For years, pesticides have been in use in an indiscriminate manner, destroying many of the natural adversaries of formerly innocuous species, along with swiftly inducing resistance in many parasites. Over the years, the green revolution has succeeded in part through the heavy use of chemical fertilizers and pesticides subsidized by governments. Many countries launched production support programs to stimulate agricultural production and achieve food self-sufficiency. Government subsidies resulted in the lower prices of fertilizers, resulting in their overuse, which not only burdened national fiscal positions but also caused environmental degradation. Thus, various countries began adopting bio-based alternatives to synthetic miticides to control environmental degradation. Malaysia reported the use of 101 metric tons of botanical and biological insecticides in agricultural practices in 2019. Plant-derived or botanical pesticides, including miticides, are typically more easily degradable and may have a lower environmental impact than chemically manufactured medications. The growing demand for such natural products to treat crops has led companies in the Asia Pacific miticides market to introduce bio-based products. Thus, the increasing popularity of organic agricultural produce and growing government efforts to develop bio-based farming practices are triggering the demand for bio-based miticides, which is likely to emerge as a significant trend in the Asia Pacific miticides market in the coming years.

The Asia Pacific miticides market is prominent due to growing awareness about crop protection chemicals among farmers, government subsidies, and rising food demand due to the increasing population. During the forecast period, surging demand for excellent agricultural products and organic produce's increasing need for high productivity and yield are expected to boost the use of miticides in Asia Pacific countries, especially China, Japan, and India. Increasing agriculture sector, these Asian countries determine a high product consumption rate. According to the Asian Development Bank, rising incomes and urbanization are transforming food consumption. Policies introduced by many international, multilateral, and bilateral organizations on regulating pesticide distribution and promoting integrated pest management (IPM) have supported the efforts of governments in the region. The development of the Food and Agriculture Organization's (FAO's) International Code of Conduct on the Distribution and Use of Pesticides has greatly helped with the process. Further, the growing fruits & vegetable industry has propelled the demand for miticides in Asia Pacific. Asia Pacific countries such as India, China, and Japan are among the top fruit and vegetable-producing countries. According to the Ministry of Agriculture & Farmers Welfare, in 2021, India was the second-largest horticulture producer behind China, producing about 12% of the global fruit and vegetable production. This increased production of fruits and vegetables in Asia Pacific is expected to boost the demand for miticides in the region in the coming years.

Strategic insights for the Asia Pacific Miticides provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Miticides refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Miticides Strategic Insights

Asia Pacific Miticides Report Scope

Report Attribute

Details

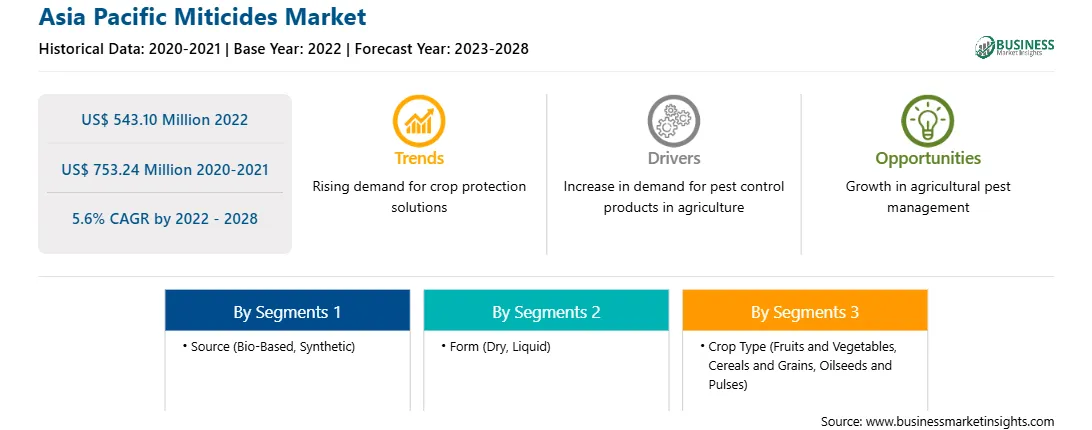

Market size in 2022

US$ 543.10 Million

Market Size by 2028

US$ 753.24 Million

Global CAGR (2022 - 2028)

5.6%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Source

By Form

By Crop Type

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Miticides Regional Insights

Asia Pacific Miticides Market Segmentation

The Asia Pacific Miticides market is segmented into source, form, crop type, and country.

Based on source, the Asia Pacific miticides market is bifurcated into bio-based and synthetic. In 2022, the synthetic segment registered a larger share in the Asia Pacific miticides market.

Based on form, the Asia Pacific miticides market is segmented into dry and liquid. In 2022, the liquid segment registered a larger share in the Asia Pacific miticides market.

Based on crop type, the Asia Pacific miticides market is segmented into fruits and vegetables, cereals and grains, oilseeds and pulses, and others. In 2022, the fruits and vegetables segment registered a largest share in the Asia Pacific miticides market.

Based on country, the Asia Pacific miticides market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. In 2022, China segment registered a largest share in the Asia Pacific miticides market.

BASF SE; Bayer AG; Certis USA LLC; FMC Corp; Gowan Co; Kemin Industries Inc.; Nihon Nohyaku Co. Ltd.; Oro Agri International BV; Syngenta AG; and UPL Ltd are the leading companies operating in the Asia Pacific miticides market.

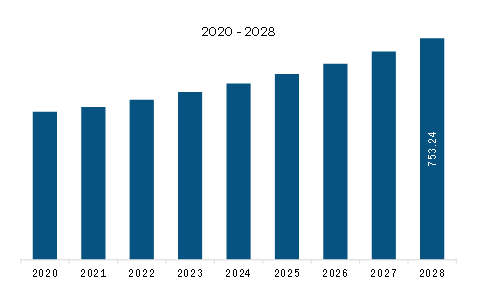

The Asia Pacific Miticides Market is valued at US$ 543.10 Million in 2022, it is projected to reach US$ 753.24 Million by 2028.

As per our report Asia Pacific Miticides Market, the market size is valued at US$ 543.10 Million in 2022, projecting it to reach US$ 753.24 Million by 2028. This translates to a CAGR of approximately 5.6% during the forecast period.

The Asia Pacific Miticides Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Miticides Market report:

The Asia Pacific Miticides Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Miticides Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Miticides Market value chain can benefit from the information contained in a comprehensive market report.