Asia Pacific Heavy Construction Equipment Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031238 | Category: Manufacturing and Construction

No. of Pages: 150 | Report Code: BMIRE00031238 | Category: Manufacturing and Construction

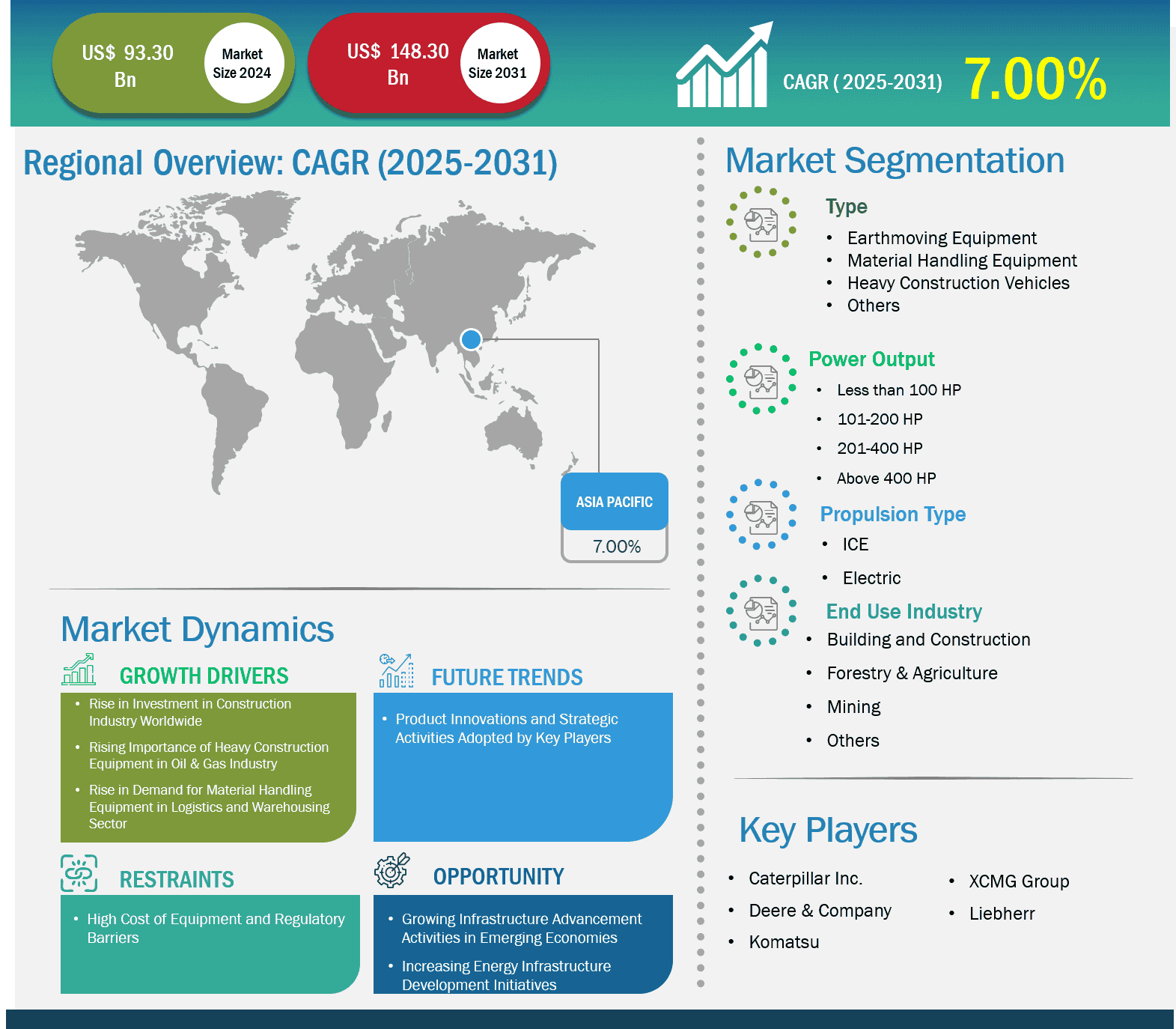

The Heavy Construction Equipment Market size is expected to reach US$ 148.26 billion by 2031 from US$ 93.30 billion in 2024. The market is estimated to record a CAGR of 6.84% from 2024 to 2031.

