APAC home sequential compression devices market is divided on the basis of the five countries China, Japan, Australia, India, South Korea, and rest of APAC. Factors driving the home sequential compression devices market are growing medical device industry in the region is expected to increase adoption of at-home medical devices. In addition, expansion and stricter regulations for medical devices related products in the region. is expected to drive the demand for home sequential compression devices in the region.

Countries in APAC are facing challenges due to increasing incidences of COVID-19. As per the data of Worldometer, as of July 1st, 2021, in India the number of cases has been increasing and reached to 30,411,634 cases with 399,475 deaths. Japan has reported 798,159 confirmed cases and 14,740 deaths. Currently, India is the second worse hit country across the world. Many measures have been implemented to contain the spread of COVID-19, that have resulted in significant operational disruption for many companies including in home sequential compression devices manufacturing industry. Staff quarantine, supply-chain failures, and reductions in demand have generated serious complications for companies. Also, there has been a significant drop in in-patient and out-patient for private hospital chains. To relieve healthcare systems, many clinics have been postponing non-critical procedures such as therapies for venous disorders. To avoid overburdening hospitals already struggling to deal with the rising pandemic pressure, doctors are recommending use of home care devices for patients suffering from venous disorders. Moreover, Medical device companies in APAC have started to forecast impact of pandemic in their business segments because people are staying at home. Various medical device companies such as Cardinal health have predicated the decline in sales in medical device segment due to the adverse impact of the COVID-19 pandemic, which was offset by sales growth from Cardinal Health at-Home Solutions such as home sequential compression systems. The countries such as India is conducting vaccination drive for the age group wise including the people within age group of 18–44, and 45 years and above. The country has also initiated testing of vaccine of the children, which is expected to bring some positive prospects for the medical device industry in the region. All these factors will support market growth for home sequential compression devices in APAC region.

Strategic insights for the Asia Pacific Home Sequential Compression Devices provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

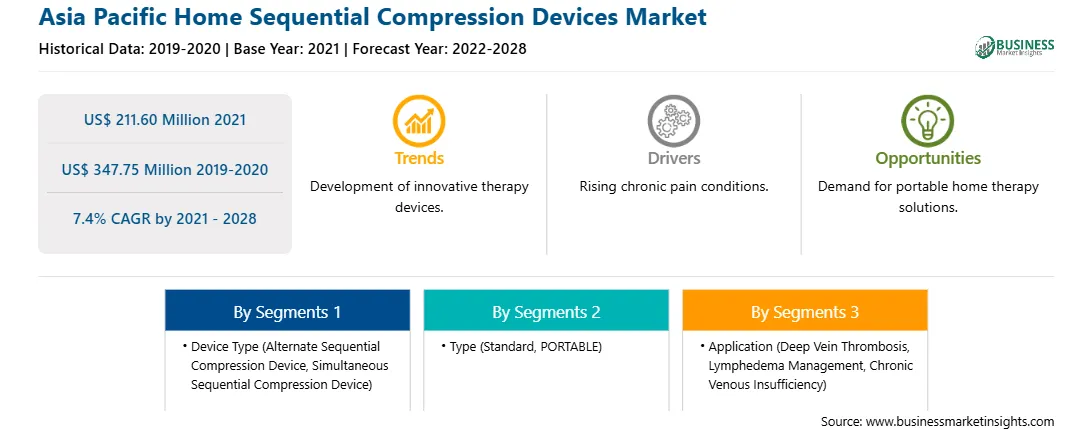

| Market size in 2021 | US$ 211.60 Million |

| Market Size by 2028 | US$ 347.75 Million |

| Global CAGR (2021 - 2028) | 7.4% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Device Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Home Sequential Compression Devices refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The home sequential compression devices market in APAC is expected to grow from US$ 211.60 million in 2021 to US$ 347.75 million by 2028; it is estimated to grow at a CAGR of 7.4% from 2021 to 2028. Sequential compression devices (SCDs) are used as a part of venous thromboembolism (VTE). As per the Center for Disease Control and Prevention (CDC), blood clotting in a deep vein results in the VTE, which is primarily a condition of blood vessels. These clots generally develop in lower leg, thigh, or pelvis, and injury to veins, slow blood flow, increased estrogen levels, heart diseases, and obesity are among the main causes of the clot formation. Venous disorders are caused due to factors such as pregnancy, obesity, varicose vein, and venous insufficiency. Venous insufficiency is observed in pregnancy mainly due to an enlarged gravid uterus, resulting in hypertension in the lower extremity veins and increased hormone secretion, weakening the vein walls. Thus, the rising prevalence of lymphatic and venous disorders is boosting the demand for home sequential compression device, thereby driving the market growth.

The APAC home sequential compression devices market is segmented on the bases of device type, type, application, and country. The APAC home sequential compression devices market, by type is segmented into alternate sequential compression device (ASCD), simultaneous sequential compression device (SSCD). The simultaneous sequential compression device (SSCD) segment held the largest share of the market in 2021. APAC home sequential compression devices market based on the type is segmented into standard and portable. In 2021, the standard segment is likely to hold the largest share of the market. The APAC home sequential compression devices market by application, is segmented into deep vein thrombosis (DVT), lymphedema management, chronic venous insufficiency (CVI) and others. The deep vein thrombosis (DVT), segment is likely to hold the largest share of the market in 2021. The APAC home sequential compression devices market, by country is segmented into Australia, China, India, Japan, and South Korea.

A few major primary and secondary sources referred to for preparing this report on the home sequential compression devices market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AIROS Medical; Arjo Medical Devices; Breg Inc.; Cardinal Health Inc; DJO Global, Inc.; DSMAREF CO.LTD; and Mego Afek ltd.are.

The Asia Pacific Home Sequential Compression Devices Market is valued at US$ 211.60 Million in 2021, it is projected to reach US$ 347.75 Million by 2028.

As per our report Asia Pacific Home Sequential Compression Devices Market, the market size is valued at US$ 211.60 Million in 2021, projecting it to reach US$ 347.75 Million by 2028. This translates to a CAGR of approximately 7.4% during the forecast period.

The Asia Pacific Home Sequential Compression Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Home Sequential Compression Devices Market report:

The Asia Pacific Home Sequential Compression Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Home Sequential Compression Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Home Sequential Compression Devices Market value chain can benefit from the information contained in a comprehensive market report.