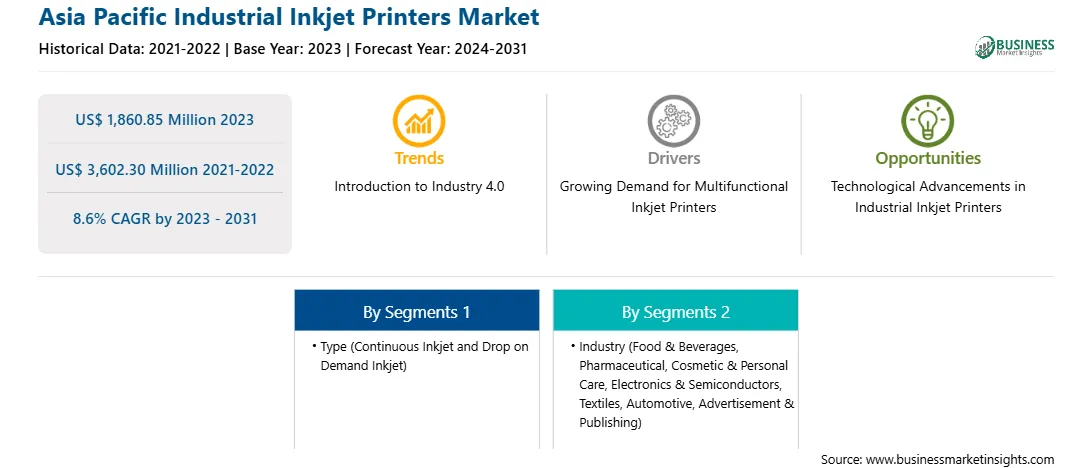

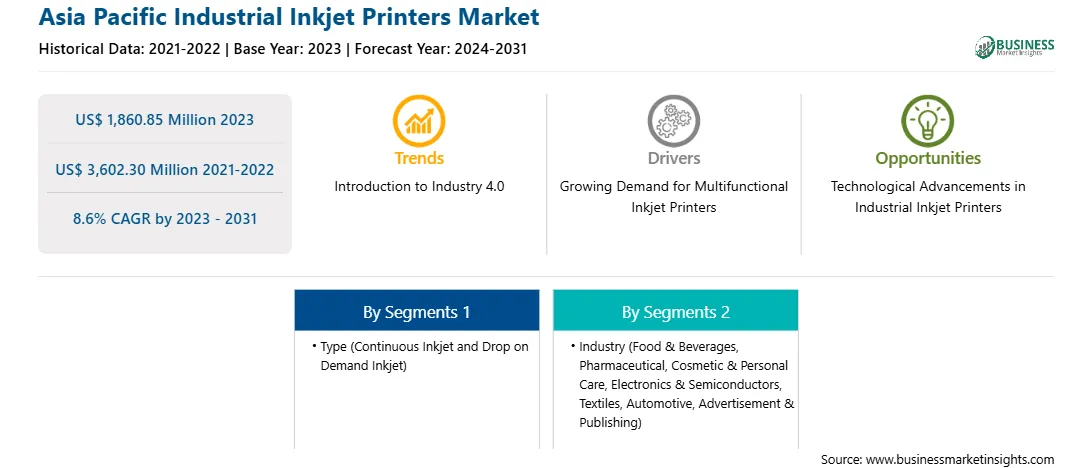

The Asia Pacific industrial inkjet printers market was valued at US$ 1,860.85 million in 2023 and is expected to reach US$ 3,602.30 million by 2031; it is estimated to register a CAGR of 8.6% from 2023 to 2031.

Technological advancements in printhead design and ink formulation have dramatically improved the print quality and resolution of industrial inkjet printers. This enhancement allows for the printing of high-definition images, fine text, and complex graphics on various materials, expanding the applicability of inkjet printers across industries. Researchers and manufacturers are highly inclined toward exploring the efficiency of industrial inkjet printers for smart design printing. For instance, in March 2023, Canon India launched 16 new advanced printers, which provide users with exceptional work efficiency, enhanced print quality, and top-notch creativity. These printers are cost-efficient and equipped with modern technology, which caters to the customers' needs. Also, in October 2023, Videojet Technologies introduced the advanced Videojet 1880+, 1880 UHS, and 1880 HR CIJ printers. These models are designed to help minimize downtime, increase throughput, and reduce costs over the printer's life while providing efficiency, performance, and productivity. The Videojet 1880+ features built-in cellular and Wi-Fi connectivity to help users meet their goals.

With the development of high-speed printers, manufacturers can print large volumes at faster speeds without compromising on quality. Various companies are launching high-speed inkjet printers that are essential for industries such as packaging, textiles, and automotive, where production efficiency is critical. For instance, in April 2024, Canon announced the launch of the ProStream 2000, under the ProStream 2000 series, which ensures high, consistent offset print quality at high-rated speed while extending the media grammage/speed range. Furthermore, the textile industry is experiencing a shift toward digital printing, with industrial inkjet printers becoming the preferred solution for printing high-quality, customized designs on fabrics. Recent technological advancements, such as AI and ML have made it possible to print complex patterns, gradients, and vivid colors on textiles at high speeds, with minimal water and chemical waste compared to traditional printing methods. Therefore, technological advancements in the printing industry are likely to provide lucrative opportunities for the industrial inkjet printer market growth during the forecast period.

