Market Introduction

Asia Pacific consists of five major countries namely China, Japan, India, Australia, and South Korea. The market is also evaluated for the rest of countries in Asia Pacific. The market is driven by the factors such as relatively lower cost for outsourcing, skilled workforce with technical expertise, and expansion of healthcare companies in countries such as India and China. Moreover, increasing number of clinical trials and rising number of companies trying to enter markets in emerging economies like India, South East Asia and China, are expected to contribute to the market growth for healthcare regulatory affairs outsourcing during the forecast period. Japan’s pharmaceutical market is growing exponentially. To address the need of Japan’s growing aging population, the government is focusing on easing the regulatory policies and thereby accelerating the development and approval of new drugs into the market. This is expected to attract the already existing global pharmaceutical companies and the new entrants to establish their market in Japan. This is expected to increase the demand of various regulatory outsourcing services that requires from the Service Type development to the commercialization stage of the Service Type. To cut the cost and streamline the Service Type timeline the companies are majorly focusing on outsourcing the regulatory and pharmacovigilance activities to the industries. This is expected to propel the growth of the healthcare regulatory affairs outsourcing market in this country. Advancements in specialty therapies, orphan drugs, and personalized medicines is the major factor driving the growth of the APAC healthcare regulatory affairs outsourcing market.

With a favorable supply market—the strong presence of global CROs and regional CROs with local expertise—pharmaceutical companies perceive Asia-Pacific as an attractive market for conducting clinical trials. However, the COVID-19 pandemic has brought unprecedented challenges across the world. The impact of COVID-19 on clinical and regulatory affairs, manufacturing and supply chains, and stakeholder engagements has slowed the pace of the ever-growing pharmaceuticals industry. Australia has been appreciated globally for its measures for managing the COVID-19 spread with strict quarantine systems and advanced contact tracing; however, patient/volunteer participation in clinical trials decreased at some sites as participants were not willing to attend clinics or hospitals dur to the fear of infection. Thus, the pandemic situation has resulted in the halting of clinical trials, delays in product approvals, and disruptions to supply chains. The pandemic has forced pharmaceutical companies and regulatory agencies to adopt innovative strategies to mitigate the challenges observed across various functional domains. The impact of COVID-19 has resulted in delay in onsite inspection due to travel bars and delay in approval for several products. This has caused resulted in the outsourcing of ~65% of pharmaceutical activities to CROs, and the number is expected to reach 75% in the future. Along with this, the demand for innovative pharmaceutical products has put pharma companies under pressure to increase their R&D spending to deliver the new products, while keeping the operating costs unaltered. These conditions have also triggered investments in digital platforms, allowing physicians to monitor patients remotely in an efficient manner. All these factors will impact on healthcare regulatory affairs outsourcing businesses in Asia Pacific.

Strategic insights for the Asia Pacific Healthcare Regulatory Affairs Outsourcing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Healthcare Regulatory Affairs Outsourcing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Healthcare Regulatory Affairs Outsourcing Strategic Insights

