BESS can store excess energy generated during peak generation times, such as sunny or windy days. Reducing their erratic nature can help make renewable energy sources more dependable and dispatchable. By regulating energy output in real-time, frequency regulation services from BESS assist in maintaining a stable grid frequency. This is crucial for renewable energy sources, whose output can change depending on the weather.

BESS containing renewable energy has huge advantages such as energy self-sufficiency, cost-effectiveness, energy resiliency, environmental benefits, and grid support. Therefore, many developed countries are adopting renewable energy. According to The International Energy Agency, China is expected to add approximately half of the world's new renewable energy capacity between 2022 and 2027 as the growth of BESS is likely to accelerate in the following five years despite eliminating solar and wind power subsidies.

BESS can maintain stable voltage levels by injecting or absorbing reactive electricity into the grid. The system is crucial for renewable energy sources since their intermittent nature might result in voltage fluctuations. It can provide a black start capability, which allows a power system to be restarted after a complete blackout. This is particularly important for systems using renewable energy sources that might be unable to restart after a blackout due to their intermittent nature. BESS can also be used to build microgrids, which are standalone power systems that can enhance the grid in conjunction with renewable energy sources. BESS provides energy independence and resilience to communities, companies, and institutions. Hence, adopting BESS leads to ample opportunities in the renewable energy pipeline during the forecast period.

The Asia Pacific lithium-ion battery energy storage market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. Asia Pacific is one of the leading regions in the lithium-ion battery energy storage market, owing to favorable government policies and a rise in investment in wind and solar energy projects. Countries such as India, China, and Japan are the dominating countries holding a major market share, which is further expected to increase during the forecast period. According to China’s National Energy Administration (NEA), solar and wind power output increased by 21% and reached 1,190 TWh in 2022. This accounted for 13.8% of the total power consumption of China, which is approximately equal to the consumption of all urban and rural households. In addition, the supportive government policies are further expanding the installation of renewable energy capacity. According to the State Council of the People’s Republic of China, in 2022, China added total capacity of 125 GW in solar parks and wind farms combined, reaching a total capacity of 1,213 GW, of which photovoltaics accounted for 87.4 GW. Furthermore, the country increased its renewable capacity by 152 GW, including 15 GW from new hydropower plants, 8.8 GW from pumped storage hydropower, and 3.3 GW from biomass facilities, which is 76% of all new power plants built in the country.

Strategic insights for the Asia Pacific Lithium-Ion Battery Energy Storage provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Lithium-Ion Battery Energy Storage refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Lithium-Ion Battery Energy Storage Strategic Insights

Asia Pacific Lithium-Ion Battery Energy Storage Report Scope

Report Attribute

Details

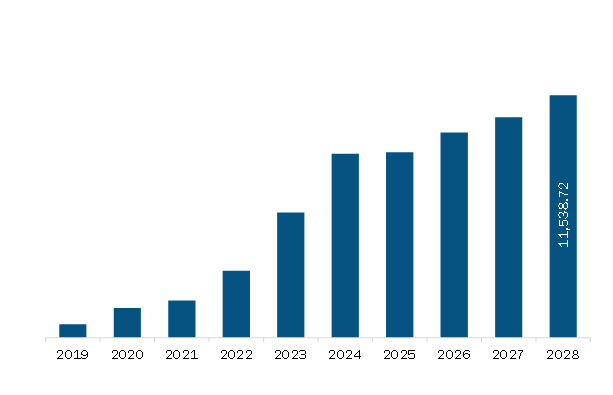

Market size in 2023

US$ 5,939.61 Million

Market Size by 2028

US$ 11,538.72 Million

Global CAGR (2023 - 2028)

14.2%

Historical Data

2021-2022

Forecast period

2024-2028

Segments Covered

By Capacity

By Connection Type

By End-use

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Lithium-Ion Battery Energy Storage Regional Insights

Asia Pacific Lithium-Ion Battery Energy Storage Market Segmentation

The Asia Pacific lithium-ion battery energy storage market is segmented into capacity, connection type, end-use, and country

Based on capacity, the Asia Pacific lithium-ion battery energy storage market is segmented into 0-10 kW, 10-20 kW, 20-50 kW, and Above 50 kW. The 10-20 kW segment held the largest share of the Asia Pacific lithium-ion battery energy storage market in 2023.

Based on connection type, the Asia Pacific lithium-ion battery energy storage market is segmented into on-grid and off-grid. The on-grid segment held a larger share of the Asia Pacific lithium-ion battery energy storage market in 2023.

Based on end use, the Asia Pacific lithium-ion battery energy storage market is segmented into residential, commercial and industrial, and utility. The utility segment held the largest share of the Asia Pacific lithium-ion battery energy storage market in 2023.

Based on country, the Asia Pacific lithium-ion battery energy storage market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the share of the Asia Pacific lithium-ion battery energy storage market in 2023.

ABB Ltd; BYD Co Ltd; Contemporary Amperex Technology Co Ltd; Doosan Gridtech Inc; Exide Industries Ltd; General Electric Co; Hitachi Energy Ltd; LG Chem Ltd; Mitsubishi Heavy Industries Ltd; Panasonic Holdings Corp; Samsung SDI Co Ltd; Siemens Energy AG; and Toshiba Corp are the leading companies operating in the Asia Pacific lithium-ion battery energy storage market.

The Asia Pacific Lithium-Ion Battery Energy Storage Market is valued at US$ 5,939.61 Million in 2023, it is projected to reach US$ 11,538.72 Million by 2028.

As per our report Asia Pacific Lithium-Ion Battery Energy Storage Market, the market size is valued at US$ 5,939.61 Million in 2023, projecting it to reach US$ 11,538.72 Million by 2028. This translates to a CAGR of approximately 14.2% during the forecast period.

The Asia Pacific Lithium-Ion Battery Energy Storage Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Lithium-Ion Battery Energy Storage Market report:

The Asia Pacific Lithium-Ion Battery Energy Storage Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Lithium-Ion Battery Energy Storage Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Lithium-Ion Battery Energy Storage Market value chain can benefit from the information contained in a comprehensive market report.