Construction is one of the most manual-intensive industries, with physical labor being the primary source of productivity. Robots do not yet play a substantial role in any stage of a building's lifecycle, whether it be new commercial construction, refurbishment, or deconstruction. However, with rising automation across all industries, the global construction sector is also experiencing a surge in investment in automated solutions, such as robots.

Several types of robots are being extensively adopted across the construction industry are 3D printing, demolition, and remote-controlled or autonomous vehicles. Since automation across the construction industry is in a very nascent stage, it is expected to propel over the coming years, thereby supporting the market. Due to these opportunities across the sector, several companies have invested heavily in developing advanced construction robots. These factors further fuel the adoption of robots across the construction industry, which is expected to contribute to the market's growth over the forecast period.

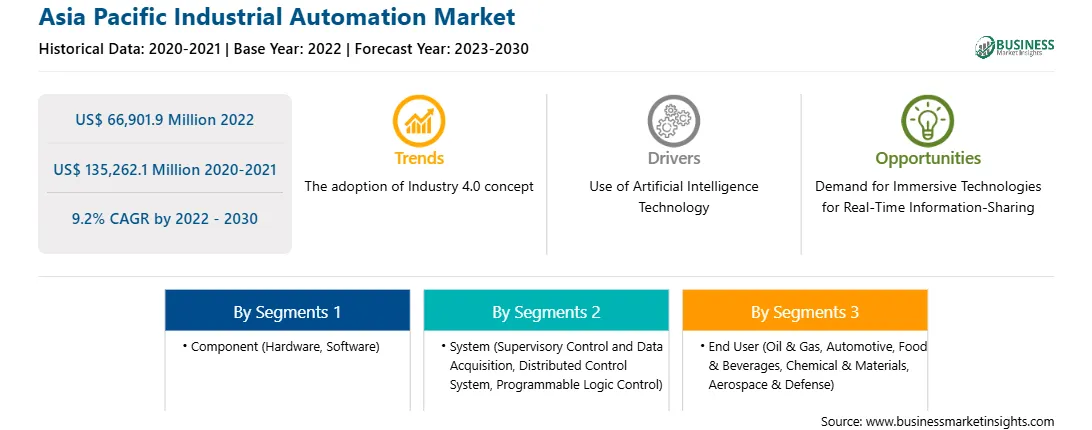

The adoption of automation in manufacturing, automotive, electronics, and other industrial sectors is rapidly increasing in APAC. The region is experiencing an upsurge in demand for high-quality products and services, which is driving manufacturers to invest in automation to improve efficiency and productivity. The growing focus on lowering operational costs and improving product quality is leading to the adoption of automation solutions. The increased availability of skilled labor in the region is making it easier for companies to implement automation solutions.

Companies such as ABB, Siemens, and Schneider Electric are operating in the Asia Pacific industrial automation market in APAC. They are investing in R&D and expanding their regional footprint, which is driving the APAC Asia Pacific industrial automation market growth. China, India, Indonesia, and other rapidly growing economies are investing heavily in infrastructure and manufacturing, which is creating a demand for automation solutions. For instance, in 2020, a local food-processing company in China invested US$ 4.6 million in automating one of its workshops that produces caramel treats, and by doing so was able to reduce the number of workers there by nearly 70%. Thus, such growing investment in automation solutions is fueling the Asia Pacific industrial automation market in the region.

The Asia Pacific industrial automation market is segmented into component, system, end user, and country.

Based on component, the Asia Pacific industrial automation market is segmented into hardware and software. The hardware segment held a larger share of the Asia Pacific industrial automation market in 2022. The hardware is further sub segmented into motors and drives, robots, sensors, machine vision systems, and others.

Based on system, the Asia Pacific industrial automation market is segmented into supervisory control and data acquisition, distributed control system, programmable logic control, and other. The distributed control system segment held the largest share of the Asia Pacific industrial automation market in 2022.

Based on end user, the Asia Pacific industrial automation market is segmented into oil & gas, automotive, food & beverage, chemical & materials, aerospace & defense, and others. The automotive segment held the largest share of the Asia Pacific industrial automation market in 2022.

Based on country, the Asia Pacific industrial automation market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific industrial automation market in 2022.

ABB Ltd, Bosch Rexroth AG, Emerson Electric Co, Hitachi Ltd, Honeywell International Inc, Mitsubishi Electric Corp, OMRON Corp, Rockwell Automation Inc, Schneider Electric SE, and Siemens AG are some of the leading companies operating in the Asia Pacific industrial automation market.

Strategic insights for the Asia Pacific Industrial Automation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 66,901.9 Million |

| Market Size by 2030 | US$ 135,262.1 Million |

| Global CAGR (2022 - 2030) | 9.2% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Industrial Automation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific Industrial Automation Market is valued at US$ 66,901.9 Million in 2022, it is projected to reach US$ 135,262.1 Million by 2030.

As per our report Asia Pacific Industrial Automation Market, the market size is valued at US$ 66,901.9 Million in 2022, projecting it to reach US$ 135,262.1 Million by 2030. This translates to a CAGR of approximately 9.2% during the forecast period.

The Asia Pacific Industrial Automation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Industrial Automation Market report:

The Asia Pacific Industrial Automation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Industrial Automation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Industrial Automation Market value chain can benefit from the information contained in a comprehensive market report.