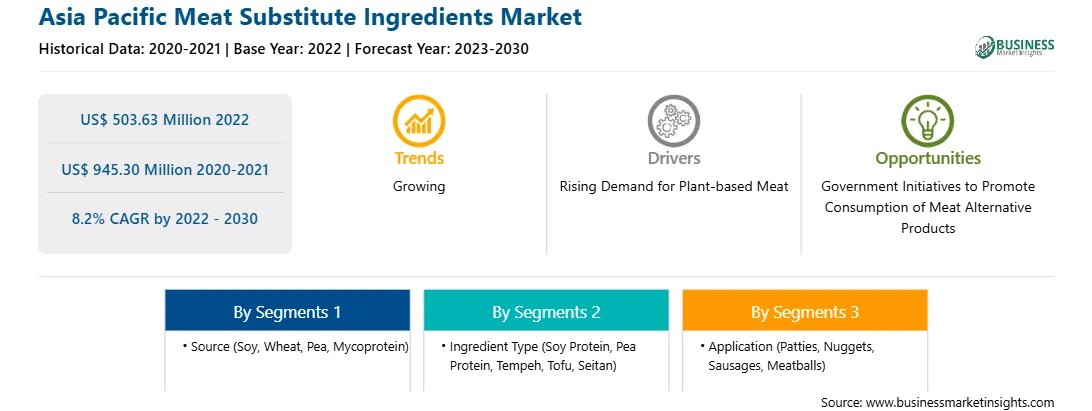

The Asia Pacific meat substitute ingredients market was valued at US$ 503.63 million in 2022 and is expected to reach US$ 945.30 million by 2030; it is estimated to record a CAGR of 8.2% from 2022 to 2030.

Government bodies across various countries are promoting the consumption of plant-based meat owing to the rising environmental concerns and health benefits offered by these products. Additionally, the governments are actively investing in R&D and new product launches of plant-based meat products. In 2021, the South Korean Ministry of Agriculture, Food and Rural Affairs established a US$ 70.3 million fund with several sub-funds dedicated to food and agriculture. The Green Bio Fund investments specifically mentioned plant-based and cultivated meat companies. Moreover, in June 2022, the Food Safety and Standards Authority of India (FSSAI) finalized the Vegan Foods Regulations and established a separate regulatory framework for food ingredients free from animal products. Also, the government announced US$ 76 million to support a project led by Australian Plant Proteins to create the largest pulse protein ingredient manufacturing capability in Australia, which is expected to generate up to US$ 2.6 billion in plant-based exports by 2032. Moreover, by establishing new dietary guidelines in 2021, the government of China announced plans to lower the country’s meat consumption by 50%. The country's health ministry recommended that individuals consume only between 40 g and 75 g of meat per day.

These measures aim to enhance public health while reducing GHG emissions significantly. Such recommendations and the influence by government agencies further boost the demand for alternative meat products. Thus, the continuous investment and support by various government bodies are expected to offer lucrative growth opportunities to the market during the forecast period.

The meat substitute ingredients market in Asia Pacific is growing consistently. A few factors contributing to the demand for meat substitute ingredients in the region are a surging vegan and vegetarian population and rising demand for plant-based food in emerging countries. Further, increasing cases of diseases caused by microbial contamination in food—such as trichinosis from pork, salmonella from poultry, scrapie from lamb, and vibrio illness and norovirus infections from fish products—drive consumer inclination toward plant-based meat alternatives.

The governments of Asian economies also boosted support for plant-based innovation. In March 2022, at the Two Sessions (China’s most important annual political conference), President Xi Jinping explicitly called for protein diversification from plant-based and microorganism sources. In China, the popularity of plant-based meat and protein alternatives is increasing due to government guidelines. In 2021, the Chinese government announced plans to lower its citizens' meat consumption by 50% to enhance public health and significantly reduce greenhouse gas emissions. Additionally, in June 2022, the Food Safety and Standards Authority of India (FSSAI) finalized a separate regulatory framework for vegan food that is free from animal products. Such government initiatives in the region boost the demand for meat substitute products, thereby driving the market for meat substitute ingredients in the region.

Strategic insights for the Asia Pacific Meat Substitute Ingredients provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Meat Substitute Ingredients refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Meat Substitute Ingredients Strategic Insights

Asia Pacific Meat Substitute Ingredients Report Scope

Report Attribute

Details

Market size in 2022

US$ 503.63 Million

Market Size by 2030

US$ 945.30 Million

Global CAGR (2022 - 2030)

8.2%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Source

By Ingredient Type

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Meat Substitute Ingredients Regional Insights

The Asia Pacific meat substitute ingredients market is categorized into source, ingredients type, application, and country.

Based on source, the Asia Pacific meat substitute ingredients market is categorized into Soy, wheat, pea, mycoprotein, and others. The soy segment held the largest market share in 2022.

Based on ingredients, the Asia Pacific meat substitute ingredients market is segmented into soy protein, pea protein, tempeh, tofu, seitan, and others. The soy protein segment held the largest market share in 2022.

In terms of application, the Asia Pacific meat substitute ingredients market is categorized into patties, nuggets, sausages, meatballs, and others. The others segment held the largest market share in 2022.

By country, the Asia Pacific meat substitute ingredients market is segmented into Australia, China, Japan, India, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific meat substitute ingredients market share in 2022.

Crespel & Deiters GmbH Co KG, DuPont de Neumours Inc, Ingredion Inc, Wilmar International Ltd, Archer Daniels Midland Co, Kerry Group Plc, Roquette Freres SA, and The Scoular Co are some of the leading companies operating in the Asia Pacific meat substitute ingredients market.

The Asia Pacific Meat Substitute Ingredients Market is valued at US$ 503.63 Million in 2022, it is projected to reach US$ 945.30 Million by 2030.

As per our report Asia Pacific Meat Substitute Ingredients Market, the market size is valued at US$ 503.63 Million in 2022, projecting it to reach US$ 945.30 Million by 2030. This translates to a CAGR of approximately 8.2% during the forecast period.

The Asia Pacific Meat Substitute Ingredients Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Meat Substitute Ingredients Market report:

The Asia Pacific Meat Substitute Ingredients Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Meat Substitute Ingredients Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Meat Substitute Ingredients Market value chain can benefit from the information contained in a comprehensive market report.