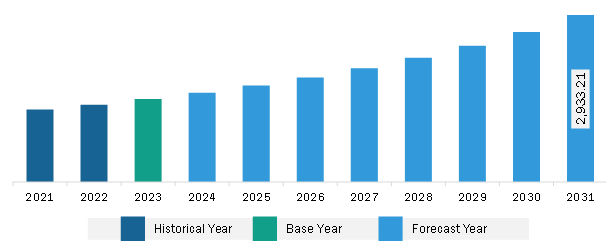

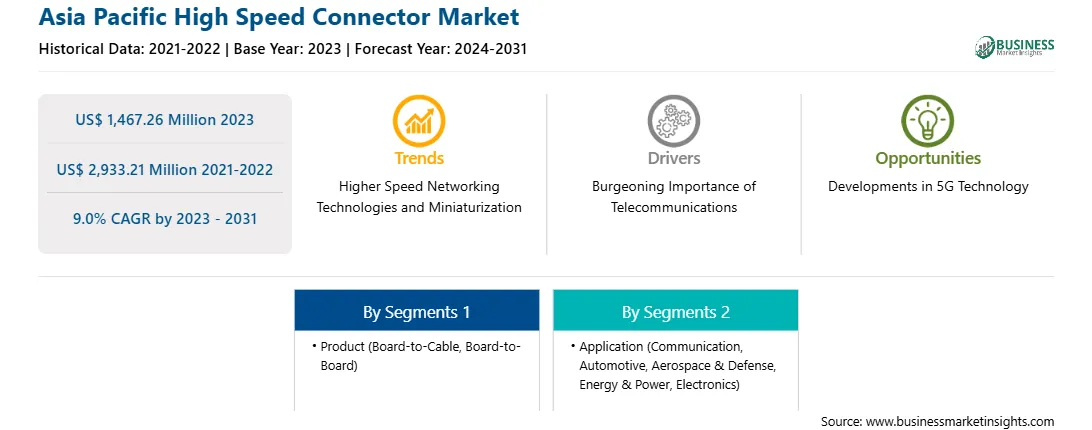

The Asia Pacific high speed connector market was valued at US$ 1,467.26 million in 2023 and is expected to reach US$ 2,933.21 million by 2031; it is estimated to register at a CAGR of 9.0% from 2023 to 2031.

The advantages of 5G are more evident in personal electronics such as smartphones and household equipment, including smart thermostats. However, the effects of the 5G rollout would be more significant after it gains traction. Significant advancements are made in applications that require data that is gained from real-time connectivity. Applications such as traffic management, wearable medical technology, robotic surgery, driverless cars, and Industrial Internet of Things (IIoT) in smart factories. Thus, the widespread adoption of 5G-enabled devices such as smartphones, tablets, and IoT devices would continue to drive the demand for high-speed connectors that are specifically designed to support the 5G technology. Further, 5G is expected to unlock entirely new applications and use cases, such as autonomous vehicles, smart factories, and remote surgery, which highly rely on high-speed data transmission, creating the demand for high-speed connectors. Connector design these days has become more innovative in terms of performance, compactness, and EMI shielding. Governments of many countries are taking initiatives to bolster their 5G infrastructure. The deployment of 5G technologies is due to the continued demand for 5G-enabled devices, the emergence of new applications, and ongoing innovation, will fuel the high-speed connector market in the coming years.

Asia Pacific comprises major economies such as Australia, China, Japan, South Korea, India, and the Rest of Asia Pacific. The high-speed connector market in Asia Pacific is segmented into Australia, China, Japan, South Korea, India, and the Rest of Asia Pacific. The market expansion in this region can be associated with the rising demand for high-speed networking and communication devices, coupled with the growing population. Telecom operators are investing in the 5G networks. According to the Mobile Economy Asia Pacific 2023 report by Global System for Mobile Communications (GSMA), telecom operators in Asia Pacific are projected to invest US$ 259 billion in network infrastructure from 2023 to 2031, with the majority of this investment directed toward fifth generation (5G) deployments. Moreover, high-speed connectors are being used at a larger scale in developing countries in the region, such as China and India, owing to the development of Industry 4.0 and the increasing adoption of digital technologies. In addition, the semiconductors industry is showing notable expansion in several Asia Pacific countries with vigorously growing domestic and international players. Further, as consumers' disposable income rises, their ability to make purchases also increases, which drives sales of computers, smartphones, connected cars, and home network connecting devices, which ultimately triggers the demand for high-speed connectors across Asia Pacific. Enterprises in the networking, automotive, electronics, and communication industries continuously focus on introducing new products to enable high-speed data transfer. With this, the need for flexible and compact connector designs that facilitate connectivity is also on the rise in the region. The emergence of IoT and Big Data technologies in 4K television, 5G wireless networks, and wearable devices further results in demand for data transfer solutions. Thus, high-speed connector market players concentrate on developing high-speed connectors that are quicker, smaller, and more effective. For instance, in February 2021, Kyocera Corporation launched a new 0.5mm-pitch floating board-to-board connector series for high-speed 16Gbps data transmission. The new connectors (F/P*1 = 170%) can float within ±0.85mm for easy and accurate mating.

Strategic insights for the Asia Pacific High Speed Connector provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific High Speed Connector refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific High Speed Connector Strategic Insights

Asia Pacific High Speed Connector Report Scope

Report Attribute

Details

Market size in 2023

US$ 1,467.26 Million

Market Size by 2031

US$ 2,933.21 Million

Global CAGR (2023 - 2031)

9.0%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific High Speed Connector Regional Insights

The Asia Pacific high speed connector market is segmented based on product, application, and country.

Based on product, the Asia Pacific high speed connector market is segmented into board-to-cable, board-to-board, and others. The board-to-board segment held the largest share in 2023.

In terms of application, the Asia Pacific high speed connector market is segmented into communication, automotive, aerospace & defense, energy & power, electronics, and others. The aerospace & defense segment held the largest share in 2023.

Based on country, the Asia Pacific high speed connector market is categorized into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific high speed connector market in 2023.

Samtech lnc; Molex LLC; TE Connectivity Ltd; Hirose Electric Co Ltd; Yamaichi Electronics Co., Ltd; Neoconix Inc; Fujitsu Ltd; OMRON Corp; IMS Connector Systems GmbH; OUPIIN ENTERPRISE CO., LTD; and Amphenol Corp are some of the leading companies operating in the Asia Pacific high speed connector market.

The Asia Pacific High Speed Connector Market is valued at US$ 1,467.26 Million in 2023, it is projected to reach US$ 2,933.21 Million by 2031.

As per our report Asia Pacific High Speed Connector Market, the market size is valued at US$ 1,467.26 Million in 2023, projecting it to reach US$ 2,933.21 Million by 2031. This translates to a CAGR of approximately 9.0% during the forecast period.

The Asia Pacific High Speed Connector Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific High Speed Connector Market report:

The Asia Pacific High Speed Connector Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific High Speed Connector Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific High Speed Connector Market value chain can benefit from the information contained in a comprehensive market report.