APAC is one of the largest and fastest growing market of medium voltage cable, with China ranked first in the market share. The presence of large population and rising standard of living are creating the ever increasing demand for electricity. Thus, investment in power plants and distribution is expected to be one of the key factors driving the market. Also, developing economies of APAC are witnessing increased demand for houses, which is boosting growth of the residential segment, thereby driving the APAC medium voltage cable market. The rapid developments pertaining to technologies, initiatives from governments, and digitalization of economies are driving economic growth. Huge population in the region has led to high demand for commercial and residential construction activities. The governments of various countries are taking different measures to attract private investments in construction and infrastructure development. For instance, the Economic Transformation Program (ETP), 2011–2020, by the government of Malaysia works toward captivating substantial foreign direct investment (FDI) in the construction and infrastructure activities in the country. In the Philippines, the government began a public–private partnership (PPP) program for facilitating the growth of local and national infrastructural projects. Thailand is also focused on PPP programs for optimizing its infrastructural development. Hence, with a huge focus on construction activities in the region, the demand for medium voltage cables is expected to boost in APAC during the forecast period.

Moreover, in case of COVID-19, APAC is highly affected specially the India. Various developing economies are situated in the region that has announced lockdowns, ceasing the construction and manufacturing activities. The government of various countries in the APAC took necessary steps to reduce the virus's spread by announcing lockdowns, thus impacting the growth of the medium voltage cable market. The introduction of lockdowns has resulted in the halt of construction projects in the region, which negatively impacted the growth of medium voltage cable in the region. However, after a prolonged lockdown, various countries have started easing the restrictions. For instance, India's government started the unlock phase, in which it allowed the construction activities to resume. However, Australia is still under lockdown. Several cable manufacturing facilities are based in China, which was highly impacted in Q1 2020. The production and demand for medium voltage cables in the country dropped during Q1 2020, followed by recovery in Q2 2020. The country is one of the biggest markets for medium voltage cables in the world. Also, India is one of the significant markets for medium voltage cables. As per Polycab, an Indian cable manufacturing company, no significant impact was witnessed due to the outbreak of the COVID-19 pandemic in India. The company witnessed a slowdown in demand for cables in metropolitan cities, although demand for cables was positive in Tier II and Tier III cities. The company also stated that no noteworthy pickup in the CAPEX cycle in 2020.

Strategic insights for the Asia Pacific Medium Voltage Cable provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

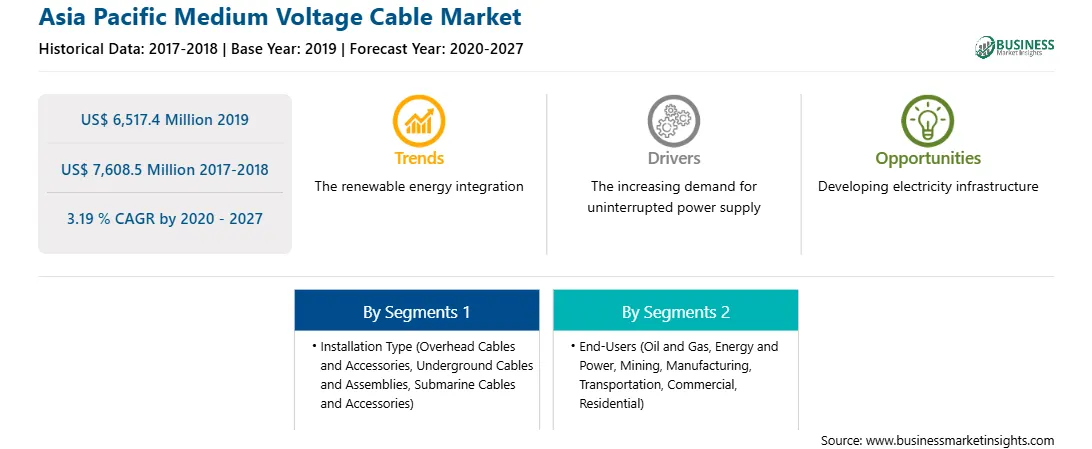

| Market size in 2019 | US$ 6,517.4 Million |

| Market Size by 2027 | US$ 7,608.5 Million |

| Global CAGR (2020 - 2027) | 3.19 % |

| Historical Data | 2017-2018 |

| Forecast period | 2020-2027 |

| Segments Covered |

By Installation Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Medium Voltage Cable refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

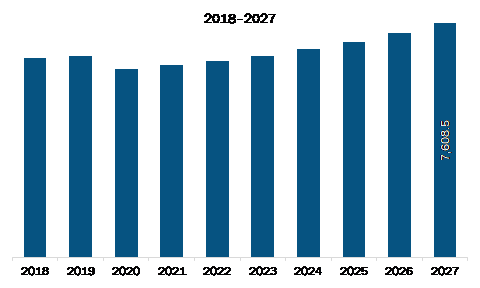

The APAC medium voltage cable market is expected to grow from US$ 6,517.4 million in 2019 to US$ 7,608.5 million by 2027; it is estimated to grow at a CAGR of 3.19 % from 2020 to 2027. Mounting urbanization and industrialization is expected to escalate the APAC medium voltage cable market. Growth in industrialization, particularly in the developing economies across APAC region, has created an ever increasing need for energy generation, transmission, and distribution. This has significantly propelled the demand for medium voltage cables. Further, industrialization has resulted in growth of urbanization in these countries as it created economic growth as well as job opportunities, which is driving people to relocate to cities. With the growth in urban population, there is an increase in investments to meet the challenges concerning need for housing, energy distribution, transportation, and other infrastructure. Moreover, urbanization and industrialization have also resulted in increased demand for basic facilities, such as education and healthcare. To meet these challenges, several governments across APAC region have laid down initiatives to meet shortages in the basic infrastructure and housing sector. Since medium voltage cables are vital component of electricity transmission and distribution, the above mentioned factors are anticipated to significantly boost the growth of the APAC medium voltage cable market.

In terms of installation type, the overhead cables and accessories segment accounted for the largest share of the APAC medium voltage cable market in 2019. In terms of end-users, the energy and power segment held a larger market share of the APAC medium voltage cable market in 2019.

A few major primary and secondary sources referred to for preparing this report on the APAC medium voltage cable market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are. Alpha Wire; Furukawa Electric Co. Ltd.; General Cable Technologies Corporation; LEONI AG; LS Cable & System Ltd.; Nexans; Sumitomo Electric Industries, Ltd.

The Asia Pacific Medium Voltage Cable Market is valued at US$ 6,517.4 Million in 2019, it is projected to reach US$ 7,608.5 Million by 2027.

As per our report Asia Pacific Medium Voltage Cable Market, the market size is valued at US$ 6,517.4 Million in 2019, projecting it to reach US$ 7,608.5 Million by 2027. This translates to a CAGR of approximately 3.19 % during the forecast period.

The Asia Pacific Medium Voltage Cable Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Medium Voltage Cable Market report:

The Asia Pacific Medium Voltage Cable Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Medium Voltage Cable Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Medium Voltage Cable Market value chain can benefit from the information contained in a comprehensive market report.