APAC is one of the leading investors in the global helicopter landing gear industry. Because of the increased production of latest-generation helicopters, the landing gear market is expected to rise rapidly. The number of helicopter buyers has increased as the economic conditions in the region have improved. As a result, the number of commercial helicopters available to support the expanding air traffic has risen dramatically in recent years. Owing to the increasing number of commercial helicopters, the market for landing gear systems is expected to grow. New Zealand has the fourth biggest civil turbine helicopter fleet in the APAC area, with 511 operating turbine helicopters. Since the end of 2017, the fleet has grown by 31 helicopters, or 6%, owing to 10 new arrivals, 43 pre-owned additions, and 22 reductions. In New Zealand, most helicopters (approximately 68%) are equipped for multi-mission and charter operations (around 11%). New Zealand, like Australia, is dealing with an aging fleet, with an average fleet age of 27.8 years. To ensure operational safety, the landing gears and other sections of the vintage fleet must be maintained on a regular basis. In response to this, Asian firms are providing customized helicopter services. For example, ST engineering, a Singapore-based aerospace firm, provides full MRO services for helicopter landing gear and accessories. ST Engineering Aerospace serves a global customer base and provides value-added and high-quality solutions in a timely manner. Also, range of MRO (maintenance, repair, and overhaul) facilities expanding is among the other factors expected to fuel the demand for helicopter landing gear in APAC.

The COVID-19 pandemic has severely impacted APAC due to wide disease spread; countries in this region are among the highly populated, which leads to the greater risk infection spread. According to the Organization for Economic Co-operation and Development (OECD), the pandemic has affected major economies such as China, India, Australia, and Japan, which are experiencing inflation. India is the worst-hit country by the pandemic in this region. Many global brands and technological companies are headquartered in the region. The limitations imposed by governments to control the spread of COVID-19, the impact of the disease on populations of different countries in the region, and current inability to utilize production capabilities are the key factors impacting military spending of Asian countries. Defense budgets have been drastically cut, resulting in a decrease in the need for mechanical components of helicopters. Therefore, the COVID-19 pandemic is likely to continue to hinder the helicopter landing gear market growth in APAC in the coming years.

Strategic insights for the Asia Pacific Helicopter Landing Gear provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