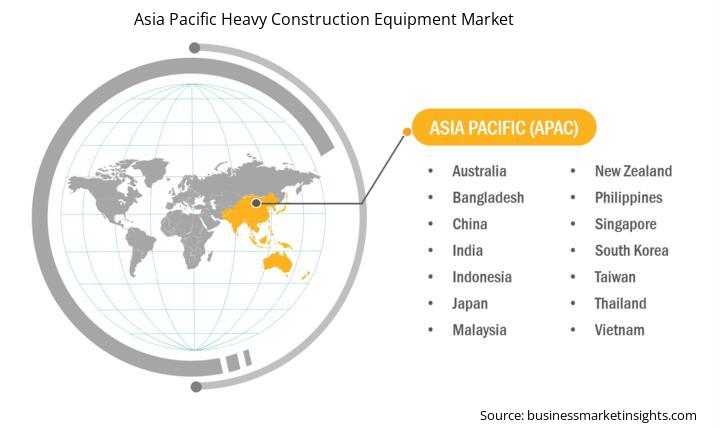

The heavy construction equipment market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, Indonesia, Singapore, Malaysia, the Philippines, Vietnam, and the Rest of Asia Pacific. The construction sector in Asia Pacific recorded ~US$ 4.36 trillion of output in 2022, representing approximately 45% of the global construction sector. However, in January 2025, infrastructure investments related to transportation, renewable energy, and manufacturing reached US$ 21.9 billion in Singapore and Malaysia. Further, the government of New Zealand is emphasizing the development of infrastructure networks such as water and wastewater systems, road and rail networks, electricity transmission, and telecommunication infrastructure. Growing population and increasing urbanization are a few factors boosting the need to expand and upgrade important infrastructure facilities in the country. The government of New Zealand plans to offer ~US$ 47 billion for infrastructure development over the coming five years 2023-2027. The growing focus on infrastructure development is anticipated to propel the growth of construction activities, along with the application of heavy construction equipment, across the country in the coming years.

Key segments that contributed to the derivation of the Heavy Construction Equipment Market analysis are machine type, power output, propulsion type, and end-use industry.

Asia Pacific (APAC) is one of the most significant and fastest-growing markets for heavy construction equipment, driven by rapid urbanization, industrialization, government infrastructure initiatives, and rising demand for advanced construction machinery. The diverse economies and varying development stages across countries in the region create unique dynamics that shape the demand for heavy construction equipment. The increasing number of modernization projects, including Singapore Changi, Beijing Capital International, and Incheon International, are positively impacting the overall construction sector. Countries such as Indonesia and Thailand are also investing in domestic infrastructural development with more focus on regional airports to improve connectivity. Currently, out of 425 airport and airport infrastructure development projects across the globe, 155 projects are under development in Asia Pacific with an investment of US$ 209 billion.

One of the largest airport development projects in Asia Pacific is Long Thanh International Airport in Vietnam, which has an investment of US$ 14.5 billion and is expected to be completed in 2025. In addition, the expansion of Terminal 5 at Changi Airport, Singapore, is a US$ 10 billion project and is expected to be completed by 2030. In July 2022, the government of the Philippines announced plans to redevelop its 30-year-old Cadlao Oil Field to boost the country's oil production in the coming years. Similarly, in May 2022, The Hoang Long, consisting of two different companies, secured a drilling rig for its planned offshore development wells in the Cuu Long basin in Vietnam. Such developments are creating the demand for heavy construction equipment in the Rest of Asia Pacific.

Based on Geography, the Asia Pacific Heavy Construction Equipment Market comprises of China, Japan, South Korea, India, Australia, Indonesia, Singapore, Malaysia, Taiwan, Thailand, Vietnam, New Zealand, Philippines, Bangladesh, and Rest of Asia Pacific. The China held the largest share in 2024.

The construction and infrastructure industry in China have witnessed transformative developments driven by rapid economic growth and the nation's ascent as a global economic powerhouse. China is one of the largest construction markets worldwide. In March 2024, the government of China announced its target to fund US$ 173 billion (CNY 1.2 trillion) in transport infrastructure projects by the end of 2024. Furthermore, in March 2024, the Yangtze River Delta region government announced an investment of US$ 19.6 billion (CNY 140 billion) to build 32 railway infrastructure projects. In February 2024, the Shanghai government announced its target to initiate work on 24 projects with a combined investment of US$ 5.8 billion (CNY 42.1 billion).

According to the government's transportation network planning outline, China aimed to add 400 airports by 2035, an increase from ~240 airports in 2022. China's 32 large and busy airports are suffering from capacity overload, and 40 of the country’s 50 largest airports need renovation or expansion, according to the Civil Aviation Administration of China (CAAC). China's 14th Five-Year Plan covers 140 airport projects, including greenfield construction, relocation, renovation, and expansion by the end of 2025. With such sustained investments and a focus on innovation toward infrastructure, China continues to shape its construction sector to accommodate escalating development and assert its positive impact on the heavy construction equipment market.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 93.30 Billion |

| Market Size by 2031 | US$ 148.26 Billion |

| Global CAGR (2025 - 2031) | 6.84% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Machinery Type

|

| Regions and Countries Covered | Asia Pacific

|

Some of the key players operating in the market includes Caterpillar Inc., Komatsu Ltd., Volvo Construction Equipment, Liebherr Group, and Hitachi Construction Machinery, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisition to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conduct a significant number of primary interviews each year with industry stakeholders and experts to validate its data, analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Heavy Construction Equipment Market is valued at US$ 93.30 Billion in 2024, it is projected to reach US$ 148.26 Billion by 2031.

As per our report Asia Pacific Heavy Construction Equipment Market, the market size is valued at US$ 93.30 Billion in 2024, projecting it to reach US$ 148.26 Billion by 2031. This translates to a CAGR of approximately 6.84% during the forecast period.

The Asia Pacific Heavy Construction Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Heavy Construction Equipment Market report:

The Asia Pacific Heavy Construction Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Heavy Construction Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Heavy Construction Equipment Market value chain can benefit from the information contained in a comprehensive market report.