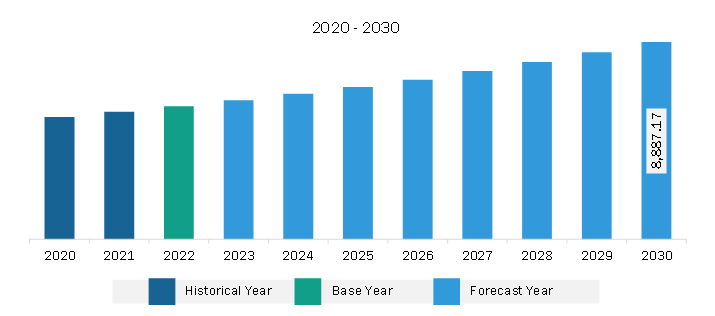

The Asia Pacific mining chemicals market was valued at US$ 6,013.78 million in 2022 and is expected to reach US$ 8,887.17 million by 2030; it is estimated to register at a CAGR of 5.0% from 2022 to 2030.

Increasing Investments and Operations in Global Mining Sector Boost Asia Pacific Mining Chemicals Market

The increase in mining activities worldwide has resulted in rising demand for mining chemicals. Further, the adoption of advanced mining technologies, such as automation and digitization, improves efficiency and environmental sustainability in mining operations globally. According to the World Bank, production of graphite, lithium, and cobalt is expected to rise by ~500% by 2050 to meet the growing demand for clean energy technologies.

The region is witnessing an increase in mining activities due to the discovery of new mineral deposits, growing infrastructure developments, and increasing demand for minerals and resources. Governments and organizations in countries such as Australia, China, the Czech Republic, Portugal, the US, Canada, and others are actively promoting exploration and mining activities. As per a report by the Green Finance and Development Centre, investments in the metals and mining industries in China reached US$ 10 billion in the first half of 2023, a rise of 131% compared to the same period in 2022. Further, in October 2023, the government of Australia invested an additional US$ 3.9 billion in the Export Finance Australia-managed Critical Minerals Facility. The funding targeted support for mining projects aligned with Australia's Critical Minerals Strategy 2023-2030. The expansion activities and rising investments in the mining sector drive the demand for mining chemicals.

Asia Pacific Mining Chemicals Market Overview

Asia Pacific marks the presence of major mining companies such as Mitsubishi Materials Corporation, Jiangxi Copper Co Ltd, Aluminum Corporation of China Ltd, Coal India Limited, China Molybdenum Co Ltd, BHP, and others. Asia Pacific has 10 major surface mining projects-Green mine (China), Sangatta mine (Indonesia), Heidaigou mine (China), Oyu Tolgoi Copper-Gold mine (Mongolia), Gevra OC mine (India), Letpadaung Copper mine (Myanmar), Li mine (Thailand), FTB Project (Thailand), and Pasir mine (Indonesia). According to the report published by the US Geological Survey in 2022, China was the largest supplier of 25 non-fuel mineral commodities to several countries globally in 2021. Additionally, China is the producer of 16 critical minerals out of 25 listed minerals. According to research conducted by the Norwegian Institute of International Affairs in 2022, Central Asia recorded a presence of 38.6% of global manganese ore reserves, 30.07% of chromium, 20% of lead, 12.6% of zinc, 8.7% of titanium, 5.8% of aluminum, and 5.3% of copper.

China, Tajikistan, Australia, Vietnam, and other countries account for major antimony mine production and reserves worldwide. As per the World Mining Data 2022 report released by the Federal Ministry Republic of Austria, the mining production rate for minerals in Australia recorded a rise of 142.2% during 2000-2020. As per the International Energy Agency, Chinese companies doubled their investments in critical mineral exploration, especially in lithium projects. The demand for mining chemicals is directly proportional to the mining operations and mineral exploration activities in the region. Therefore, growth in mining operations bolsters the demand for mining chemicals in Asia Pacific.

Asia Pacific Mining Chemicals Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Mining Chemicals provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 6,013.78 Million |

| Market Size by 2030 | US$ 8,887.17 Million |

| Global CAGR (2022 - 2030) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Mining Chemicals refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

1. Orica Ltd

2. Kemira Oyj

3. BASF SE

4. Clariant AG

5. Dow Inc

6. AECI Ltd

7. Nouryon Chemicals Holding BV

8. Solvay SA

9. Arkema SA

The Asia Pacific Mining Chemicals Market is valued at US$ 6,013.78 Million in 2022, it is projected to reach US$ 8,887.17 Million by 2030.

As per our report Asia Pacific Mining Chemicals Market, the market size is valued at US$ 6,013.78 Million in 2022, projecting it to reach US$ 8,887.17 Million by 2030. This translates to a CAGR of approximately 5.0% during the forecast period.

The Asia Pacific Mining Chemicals Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Mining Chemicals Market report:

The Asia Pacific Mining Chemicals Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Mining Chemicals Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Mining Chemicals Market value chain can benefit from the information contained in a comprehensive market report.