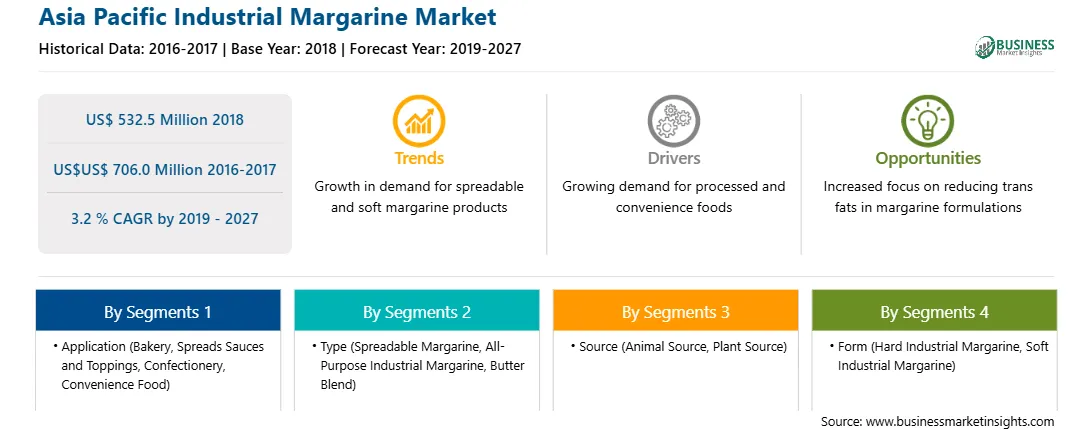

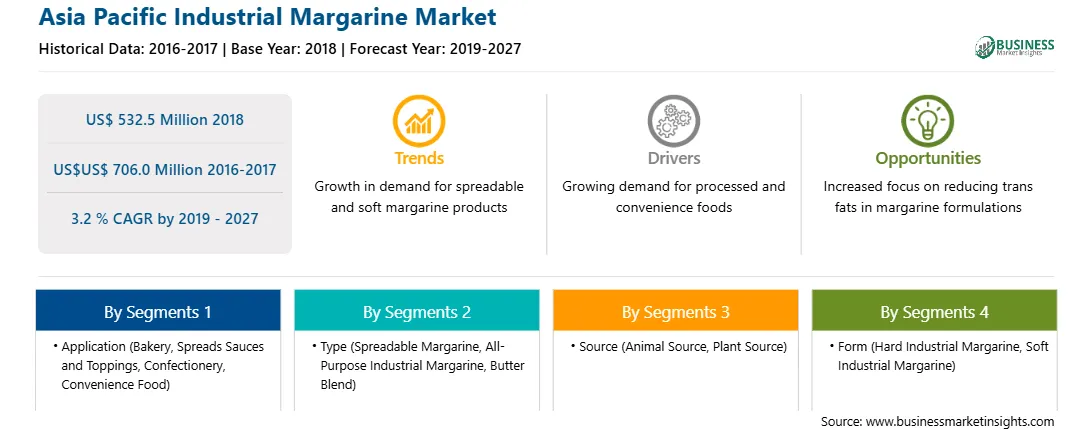

The Asia Pacific industrial margarine market is accounted to US$ 532.5 Mn in 2018 and is expected to grow at a CAGR of 3.2 %during the forecast period 2019 – 2027, to account to US$ 706.0 Mn by 2027.

Margarine is an evolution to a highly accepted spread that is a prime example of technological advancement made through the combined efforts of oil chemists, food technologists, nutritionists, and chemical engineers. Industrial margarine has taken its place all over the globe as an excellent nutritive food owing to its concentrated source of food energy; it can be a uniform supplement of vitamins D and A, it can also be a source of polyunsaturated essential fatty acids. Industrial margarine is neither a substitute for, nor an imitation of, butter, even though the spread is made from naturally occurring products and is known to possess all the physical, sensory, and nutritional attributes of butter. Moreover, products like cakes and pastries are all the time popular confectionaries for most of the consumers, but people try to avoid these items due to its high fat and calorie content. To fulfil the consumer’s demand of with low fat, low cholesterol and less calorie bakery and confectionary, manufacturers are using industrial margarine instead of butter as an alternative.

