Asia Pacific Immersive Entertainment Market

No. of Pages: 121 | Report Code: BMIRE00030980 | Category: Technology, Media and Telecommunications

No. of Pages: 121 | Report Code: BMIRE00030980 | Category: Technology, Media and Telecommunications

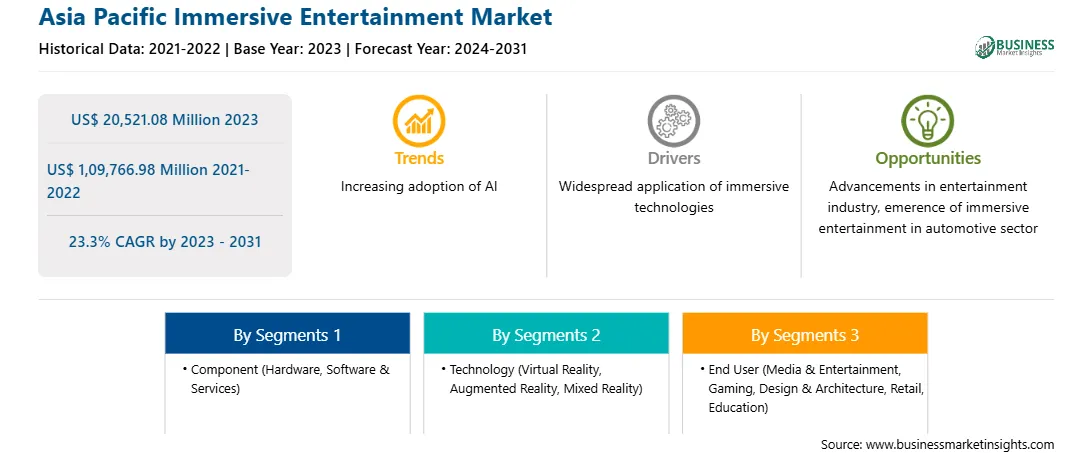

The Asia Pacific immersive entertainment market was valued at US$ 20,521.08 million in 2023 and is expected to reach US$ 1,09,766.98 million by 2031; it is estimated to record a CAGR of 23.3% from 2023 to 2031.

The automotive in-cabin experience has evolved into a truly digital experience. The integration of a software environment in the vehicle allows consumers to seamlessly enjoy the immersive communication options, productivity tools, and entertainment options. Connected vehicles offer more immersive experiences to passengers, including personalized entertainment and AR displays. Automotive manufacturers are using a variety of immersive technologies such as VR, AR, and AI to offer their customers personalized and engaging in-car entertainment experiences. Numerous automotive manufacturers such as BMW and Tesla are focusing on integrating immersive technologies to develop technologically advanced vehicles. These technologies help automotive manufacturers enhance safety and security, as well as improve the driving experience of customers. In May 2023, Meta Platforms Inc announced that it is working with International Business Machines Corp to explore AR and VR technologies and their benefits in fast-moving vehicles. Thus, the emergence of immersive technology in the automotive industry, increasing adoption of autonomous driving vehicles and connected vehicles, and rising demand for in-car entertainment among consumers are expected to create opportunities in the immersive entertainment market in the coming years.

The APAC immersive entertainment market is segmented into Australia, China, Japan, South Korea, India, and the Rest of APAC. The media & entertainment and gaming industries are experiencing significant growth owing to rising internet penetration, increasing adoption of over-the-top (OTT) platforms, and growing number of live events. In 2023, APAC had the highest number of gamers, which was around 1.48 billion. The growing gaming industry is fueling the APAC immersive entertainment market growth. As the gaming industry is evolving in the region, sensory stimulation is rapidly becoming an important part of the gaming experience; in the process, making hand-held controller games feel dated and marginally engaging. To engage customers, gaming designers are incorporating significantly enhanced and sensorial experiences involving AR and complete VR simulations.

Furthermore, the gaming industry in APAC has been supported by favorable government policies and infrastructure developments. Countries such as China and South Korea have implemented policies to promote the growth of their gaming industries, providing incentives for companies to invest in game development and esports. Moreover, the government of the region is focusing on the development of VR technology. In January 2024, the South Korean government unveiled its plans to bolster the console gaming sector as it seeks to diversify the industry landscape currently focused on mobile and online platforms. Thus, the rising gaming industry in APAC is fueling the immersive entertainment market growth.

Strategic insights for the Asia Pacific Immersive Entertainment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 20,521.08 Million |

| Market Size by 2031 | US$ 1,09,766.98 Million |

| Global CAGR (2023 - 2031) | 23.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Immersive Entertainment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific immersive entertainment market is categorized into component, technology, end user, and country.

Based on component, the Asia Pacific immersive entertainment market is bifurcated into hardware and software & services. The hardware segment held a larger market share in 2023.

By technology, the Asia Pacific immersive entertainment market is categorized into virtual reality (VR), augmented reality (AR), mixed reality (MR), and others. The virtual reality (VR) segment held the largest market share in 2023.

In terms of end user, the Asia Pacific immersive entertainment market is categorized into media & entertainment, gaming, design & architecture, retail, education, and others. The media & entertainment segment held the largest market share in 2023.

By country, the Asia Pacific immersive entertainment market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific immersive entertainment market share in 2023.

Microsoft Corp, Qualcomm Inc, Google LLC, Sony Group Corp, Infosys Ltd, HTC Corp, Samsung Electronics Co Ltd, Apple Inc, and Salesforce Inc are some of the leading companies operating in the Asia Pacific immersive entertainment market.

The Asia Pacific Immersive Entertainment Market is valued at US$ 20,521.08 Million in 2023, it is projected to reach US$ 1,09,766.98 Million by 2031.

As per our report Asia Pacific Immersive Entertainment Market, the market size is valued at US$ 20,521.08 Million in 2023, projecting it to reach US$ 1,09,766.98 Million by 2031. This translates to a CAGR of approximately 23.3% during the forecast period.

The Asia Pacific Immersive Entertainment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Immersive Entertainment Market report:

The Asia Pacific Immersive Entertainment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Immersive Entertainment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Immersive Entertainment Market value chain can benefit from the information contained in a comprehensive market report.