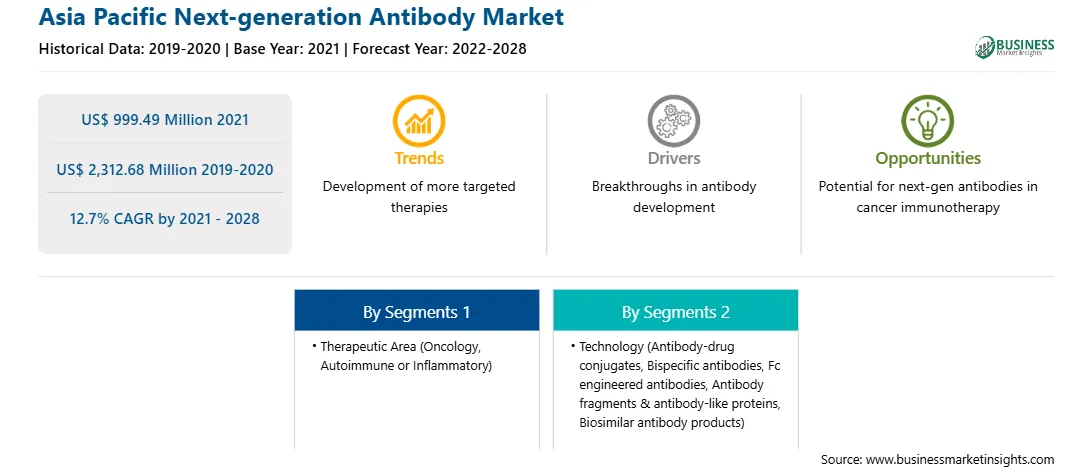

The Asia Pacific Next-generation Antibody Market is valued at US$ 999.49 Million in 2021, it is projected to reach US$ 2,312.68 Million by 2028.

As per our report Asia Pacific Next-generation Antibody Market, the market size is valued at US$ 999.49 Million in 2021, projecting it to reach US$ 2,312.68 Million by 2028. This translates to a CAGR of approximately 12.7% during the forecast period.

The Asia Pacific Next-generation Antibody Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Next-generation Antibody Market report:

The Asia Pacific Next-generation Antibody Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Next-generation Antibody Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Next-generation Antibody Market value chain can benefit from the information contained in a comprehensive market report.