Strategic insights for the Asia Pacific Industrial Margarine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 532.5 Million |

| Market Size by 2027 | US$US$ 706.0 Million |

| Global CAGR (2019 - 2027) | 3.2 % |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Industrial Margarine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The consumers in most of the developed and developing countries in Asia Pacific are quite concern regarding maintenance of healthy life style and healthy diet or food habits. There is a growing demand for low fat food & beverages owing to changing lifestyles and rising health consciousness, which in turn is driving the industrial margarine market growth. Young consumers are increasingly getting aware of the health benefits of adopting a healthy diet with low fat, low cholesterol and less calorie foods to prevent obesity and diabetes. The rising demand for bakery and confectionary products among the consumers in Asia Pacific is expected to fuel the market growth for industrial margarine market. Products like cakes and pastries are all the time popular confectionaries for most of the consumers, but people try to avoid these items due to its high fat and calorie content. To fulfil the consumer’s demand of with low fat, low cholesterol and less calorie bakery and confectionary, manufacturers are using industrial margarine instead of butter as an alternative. However, industrial margarine contains trans-fat from 0.2-26g, consumption of which is banned in some of the countries like China, Japan, Denmark, and many more. The key players in the industrial margarine market are experimenting with new and innovative flavors & products. As flavor options increase, consumers easily get attracted towards the products, which helps in increased in sale and revenue generation. Currently, the industrial margarine demand is continuously growing with the rise in application of this product from the baking, HORECA, and food processing industries. Food processing industries prefers to use margarine in the processed food products since it is less costly than butter.

The Asia Pacific Industrial Margarine market is segmented on the basis of application is segmented into bakery, spreads sauces and toppings, confectionery, convenience food and others. The bakery segment led the Asia Pacific industrial margarine market by application. Industrial margarine is a water-in-fat emulsion, in which tiny water droplets are dispersed uniformly throughout the fat phase. It is widely used spread for flavoring, cooking, and baking. Margarine is rich in vitamin E and sodium. As margarine is deficient in essential micro-nutrients it is fortified with Vitamin A, Vitamin C, Vitamin D, and other micro-nutrients. Margarine is a vegetable or animal fat used widely as a spread. It resembles in taste and texture to butter and is commonly used as a butter substitute in baked goods. In recent times, margarine has been recognized by health professionals as a healthy table spread and a cheap alternative to butter used in cooking and baking food. Margarine has become a dietary staple in many nations owing to its taste, low price, spread ability, and convenience. Industrial margarine is used in bakeries to produce a wide range of confectioneries such as puff pastries, cakes, croissants, Danish pastries etc. Cake margarines are specifically designed to make the batter and the final product more stable. Margarines are used as ingredients to cook a number of convenience foods such as soups, party dips, and as mixes for cakes and bread. Margarine is used in the preparation of bread. It is used as an ingredient in preparation of bread products as it keeps the wheat dough moisture while allowing the bread to be tender. Margarine adds more flavor than shortening and hence is often used in making dough.

