Emergence of Big Data Analytics and IoT will be Driving the Asia Pacific Maritime Information Market in Coming Years

Information collected from large operation systems, such as ships and ports, is verified using data analytics which includes information about container weight, type, and destination. Additionally, it can analyze the ship’s trim, stability, engine performance, and communication data, among others. Big data analytics on ships can provide insights into historical container patterns and maritime conditions. Ships move by responding to various shifts in weather conditions. Big data analytics analyses these parameters and increases the efficiency and overall performance of the sea vessels. Further, Internet of Things (IoT) enables the remote control of some objects. It functions with a GPS and a cloud-based database that stores all the information gathered by equipment on the ship. IoT can connect all other equipment and shipments through wireless networks, such as robots. Thus, the Emergence of big data analytics and IoT is anticipated to boost the growth of the maritime information across the region

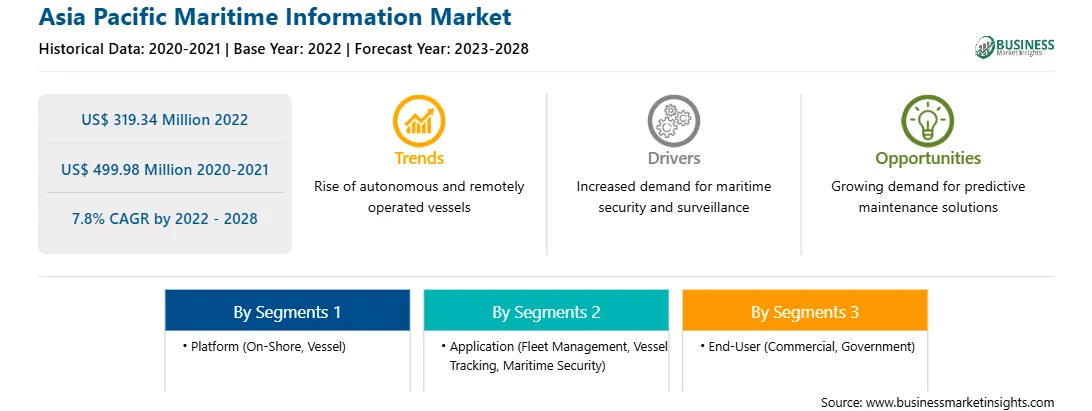

Asia Pacific Maritime Information Market Overview

Australia, China, India, Japan, South Korea, and rest of Asia Pacific are the key contributors to the maritime information market in the Asia Pacific. Based on a report by Allianz Global Corporate & Specialty (AGCS), a unit of Allianz Group, the number of shipping incidents in Asia has increased by 22% since 2018. This requires greater use of maritime information systems. Many ports, specifically Indian ports, are now adopting new technologies in which automated identification systems play a vital role. This is expected to address the inefficiencies of Indian ports in handling cargo due to constraints such as long dwell times. Maritime information plays a crucial role in economic development, as most of the world's trade is carried across Asia Pacific seas. As this continued commercial growth has increased the number of illegal activities, governments in countries such as China, Japan, and India are increasing their maritime budgets, potentially creating opportunities for market growth. Shanghai, Singapore, Hong Kong, Tianjin, Qingdao, Guangzhou, Busan, Ningbo-Zhoushan, and Shenzhen are among the busiest ports in the world; they are all located in Asia Pacific. Strong sea trade from countries in Asia Pacific, such as China, Japan, India, and South Korea, mainly contributed to the region's leading position in the market. In addition, large export volumes, intra-regional trading activities, and expanding manufacturing activities, especially in these countries, are expected to support market growth. For instance, in April 2019, a new land-sea freight route was implemented, connecting Southwest China's Chongqing Municipality with Indonesia. Cargo overturns at Asia's major hub ports surged through December 2020 as the rising container demand from the US and Europe overwhelmed terminals and carrier capacity, despite deploying all available vessels and extra loaders on both trades. Hence, the growing marine trading across the region is expected to propel the Asia Pacific maritime information market over the forecast period.

Strategic insights for the Asia Pacific Maritime Information provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Maritime Information refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Maritime Information Strategic Insights

Asia Pacific Maritime Information Report Scope

Report Attribute

Details

Market size in 2022

US$ 319.34 Million

Market Size by 2028

US$ 499.98 Million

Global CAGR (2022 - 2028)

7.8%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Platform

By Application

By End-User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Maritime Information Regional Insights

Asia Pacific Maritime Information Market Segmentation

The Asia Pacific maritime information market is segmented into platform, application, end-user, and country.

Based on platform, the Asia Pacific maritime information market is bifurcated into on-shore and vessel. In 2022, the vessel segment registered the larger share in Asia Pacific maritime information market.

Based on application, the Asia Pacific maritime information market is segmented into fleet management, vessel tracking, and maritime security. In 2022, the fleet management segment registered the largest share in Asia Pacific maritime information market.

Based on end user, the Asia Pacific maritime information market is bifurcated into commercial and government. In 2022, the commercial segment registered the larger share in Asia Pacific maritime information market.

Based on country, the Asia Pacific maritime information market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. In 2022, the Rest of Asia Pacific segment registered the largest share in Asia Pacific maritime information market.

BAE Systems Plc; Fujitsu Limited; Iridium Communications Inc.; L3Harris Technologies Inc.; Lockheed Martin Corp; Northrop Grumman Corp; ONEOCEAN; ORBCOMM Inc.; Polestar; Saab AB; Siemens AG; Spire Global; Thales Group; and Windward Ltd are the leading companies operating in the Asia Pacific maritime information market.

The Asia Pacific Maritime Information Market is valued at US$ 319.34 Million in 2022, it is projected to reach US$ 499.98 Million by 2028.

As per our report Asia Pacific Maritime Information Market, the market size is valued at US$ 319.34 Million in 2022, projecting it to reach US$ 499.98 Million by 2028. This translates to a CAGR of approximately 7.8% during the forecast period.

The Asia Pacific Maritime Information Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Maritime Information Market report:

The Asia Pacific Maritime Information Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Maritime Information Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Maritime Information Market value chain can benefit from the information contained in a comprehensive market report.