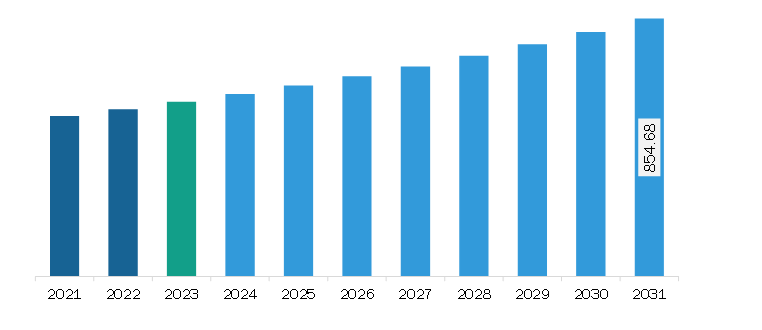

The Asia Pacific intermittent catheters market was valued at US$ 578.56 million in 2023 and is expected to reach US$ 854.68 million by 2031; it is estimated to register a CAGR of 5.0% from 2023 to 2031.

Benign prostatic hyperplasia (BPH) and prostatitis are among the most common reasons for intermittent self-catheterization in men. Many women face difficulties in bladder control, which compels them to opt for intermittent self-catheterization, which assists them to lead a normal life. Companies in the catheter market are increasingly investing in efforts to introduce newer products. In 2022, Convatec introduced the GentleCath catheter line, which features FeelClean Technology, a groundbreaking innovation. The next-generation material used in GentleCath catheters with FeelClean Technology is naturally slippery when wet, negating the need for a coating. They reduce the risk of trauma or bleeding and the associated pain since they have low friction levels during insertion and do not become sticky when removed. Thus, the increasing preference for self-catheterization and investments in urinary catheter developments are likely to create significant growth opportunities in the market in the coming years.

China has one of the world's fastest-growing geriatric populations. According to the WHO, in China, adults over 60 years old are expected to account for 28% of the population by 2040, owing to higher life expectancy and lower fertility rates. This massive demographic shift creates numerous challenges and opportunities for public health and socioeconomic development, particularly an integrated system that addresses the health and social needs of older people while providing equal access to healthcare. Older adults are more likely to experience chronic urinary retention, which will increase the use of intermittent catheters for treatment.

Strategic insights for the Asia Pacific Intermittent Catheters provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 578.56 Million |

| Market Size by 2031 | US$ 854.68 Million |

| Global CAGR (2023 - 2031) | 5.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2031 |

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Intermittent Catheters refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific intermittent catheters market is categorized into product, indication, category, system type, end user, and country.

By product, the Asia Pacific intermittent catheters market is bifurcated into coated intermittent catheters and uncoated intermittent catheters. The coated intermittent catheters segment held a larger share of the Asia Pacific intermittent catheters market share in 2023.

In terms of indication, the Asia Pacific intermittent catheters market is segmented into urinary incontinence, general surgeries, spinal cord injuries, Parkinson’s Disease (PD), multiple sclerosis, and others. The urinary incontinence segment held the largest share of the Asia Pacific intermittent catheters market share in 2023.

Based on category, the Asia Pacific intermittent catheters market is female length catheters, male length catheters, and kid length catheters. The female length catheters segment held the largest share of the Asia Pacific intermittent catheters market share in 2023.

By system type, the Asia Pacific intermittent catheters market is bifurcated into closed intermittent catheters systems and open intermittent catheters systems. The closed intermittent catheters systems segment held a larger share of the Asia Pacific intermittent catheters market share in 2023.

In terms of end user, the Asia Pacific intermittent catheters market is segmented into hospitals, ambulatory surgical centers, home care settings, and others. The hospitals segment held the largest share of the Asia Pacific intermittent catheters market share in 2023.

Based on country, the Asia Pacific intermittent catheters market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China segment held the largest share of Asia Pacific intermittent catheters market in 2023.

Advin Health Care Pvt Ltd, B Braun SE, Boston Scientific Corp, Cardinal Health Inc, Coloplast Corp, Convatec Group Plc, Hollister Inc, Teleflex Inc, and Wellspect HealthCare are some of the leading companies operating in the Asia Pacific intermittent catheters market.

The Asia Pacific Intermittent Catheters Market is valued at US$ 578.56 Million in 2023, it is projected to reach US$ 854.68 Million by 2031.

As per our report Asia Pacific Intermittent Catheters Market, the market size is valued at US$ 578.56 Million in 2023, projecting it to reach US$ 854.68 Million by 2031. This translates to a CAGR of approximately 5.0% during the forecast period.

The Asia Pacific Intermittent Catheters Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Intermittent Catheters Market report:

The Asia Pacific Intermittent Catheters Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Intermittent Catheters Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Intermittent Catheters Market value chain can benefit from the information contained in a comprehensive market report.