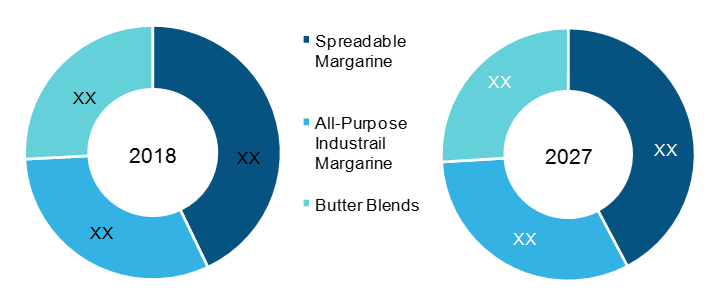

The Asia Pacific Industrial Margarine market is segmented on the basis type as spreadable margarine, all-purpose industrial margarine and butter blend. The all-purpose industrial margarine segment led the Asia Pacific industrial margarine market. Margarine is used as a spread for cooking, baking, and flavoring applications. It is sometimes described as a non-dairy spread. Spreadable margarine have fat content in the range of 10 to 90%.All-purpose industrial Margarine is an all-purpose margarine suitable for industrial uses related to baking. They margarine have added colors and flavor to improve the taste of the final product. It is particularly suitable for use in general baking applications. Butter blends are prepared by blending several vegetable fats and margarine to produce a product similar to that of butter for uses in the bakery industry. Butter blends have a flavor similar that of butter. Butter blends have rich texture and buttery taste while being economical compared to pure butter. Butter blends made from anhydrous milk fat and vegetable oils can have cholesterol levels less than 95% compared to pure butter.

The Asia Pacific Industrial Margarine market is segmented on the basis of source into animal source and plant source. The plant source segment dominated the Asia Pacific industrial margarine market. Margarine is a butter substitute made typically by combining water and vegetable oils, such as corn, soybean, canola, palm, or olive oils. Ingredients like colorings, salt, and natural or artificial flavorings are sometimes added. Therefore, most margarine contains absolutely no animal products, which makes it a suitable vegan alternative to butter. Although most margarine is made from plant-based ingredients, they remain a refined product. This means that they’re produced from extracted components of whole foods, such as plant oils, instead of the whole foods themselves. At first, in the 19th century, margarine was made with animal fats, as these provided a convenient source of saturated fat. This soon led to shortages since animal fat was also used to manufacture soap. The various types of ingredients that are derived from the animal source in making margarine include lactose, whey, casein, vitamin D3, marine oil, and lecithin, among others. Vitamin D3 is usually made from lanolin that is derived from sheep’s wool. Marine oil is derived from fish, or other aquatic animals are used in margarine, especially shortening types.

The Asia Pacific Industrial Margarine market is segmented on the basis of form into hard industrial margarine and oft industrial margarine. The hard industrial margarine dominates the Asia Pacific industrial margarine market. Hard industrial margarines are usually composed of 80% saturated fat, 14% monounsaturated fat and 6% polyunsaturated fats. Hard industrial margarines have smoke point around 302°f (150°c), and a fire point of around 700°f (371°c). They are used in bakeries, and food processing plants to manufacture pies, crackers, rusks, doughnuts, croissants, and Danish pastries. Hard industrial margarines generally have high trans-fat content. Soft industrial margarine is available in tubs and mostly used as a spread. It is low in both saturated as well as trans-fats and hence is preferred over hard margarine. Soft Margarine is used in applications such as baking, condiments, gentle sautéing, and pressure cooking. Soft industrial margarines are made with less hydrogenated oils compared to hard industrial margarine. Soft industrial margarine is low in trans-fats. The low trans-fat contents in soft industrial margarine are associated with significantly reducing the risks of heart disease, metabolic disorders, and strokes. Growing demand from food processing sector owing to the tenderness and smooth consistency of soft industrialized margarine is expected to drive the soft industrial margarine market in the forecast period.

Strategic insights for the Asia Pacific Industrial Margarine provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 532.5 Million |

| Market Size by 2027 | US$US$ 706.0 Million |

| Global CAGR (2019 - 2027) | 3.2 % |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Application

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Industrial Margarine refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

ASIA PACIFIC INDUSTRIAL MARGARINE MARKET SEGMENTATION

The List of Companies - Asia Pacific Industrial Margarine Market

The Asia Pacific Industrial Margarine Market is valued at US$ 532.5 Million in 2018, it is projected to reach US$US$ 706.0 Million by 2027.

As per our report Asia Pacific Industrial Margarine Market, the market size is valued at US$ 532.5 Million in 2018, projecting it to reach US$US$ 706.0 Million by 2027. This translates to a CAGR of approximately 3.2 % during the forecast period.

The Asia Pacific Industrial Margarine Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Industrial Margarine Market report:

The Asia Pacific Industrial Margarine Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Industrial Margarine Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Industrial Margarine Market value chain can benefit from the information contained in a comprehensive market report.