The importance of efficient and cost-effective manufacturing solutions is increasing with the rise in demand for metal products across various industries. Automated fabrication processes and robotics offer several advantages over traditional manual manufacturing methods. Automated fabrication processes can streamline the metal processing workflow by integrating computer-aided design and computer-aided manufacturing (CAD/CAM) systems. These systems allow manufacturers to automate tasks such as cutting, bending, welding, and finishing, reducing the need for manual laborers and improving overall efficiency. Automated processes can also enhance product quality by reducing errors and inconsistencies with manual production. In 2022, TRUMPF launched a new automated loading solution in collaboration with STOPA for laser tube cutting machines. This solution would help TRUMPF to automatically transfer tubes from a storage system to a tube-cutting machine. Automating such processes also allows enterprises to reduce nonproductive time, which results in enhanced overall productivity.

In addition to automated fabrication processes, the use of robotics in metal processing operations has gained significant attention in recent years. Robots can perform various tasks from handling raw materials to finishing and packaging final products. They can work around the clock, improving productivity and reducing lead times. Furthermore, robots offer greater precision, accuracy, and repeatability than manual workers, leading to higher product quality and consistency. In 2020, Shape Process Automation partnered with TRUMPF and FANUC Robotics. This collaboration is expected to bring expertise into the company in robotics laser cutting systems. Technological developments in robotics allow companies to achieve cutting precision, cost reduction, quality improvement, and efficiency enhancement. Companies such as Ford, Boeing, Airbus, Toyota, Caterpillar, Apple, and Samsung have managed to enhance their productivity with such advancements in metal processing operations. Thus, the adoption of automated fabrication processes and the use of robotics presents significant opportunities for the growth of the Asia Pacific metal processing machine market.

The Asia Pacific metal processing machine market in APAC is segmented into South Korea, India, China, Japan, Australia, and the Rest of APAC. The region consists of various growing economies such as India, China, Indonesia, and the Philippines. These countries are witnessing a gradual rise in the adoption of advanced technologies. Further, the availability of low labor costs, low taxes and duties, and a strong business ecosystem are attracting global players in the manufacturing industry to expand their manufacturing facilities in this region. In October 2021, Novelis, one of the world's largest aluminum recycler companies, announced an investment of US$ 375 million in the expansion of a recycling and production facility in China for aluminum products used in the auto industry. In November 2022, Kennametal Inc. announced the launch of its new metal cutting inserts manufacturing facility in Bengaluru, India. With this strategic development, the company aims to enhance its capabilities and capacity to fulfill the growing demand from the APAC market. Thus, the growing manufacturing industry in APAC is anticipated to offer lucrative opportunities for the metal processing machinery market in the coming years.

Strategic insights for the Asia Pacific Metal Processing Machines provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Metal Processing Machines refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Metal Processing Machines Strategic Insights

Asia Pacific Metal Processing Machines Report Scope

Report Attribute

Details

Market size in 2023

US$ 10,678.24 Million

Market Size by 2030

US$ 15,722.67 Million

Global CAGR (2023 - 2030)

5.7%

Historical Data

2021-2022

Forecast period

2024-2030

Segments Covered

By Press Brake

By Laser Cutting Machine

By Bending Machine

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Metal Processing Machines Regional Insights

