The Asia Pacific Leukapheresis market is analyzed based on three large countries: the China, Japan, India, South Korea, Australia, and Rest of APAC. China is contributing a major share in the growth of leukapheresis market. Due to the rapid socio-economic development, environmental problems, lifestyle changes, and urbanization, China faces several obstacles in maintaining and improving people's health. The Chinese government announced the Healthy China 2030 Plan, emphasizing the strategic importance of health for China's growth. In 2018 there were approximately 506,003 public primary care facilities and around 437,636 private village clinics. In 2018 there were about 12,000 public hospitals and 21,000 private hospitals (excluding city and community hospitals), of which about 20,500 were non-profit, and 12,600 were for-profit. With increasing investments in the health sector and a rising leukemia rate, China is deriving the demand for the leukapheresis market. Patients with leukemia often present with severe anemia and thrombocytopenia. The leukapheresis machines currently used in clinical practice can cause rapid red blood cell and platelet loss, increasing the risk of bleeding, exacerbating anemia, and reducing the effectiveness of subsequent chemotherapy. Since the current method of leukocyte depletion requires increased systemic blood circulation and takes longer, it is difficult for some patients to tolerate it. Further improvements in leukapheresis machines to achieve rapid and accurate sorting of leukocytes and minimize the possible side effects during the procedure are the problems that urgently need to be resolved. The rising medical infrastructure, new technologies, studies, and investments owing to the increasing geriatric population as well as the cases of leukemia are paving the way for market growth. According to Globocan, an increase of over 14,000 cases of acute lymphoblastic leukemia is expected in China by 2029.

Countries in the Asia Pacific are facing challenges due to increasing incidences of COVID-19. The COVID-19 pandemic has put a major strain on the health systems of many countries around the world. The cases of COVID-19 in India, the pandemic caused by SARS-CoV-2, has reached to 10,582,647 and total deaths above 152,000 on January 19, 2021. There is currently no proven specific therapy, and multiple novel and repurposed molecules are being used on an experimental basis. The lack of effective therapeutic options has been a major hurdle in our pandemic mitigation measures. There are a few contender medicines including the malaria drug hydroxychloroquine, an antiviral Remdesivir, and Ivermectin, a drug used for worms and other parasites, but the results are not hugely encouraging and at times conflicting. In this backdrop, plasma therapy is being seen with interest as a cure for COVID-19 patients in India. Further, Medical equipment that carries out the apheresis procedure was installed at the GMCH at nearby Thrissur last month and the technique was used for the first time in Kerala to administer plasma to a 51-year old man. The apheresis procedure was carried out by GMC's technologists working with the departments of medicine, transfusion medicine and anesthesia.

Strategic insights for the Asia Pacific Leukapheresis provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 14.69 Million |

| Market Size by 2028 | US$ 27.91 Million |

| Global CAGR (2021 - 2028) | 9.6% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Leukapheresis refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

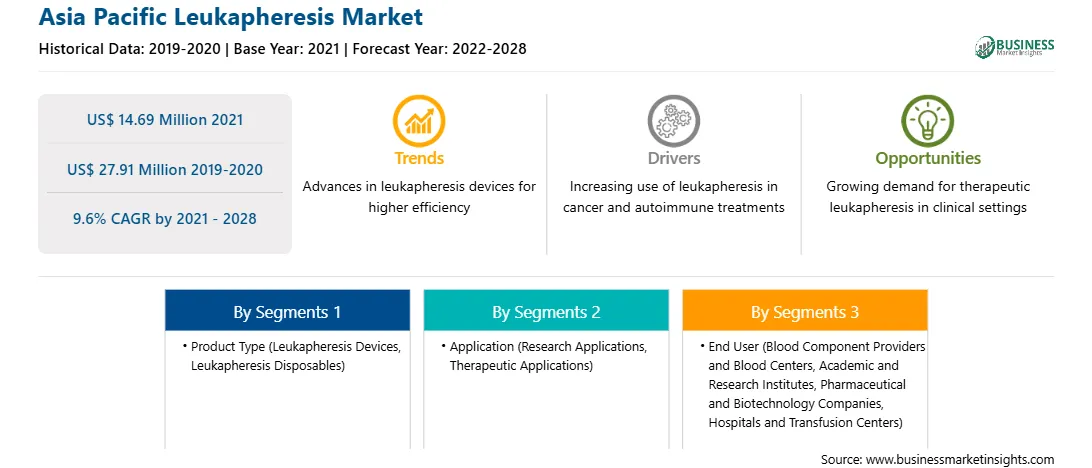

The leukapheresis market in Asia Pacific is expected to grow from US$ 14.69 million in 2021 to US$ 27.91 million by 2028; it is estimated to grow at a CAGR of 9.6% from 2021 to 2028. Blood transfusion is an integral part of the national health infrastructure and policies of various countries. Advancements in the medical industry have led to improvements in the treatment procedures of serious illnesses and injuries, which eventually has propelled the need for blood transfusion for patients’ survival. Growing awareness regarding the importance of blood transfusion and blood availability in healthcare services has led to rise in the number of people willing to donate their blood for medical causes. As per the World Health Organization (WHO) data, ~117.4 million blood donations were reported worldwide in 2018. Blood donors are usually classified to be voluntary unpaid, paid, and family/replacement, and as per the WHO claims, voluntary/unpaid donors are the major source of a reliable and adequate supply of blood. According to WHO data in 2019, blood donations by voluntary unpaid donors increased by 11.6 million from 2008 to 2015 in 139 countries in the world. The trend of blood donation is also gaining significant prominence in low and middle-income countries. According to the data presented during the CAG annual meeting 2017, ~13,000 procedures were performed on 1,087 patients in 2016. National programs developed and rolled out in many countries are further attracting a large number of platelet and blood donors. For example, in India, the National Blood Transfusion Council (NBTC), constituted within the National AIDS Control Organization (NACO), is the central body that coordinates with the State Blood Transfusion Councils (SBTCs), established within State AIDS Control Societies (SACS). The NBTC supports health programs for various activities related to blood transfusion services (BTS). Thus, the rising number of eligible donors in different countries across the world is fostering the need for leukapheresis equipment that is used to separate the required blood components.

In terms of product type, the leukapheresis disposables segment held a larger share in 2021. Based on application, research applications segment held the largest share in 2021. Based on end user, blood component providers and blood centers segment held the largest share in 2021.

A few major primary and secondary sources referred to for preparing this report on the leukapheresis market in Asia Pacific are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Asahi Kasei Corporation; Fresenius SE & Co. KGaA; Haemonetics Corporation; Terumo Corporation; STEMCELL Technologies Inc.; HemaCare; Macopharma; AllCells; STEMEXPRESS; and BioIVT among others.

The Asia Pacific Leukapheresis Market is valued at US$ 14.69 Million in 2021, it is projected to reach US$ 27.91 Million by 2028.

As per our report Asia Pacific Leukapheresis Market, the market size is valued at US$ 14.69 Million in 2021, projecting it to reach US$ 27.91 Million by 2028. This translates to a CAGR of approximately 9.6% during the forecast period.

The Asia Pacific Leukapheresis Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Leukapheresis Market report:

The Asia Pacific Leukapheresis Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Leukapheresis Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Leukapheresis Market value chain can benefit from the information contained in a comprehensive market report.