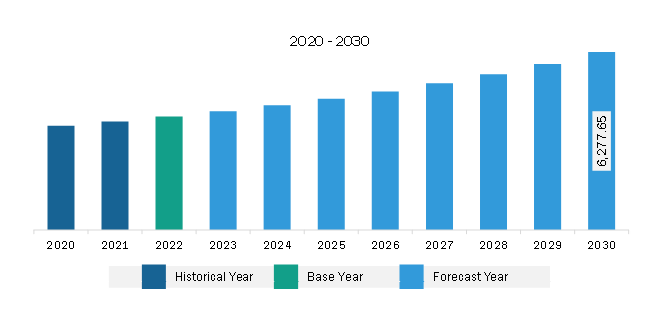

The Asia Pacific hot melt adhesives market was valued at US$ 4,005.47 million in 2022 and is expected to reach US$ 6,277.65 million by 2030; it is estimated to register a CAGR of 5.8% from 2022 to 2030. Changing Trend from Solvent Adhesive to Hot Melt Adhesive Boosts Asia Pacific Hot Melt Adhesives Market

Hot melt adhesives offer superior properties such as versatility, resistance to water & moisture, and low cost, making these adhesives the ideal choice for many applications. Hot melt adhesives are used when the glued products can be in contact with water or moisture, including boxes for shipping food. Utilizing traditional glues in such cases can take several minutes, and further, they can cause a worker to hold on to the items to keep the two surfaces together until the glue dries. With hot melt adhesives, the drying time has been cut down to seconds, leaving the person free to continue with the next task. Hot melt adhesives are nowadays preferred among various end-use industries to solvent adhesives, owing to advantages such as eco-friendliness, high productivity induced by process automation, and re-adhesion possibility. Hot melt adhesives do not need any drying or curing like solvent-based adhesives. Hot melt adhesives can further apply in the molten state itself, so that it can be bonded immediately post-application. This further provides hot melt adhesives a significant advantage of faster processing time when applied to food packaging, consumer goods packaging, furniture, crafting, and others. Volatile organic compounds can be reduced or eliminated, and the drying or curing step can be eliminated while using hot melt adhesives. Hot melt adhesives can also be disposed of by taking special precautions, and they have a long shelf life as compared to typical adhesives. Due to all these benefits, industries are adopting hot melt adhesives over solvent-based adhesives.

Hot melt adhesives can also dissolve the polymer using water, owing to which most of the sectors are adopting these adhesives over solvent adhesives. Moreover, manufacturers are offering innovative products to cater to this demand. In September 2020, SABA announced the launch of a new hot melt adhesive in the market - Sabamelt 4732, which was meant to produce pocket coil units. The company could see an increased demand for environment-friendly, solvent-free foam bonding solutions. Expansion of the company's product portfolio with new, high-quality hot melt adhesives brought more value to bedding, as well as furniture manufacturers. SABA's pocket coil hot melt is the first addition, and the company is planning to bring more such products to the market.Asia Pacific Hot Melt Adhesives Market Overview

Various emerging countries in Asia Pacific are witnessing an upsurge in industrialization mainly in the manufacturing, automotive, packaging, and construction industries, which further offers ample opportunities for the key market players in the hot melt adhesive market. Chemicals, textile, pulp & paper, and electronics are among the prime industries in countries such as Australia, Japan, India, China, South Korea, Singapore, Taiwan, and Indonesia. These industries are highly adopting advanced technologies and processes.

According to Bostik India, a key market player, factors such as the rise in adoption of e-commerce, along with the increased purchasing power of people, are bolstering the adhesives market growth. Also, the shift in preference toward completely decomposable and biodegradable materials is emerging as a challenge as well as an opportunity for adhesive manufacturers, especially in the Asia Pacific, which is projected to be the largest consumer of hot melt adhesives during the forecast period. The hot melt adhesives market in the Asia Pacific is expected to witness the highest growth in the upcoming years; this is mainly attributed to the rise in need for medical and hygiene products such as PPE suits, medical supplies, personal hygiene products, masks, ventilators, and paper products, which would propel the demand for hot melt adhesives. In addition to the rising need for PPE suits from the healthcare sector, increasing the use of packaging products in the FMCG and e-commerce sectors would bolster the demand for hot melt adhesives in countries such as India and China. Bostik has introduced new technology and materials such as Kizen, a hot melt adhesive mainly designed for cardboard packaging based on water-white technology. This is to ensure the safe delivery of goods to customers, which further combines ease of utilization with the strong bond performance of hot melt adhesive.

Asia Pacific Hot Melt Adhesives Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Hot Melt Adhesives provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Hot Melt Adhesives refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Hot Melt Adhesives Strategic Insights

Asia Pacific Hot Melt Adhesives Report Scope

Report Attribute

Details

Market size in 2022

US$ 4,005.47 Million

Market Size by 2030

US$ 6,277.65 Million

Global CAGR (2022 - 2030)

5.8%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Product Type

By Type

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Hot Melt Adhesives Regional Insights

Asia Pacific Hot Melt Adhesives Market Segmentation

The Asia Pacific hot melt adhesives market is categorized into product type, type, application, and country.

Based on product type, the Asia Pacific hot melt adhesives market is segmented into glue sticks, glue slugs, and others. The glue sticks segment held the largest market share in 2022.

In terms of type, the Asia Pacific hot melt adhesives market is segmented into ethylene vinyl acetate, polyolefins, polyamides, polyurethanes, styrene block copolymers, and other. The ethylene vinyl acetate segment held the largest share of Asia Pacific hot melt adhesives market in 2022.

By application, the Asia Pacific hot melt adhesives market is divided into packaging, construction, automotive, furniture, footwear, electronics, and others. The packaging segment held the largest share of Asia Pacific hot melt adhesives market in 2022.

Based on country, the Asia Pacific hot melt adhesives market is categorized into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific hot melt adhesives market share in 2022.

H.B. Fuller Company; Henkel AG & COMPANY, KGAA; Arkema; 3M; Sika AG; Jowat SE; Hexcel Corporation; The Dow Chemical Company; Beardow Adams; Gorilla Glue Company; and Adhesive Technologies, Inc. are some of the leading companies operating in the Asia Pacific Hot Melt Adhesives market.

1. H.B. Fuller Company

2. Henkel AG & COMPANY, KGAA

3. Arkema

4. 3M

5. Sika AG

6. Jowat SE

7. Hexcel Corporation

8. The Dow Chemical Company

9. Beardow Adams

10. Gorilla Glue Company

11. Adhesive Technologies, Inc.

The Asia Pacific Hot Melt Adhesives Market is valued at US$ 4,005.47 Million in 2022, it is projected to reach US$ 6,277.65 Million by 2030.

As per our report Asia Pacific Hot Melt Adhesives Market, the market size is valued at US$ 4,005.47 Million in 2022, projecting it to reach US$ 6,277.65 Million by 2030. This translates to a CAGR of approximately 5.8% during the forecast period.

The Asia Pacific Hot Melt Adhesives Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Hot Melt Adhesives Market report:

The Asia Pacific Hot Melt Adhesives Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Hot Melt Adhesives Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Hot Melt Adhesives Market value chain can benefit from the information contained in a comprehensive market report.