Asia Pacific Metal Processing Machines Market Segmentation

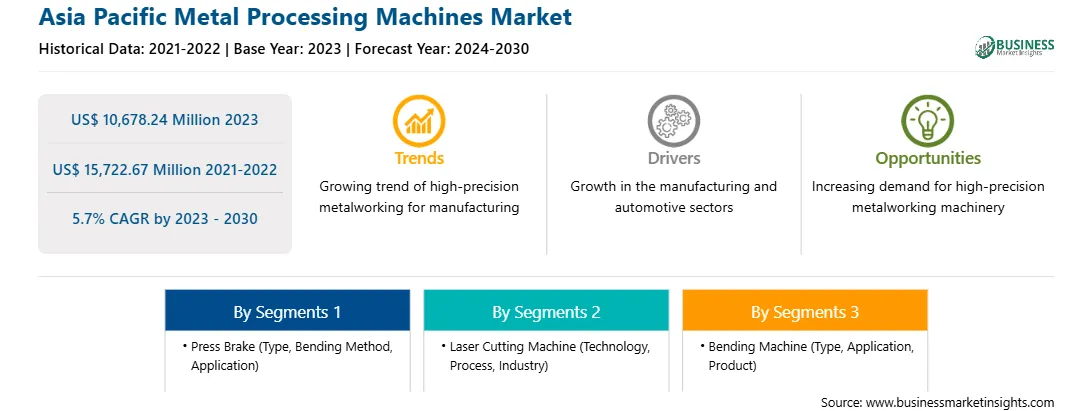

The Asia Pacific metal processing machines market is segmented into press brake, laser cutting machine, bending machine, and country.

The press brake market is further categorized into type, bending method, and application. By press brake, the type segment is further sub-segmented into manual, hydraulic, and electronic. The hydraulic sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023. The bending method segment, by press brake, is classified into air bending, bottom bending, and coining. The air bending sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023. Also, the application segment, by press brake, is sub-segmented into automotive, aerospace, metal, furniture, and others. The automotive sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023.

The laser cutting machine market is further categorized into technology, process, and industry. By laser cutting machine, the technology segment is further sub-segmented into fiber laser and plasma laser. The fiber laser sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023. The process segment, by press brake, is classified into fusion cutting, flame cutting, and sublimation cutting. The flame cutting sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023. Also, the industry segment, by press brake, is sub-segmented into automotive, aerospace & defense, consumer electronics, industrial, and others. The industrial sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023.

The bending machine market is further categorized into type, application and products. By bending machine, the type segment is further sub-segmented into electric, hydraulic, pneumatic, and electromagnetic. The hydraulic sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023. The application segment, by bending machine, is classified into manufacturing, precision machinery, metals and mining, automotive, and building and construction. The automotive sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023. Also, the products segment, by bending machine, is sub-segmented into sheets, tube, and others. The tube sub-segment held the largest share of the Asia Pacific metal processing machines market in 2023.

Based on country, the Asia Pacific metal processing machines market is segmented into China, Japan, South Korea, Indonesia, Malaysia, and the Rest of Asia Pacific. The China dominated the share of the Asia Pacific metal processing machines market in 2023.

Amada (India) Pvt Ltd, Bystronic AG; Dener USA LLC; Durmazlar Machinery Inc; Ermaksan Machinery Industry and Trade Inc; LVD Company NV; Prima Industrie SpA; Salvagnini Italia SPA; and TRUMPF SE + Co KG are the leading companies operating in the Asia Pacific metal processing machines market.

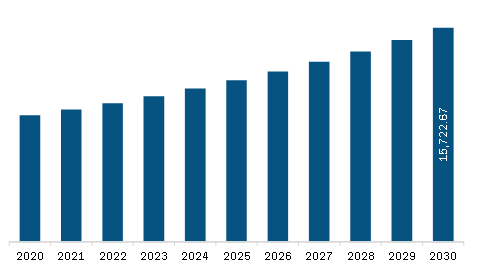

The Asia Pacific Metal Processing Machines Market is valued at US$ 10,678.24 Million in 2023, it is projected to reach US$ 15,722.67 Million by 2030.

As per our report Asia Pacific Metal Processing Machines Market, the market size is valued at US$ 10,678.24 Million in 2023, projecting it to reach US$ 15,722.67 Million by 2030. This translates to a CAGR of approximately 5.7% during the forecast period.

The Asia Pacific Metal Processing Machines Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Metal Processing Machines Market report:

The Asia Pacific Metal Processing Machines Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Metal Processing Machines Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Metal Processing Machines Market value chain can benefit from the information contained in a comprehensive market report.