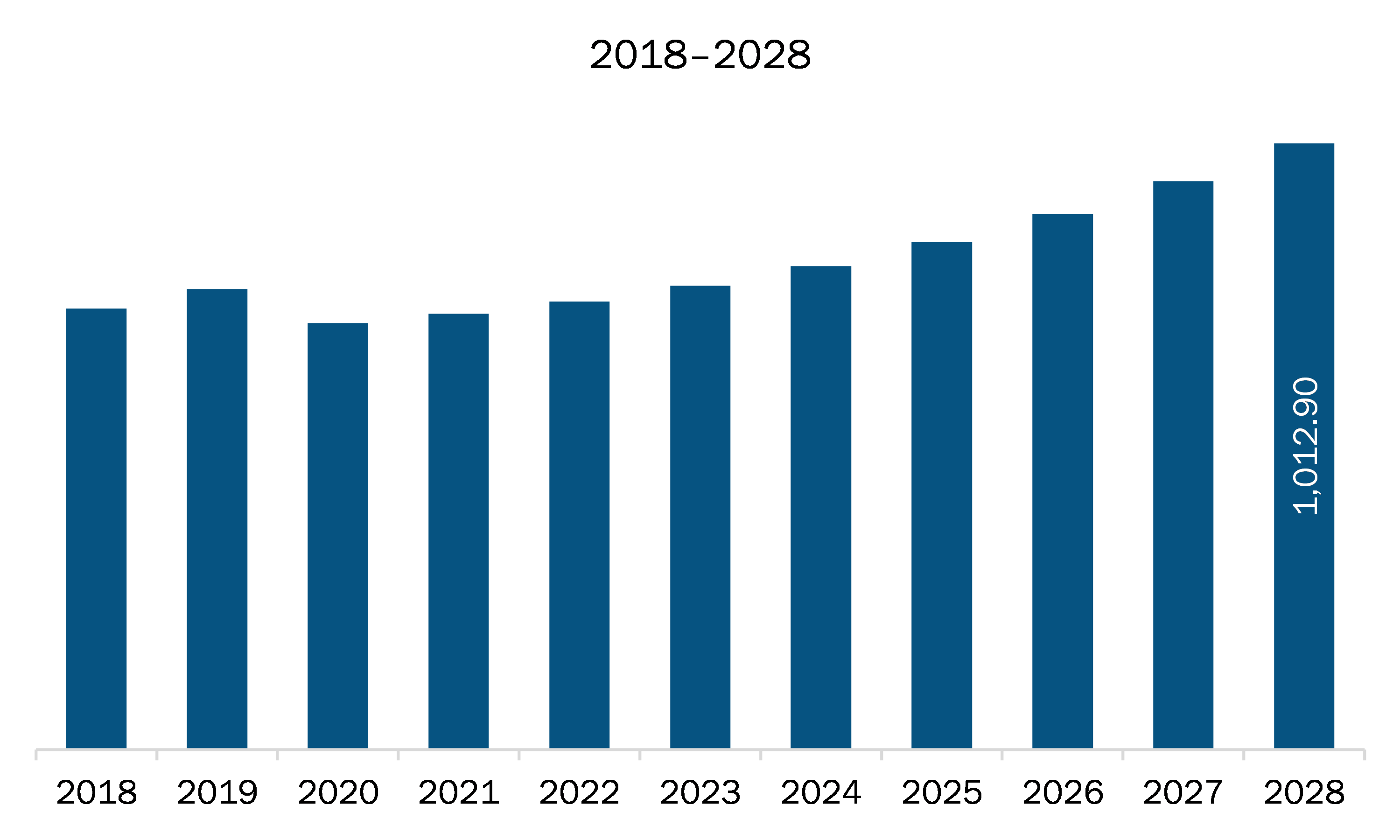

| Market size in 2021 | US$ 728.34 Million |

| Market Size by 2028 | US$ 1,012.90 Million |

| Global CAGR (2021 - 2028) | 4.8% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Helicopter Landing Gear refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The helicopter landing gear market in APAC is expected to grow from US$ 728.34 million in 2021 to US$ 1,012.90 million by 2028; it is estimated to grow at a CAGR of 4.8% from 2021 to 2028. The helicopter sector is quite dynamic as it adapts quickly with the ever-changing market forces and customer needs. The macroeconomic trends across geographies shape the overall growth outlook of the aviation industry. With an increase in adoption of helicopters for military as well as commercial purpose, the production capabilities of the same are also getting boosted. As per the data released by the General Aviation Manufacturers Association (GAMA), in 2020, the military helicopters stood at 117 units, which includes helicopters of Airbus, Boeing, and Bell Helicopters, while piston and turbine helicopters stood at 709 units. Such massive units of helicopter production will positively contribute toward the demand for helicopter components including landing gear. Landing gear is among the essential subsystems of a helicopter, and it requires improved safety and smooth actuation; hence, standards and guidelines must be followed while developing landing gears. The growth of this market is attributed to the growing demand for both civil and military helicopters across the world. Countries such as China and India have a large military base and high expenditure, which is positively encouraging the demand for military helicopters.

The APAC helicopter landing gear market is segmented into Type, material, and application. Based on type, the helicopter landing gear are segmented into skids and wheeled. The skids segment held the largest market share in 2020. Based on material, the helicopter landing gear market is segmented into aluminum landing gear set, steel landing gear set, composite landing gear set, and titanium landing gear set. The composite landing gear set segment dominated the market in 2020. Based on application, the helicopter landing gear market is segmented into civil helicopter and military helicopter. Military helicopter segment held the largest market share in 2020.

A few major primary and secondary sources referred to for preparing this report on the helicopter landing gear market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are CIRCOR AEROSPACE, INC.; Dart Aerospace; LIEBHERR-INTERNATIONAL DEUTSCHLAND GMBH; Safran;

The Asia Pacific Helicopter Landing Gear Market is valued at US$ 728.34 Million in 2021, it is projected to reach US$ 1,012.90 Million by 2028.

As per our report Asia Pacific Helicopter Landing Gear Market, the market size is valued at US$ 728.34 Million in 2021, projecting it to reach US$ 1,012.90 Million by 2028. This translates to a CAGR of approximately 4.8% during the forecast period.

The Asia Pacific Helicopter Landing Gear Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Helicopter Landing Gear Market report:

The Asia Pacific Helicopter Landing Gear Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Helicopter Landing Gear Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Helicopter Landing Gear Market value chain can benefit from the information contained in a comprehensive market report.