The introduction of robotic surgery is the most recent advancement in liposuction. The surgeon controls the treatments from a master console, while the robotic patient cart conducts the procedures with greater ease and precision than laparoscopy. Because of its 3D vision and accurate, intuitive multi-range instruments, robotic surgery for obesity has distinct advantages over traditional laparoscopic surgery, providing patients with increased safety. It also aids in the improvement of suturing abilities and the reduction of post-operative pain and recovery time. It is recommended even for hugely obese individuals weighing more than 250 kg, a procedure that is more demanding and difficult to execute by laparoscopy. Similarly, as per an article published in 2020 on the comparison between the surgical outcomes of integrated robotic surgery and conventional laparoscopic surgery for distal gastrectomy, the surgical success rate in the integrated robotic distal gastrectomy (IRDG) group was 98.0%, significantly higher than the success rate in conventional laparoscopic distal gastrectomy (CLDG) group, i.e., 89.5%. Although both groups had similar rates of in-patient and out-patient problems, the readmission rate of the IRDG group was much lower than the CLDG group. Further, robotic surgeries aid better visualization capabilities that provide surgeons a greater view of the work area and allow them to see microscopic details by using high-definition cameras. These systems have more dexterity than the human hand, and their ability to rotate 360° and navigate better allows surgeons to reach hard-to-access areas. For instance, a team of researchers has combined a nitrogen-powered arm (as a fifth robotic arm) with an optical magnification video lens system to develop a robotic platform for extracorporeal robotic microsurgical treatments. The VITOM is an HD exoscopic video system with optical lenses that is used for spine surgery and pediatric surgery. The optical magnification in the system ranges from 16x to 25x. The microsurgeon can view the image from the VITOM system just below the main 3D robot camera view using the TilePro imaging software in the surgeon interface. Thus, robotic microsurgeries ensure greater accuracy, repeatability, control, and efficiency. Along with these benefits, the growing desire for better, faster healthcare services propels the micro-surgical robot market growth.

With the new features and technologies, vendors can attract new customers and expand their footprints in emerging markets. This factor is likely to drive the Asia Pacific micro-surgical robot market. The Asia Pacific micro-surgical robot market is expected to grow at a notable CAGR during the forecast period.

Strategic insights for the Asia Pacific Micro-Surgical Robot provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

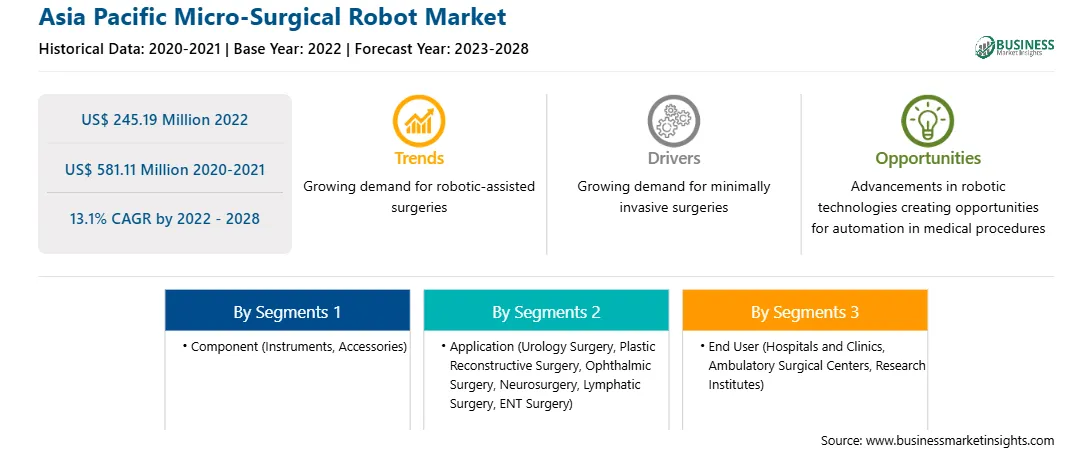

| Market size in 2022 | US$ 245.19 Million |

| Market Size by 2028 | US$ 581.11 Million |

| Global CAGR (2022 - 2028) | 13.1% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Micro-Surgical Robot refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Micro-Surgical Robot Market Segmentation

The Asia Pacific micro-surgical robot market is segmented based on component, application, end user, and country. Based on component, the Asia Pacific micro-surgical robot market is divided into instruments and accessories. The instruments segment dominated the Asia Pacific micro-surgical robot market in 2022. Based on application, the Asia Pacific micro-surgical robot market is categorized into urology surgery, plastic reconstructive surgery, ophthalmic surgery, neurosurgery, lymphatic surgery, ENT surgery, and other. The urology surgery segment dominated the Asia Pacific micro-surgical robot market in 2022. Based on end user, the Asia Pacific micro-surgical robot market is categorized into hospitals and clinics, ambulatory surgical centers, research institutes, and others. The hospitals and clinics segment dominated the Asia Pacific micro-surgical robot market in 2022. Based on country, the Asia Pacific micro-surgical robot market is segmented into China, Japan, India, South Korea, Australia, and Rest of Asia Pacific. China dominated the Asia Pacific micro-surgical robot market in 2022.

Microsure B.V; Stryker Corporation; Intuitive Surgical; Medtronic; Ethicon (Johnson & Johnson Services, Inc.); Asensus Surgical, Inc.; and Zimmer Biomet by Altair are among the leading companies in the Asia Pacific micro-surgical robot market.

The Asia Pacific Micro-Surgical Robot Market is valued at US$ 245.19 Million in 2022, it is projected to reach US$ 581.11 Million by 2028.

As per our report Asia Pacific Micro-Surgical Robot Market, the market size is valued at US$ 245.19 Million in 2022, projecting it to reach US$ 581.11 Million by 2028. This translates to a CAGR of approximately 13.1% during the forecast period.

The Asia Pacific Micro-Surgical Robot Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Micro-Surgical Robot Market report:

The Asia Pacific Micro-Surgical Robot Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Micro-Surgical Robot Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Micro-Surgical Robot Market value chain can benefit from the information contained in a comprehensive market report.