Enzymes are proteins produced in living cells of plants, animals, and microorganisms. All living organisms require enzymes for growth and for the production and utilization of energy which is essential for life. In the living cell, enzymes act as catalysts to speed up the chemical reactions which control life processes. Enzymes have been significant industrial products for more than a hundred years. However, the range of potential applications is increasing rapidly. With the advent of recombinant DNA technology, it has become possible to make formerly rare enzymes in large quantities and hence to reduce cost. Also, in pharmaceutical manufacturing, the desire to make chirally pure compounds is leading to new opportunities. Technological advances have facilitated the use of enzymes over an increasingly broad range of process conditions.

Thus, the significant increase in research and development activities is expected to create a significant demand for medical enzyme technology in the coming years, which is further anticipated to drive the medical enzyme technology market.

Following a string of pneumonia cases in Wuhan, the Chinese health authorities, the capital city of Hubei province (China), declared in January 2020 that these cases were caused by a novel coronavirus, officially known as extreme acute respiratory syndrome coronavirus (SARS-CoV)-2. In the initial outbreak in Wuhan, China, COVID-19 patients with digestive symptoms were found. In a descriptive, cross-sectional, multicenter study involving 204 COVID-19 patients validated by laboratory testing, 41.6% of COVID-19 patients reported nausea or vomiting, and 17.2% reported diarrhea. Importantly, patients with serious disease have a higher prevalence of diarrhea, nausea, or vomiting than those with mild disease. Another single-center study from a single hospital in Wuhan found that digestive symptoms are closely related to the severity of COVID-19. Diarrhea, nausea, vomiting, stomach pain, and anorexia were more common in patients admitted to the intensive care unit (ICU) than in those who were not moved to the ICU, and the prevalence of anorexia between the two groups was statistically significant, suggesting that it could be a strong predictor of a serious illness. Thus, the increasing demand for digestive enzymes is due to rising cases of COVID-19 is driving the growth of the market in the forecasted period.

Strategic insights for the Asia Pacific Medical Enzyme Technology provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

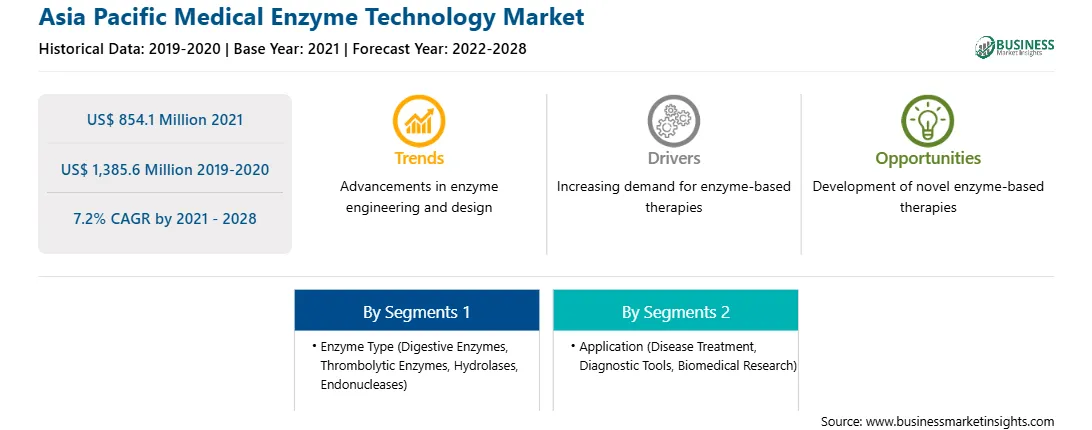

| Market size in 2021 | US$ 854.1 Million |

| Market Size by 2028 | US$ 1,385.6 Million |

| Global CAGR (2021 - 2028) | 7.2% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Enzyme Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Medical Enzyme Technology refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Medical enzyme technology market in Asia Pacific is expected to grow from US$ 854.1 million in 2021 to US$ 1,385.6 million by 2028; it is estimated to grow at a CAGR of 7.2% from 2021 to 2028. Enzymes are the preferred markers in various disease states such as myocardial infarction, jaundice, pancreatitis, cancer, and neurodegenerative disorders. They provide insight into the disease process by diagnosis, prognosis, and assessment of response therapy. Furthermore, many enzymes are used as diagnostic reagents in medical treatment. Due to the unique enzyme characteristics of specificity, high-catalytic efficiency, and mild action conditions, the enzymatic diagnosis has become a reliable, simple, and rapid diagnostic method. Because of their characteristics of remarkable curative effect and insignificant side effects, the medicinal enzymes have more and more applications in the healthcare sector, which is driving the medical enzyme technology market.

In terms of enzyme type, the hydrolases segment accounted for the largest share of the Asia Pacific medical enzyme technology market in 2020. In terms of application, the disease treatment segment accounted for the largest share of the Asia Pacific medical enzyme technology market in 2020.

A few major primary and secondary sources referred to for preparing this report on the medical enzyme technology market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Merck Kgaa, Thermo Fisher Scientific Inc., Novozymes, Takeda Pharmaceutical Company Limited, Agilent Technologies, Inc., Genzyme Corporation, Asahi Kasei Corporation, Promega Corporation, Cytiva, and Amano Enzyme Inc.

By Enzyme Type

By Application

By Country

The Asia Pacific Medical Enzyme Technology Market is valued at US$ 854.1 Million in 2021, it is projected to reach US$ 1,385.6 Million by 2028.

As per our report Asia Pacific Medical Enzyme Technology Market, the market size is valued at US$ 854.1 Million in 2021, projecting it to reach US$ 1,385.6 Million by 2028. This translates to a CAGR of approximately 7.2% during the forecast period.

The Asia Pacific Medical Enzyme Technology Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Medical Enzyme Technology Market report:

The Asia Pacific Medical Enzyme Technology Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Medical Enzyme Technology Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Medical Enzyme Technology Market value chain can benefit from the information contained in a comprehensive market report.