China has one of the most robust manufacturing industries in the world. According to the Organization for Economic Co-operation and Development (OECD) TiVA database 2023, China held 35% of the global manufacturing sector on the basis of gross production. China is one of the strong players in the manufacturing industry due to government initiatives such as Made in China 2025 to promote local manufacturing across the country. The growing manufacturing industry generates the requirement for fast, efficient printing solutions for labeling, packaging, and product identification. In December 2022, Xaar opened a state-of-the-art inkjet printing laboratory in Shenzhen, China, comprising the latest printhead test equipment and print process experimentation platforms. This laboratory collaborates with the local market players and supports inkjet printing in various sectors, including ceramics, glass, PCB, textiles, 3D printing, and packaging and labels.

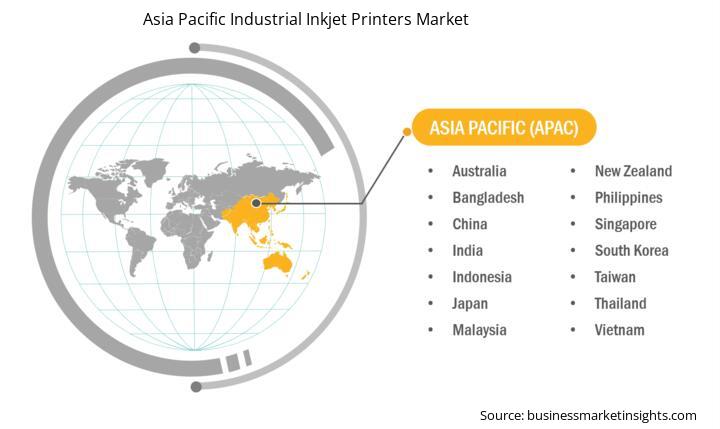

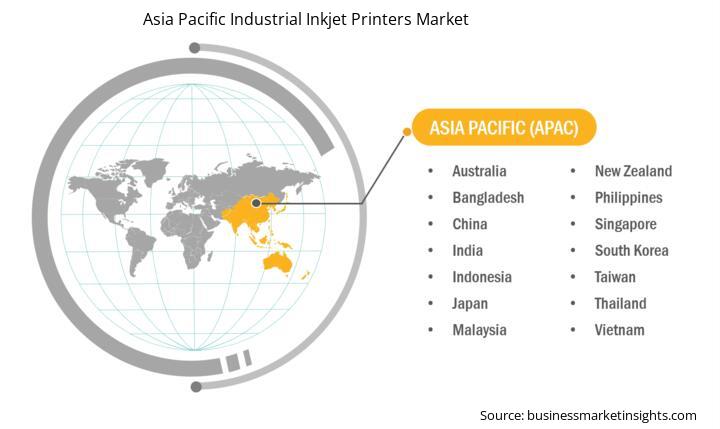

Strategic insights for the Asia Pacific Industrial Inkjet Printers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Industrial Inkjet Printers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Industrial Inkjet Printers Strategic Insights

Asia Pacific Industrial Inkjet Printers Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,860.85 Million

Market Size by 2031

US$ 3,602.30 Million

Global CAGR (2023 - 2031)

8.6%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Industry

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Industrial Inkjet Printers Regional Insights

Strategic insights for the Asia Pacific Industrial Inkjet Printers provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,860.85 Million |

| Market Size by 2031 | US$ 3,602.30 Million |

| Global CAGR (2023 - 2031) | 8.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Industrial Inkjet Printers refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific industrial inkjet printers market is categorized into type, industry, and country.

By type, the Asia Pacific industrial inkjet printers market is bifurcated into continuous inkjet and drop on demand inkjet. The drop on demand inkjet segment held a larger share of the Asia Pacific industrial inkjet printers market share in 2023.

In terms of industry, the Asia Pacific industrial inkjet printers market is segmented into food & beverages, pharmaceutical, cosmetic & personal care, electronics & semiconductors, textiles, automotive, advertisement & publishing, and others. The food & beverages segment held the largest share of the Asia Pacific industrial inkjet printers market share in 2023.

Based on country, the Asia Pacific industrial inkjet printers market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China segment held the largest share of Asia Pacific industrial inkjet printers market in 2023.

Brother Industries Ltd; Canon Inc; CTC Japan Inc; Docod Precision Group Limited; FUJIFILM Holdings America Corporation; Hitachi Industrial Equipment & Solutions America, LLC; HP Development Company L.P; Industrial Inkjet Ltd.; InkJet, Inc; KYOCERA Corporation; Lexmark International Inc; Linx Printing Technologies; Markem-Imaje; Pannier Corporation; REA Elektronik GmbH; Seiko Epson Corp; Squid Ink Manufacturing; Videojet Technologies Inc; Weber Marking Systems GmbH; and Xerox Corporation are some of the leading companies operating in the Asia Pacific industrial inkjet printers market.

The Asia Pacific Industrial Inkjet Printers Market is valued at US$ 1,860.85 Million in 2023, it is projected to reach US$ 3,602.30 Million by 2031.

As per our report Asia Pacific Industrial Inkjet Printers Market, the market size is valued at US$ 1,860.85 Million in 2023, projecting it to reach US$ 3,602.30 Million by 2031. This translates to a CAGR of approximately 8.6% during the forecast period.

The Asia Pacific Industrial Inkjet Printers Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Industrial Inkjet Printers Market report:

The Asia Pacific Industrial Inkjet Printers Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Industrial Inkjet Printers Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Industrial Inkjet Printers Market value chain can benefit from the information contained in a comprehensive market report.