Asia Pacific Healthcare Regulatory Affairs Outsourcing Report Scope

Report Attribute

Details

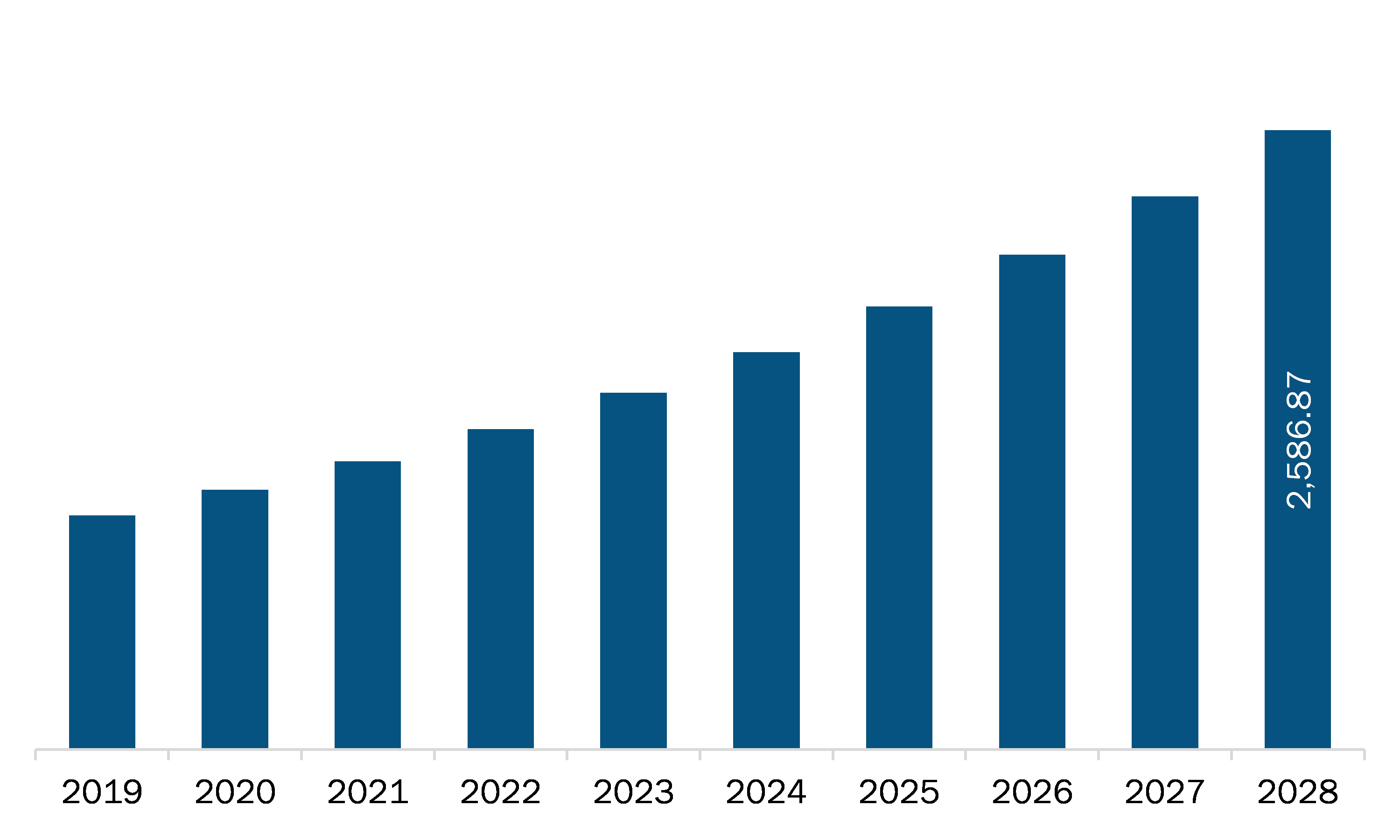

Market size in 2021

US$ 1,203.97 Million

Market Size by 2028

US$ 2,586.87 Million

Global CAGR (2021 - 2028)

11.5%

Historical Data

2019-2020

Forecast period

2022-2028

Segments Covered

By Service Type

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Healthcare Regulatory Affairs Outsourcing Regional Insights

Market Overview and Dynamics

The healthcare regulatory affairs outsourcing market in APAC is expected to grow from US$ 1,203.97 million in 2021 to US$ 2,586.87 million by 2028; it is estimated to grow at a CAGR of 11.5% from 2021 to 2028. The healthcare regulatory affairs industry is highly fragmented with several hundred small and medium-sized limited-service providers, and a small number of large, full-service, multinational CROs. Small CROs face a few barriers entering into the healthcare regulatory affairs outsourcing market, whereas a full-service CROs with regional presence need to build the necessary infrastructure with the ability to simultaneously manage multiple complex regulatory services across numerous countries; the later also need to build the requisite relationships with strategic partners, developing relevant therapeutic and development of expertise to serve the needs of their clients. The consolidation across the regulatory affairs industry is an emerging trend that helps the prime players to strengthen their service offerings and garner the major share in the market. However, this has led to the generation of handful of larger CROs with the wide reach, extensive therapeutic and development expertise, enormous capital, and technical resources, which allows them to manage the demanding drug development programs of pharmaceutical and biopharmaceutical companies.

Key Market Segments

The APAC healthcare regulatory affairs outsourcing market has been segmented based on service type, end user, and country. On the basis of service type, the APAC healthcare regulatory affairs outsourcing market is segmented into medical & scientific writing, pharmacovigilance, data management services, life cycle management services, eCTD and e-Submissions, regulatory and scientific strategy development, chemistry manufacturing and controls (CMC) services, regulatory labelling, and regulatory artwork services. The medical & scientific writing segment dominated the market in 2020 and pharmacovigilance segment is expected to be the fastest growing during the forecast period. Based on end user, the market is segmented into pharmaceutical companies, biotechnology companies, and medical devices companies. The pharmaceutical companies segment dominated the market in 2020 and is expected to be the fastest growing during the forecast period. Likewise, the medical devices companies segmented is categorized into medical device materials & biomaterials, medical device, biomarkers and in vitro diagnostics (IVD), medical device software (SaMD), medical device electromechanics, medical device substance-based, and medical device of combination product.

Major Sources and Companies Listed

A few major primary and secondary sources referred to for preparing this report on healthcare regulatory affairs outsourcing market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Arriello Ireland Ltd., Azierta Contract Science Support Consulting ,IQVIA Inc., PAREXEL INTERNATIONAL CORPORATION, PHARMALEX GMBH, ProductLife Group, ProPharma Group, and Voisin Consulting Life Sciences (VCLS) are among others.

Reasons to buy report

APAC Healthcare Regulatory Affairs Outsourcing Market Segmentation

APAC Healthcare Regulatory Affairs Outsourcing Market –By

Service Type

APAC Healthcare Regulatory Affairs Outsourcing Market –By End User

APAC Healthcare Regulatory Affairs Outsourcing Market -By Country

APAC Healthcare Regulatory Affairs Outsourcing Market -

Company Profiles

The Asia Pacific Healthcare Regulatory Affairs Outsourcing Market is valued at US$ 1,203.97 Million in 2021, it is projected to reach US$ 2,586.87 Million by 2028.

As per our report Asia Pacific Healthcare Regulatory Affairs Outsourcing Market, the market size is valued at US$ 1,203.97 Million in 2021, projecting it to reach US$ 2,586.87 Million by 2028. This translates to a CAGR of approximately 11.5% during the forecast period.

The Asia Pacific Healthcare Regulatory Affairs Outsourcing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Healthcare Regulatory Affairs Outsourcing Market report:

The Asia Pacific Healthcare Regulatory Affairs Outsourcing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Healthcare Regulatory Affairs Outsourcing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Healthcare Regulatory Affairs Outsourcing Market value chain can benefit from the information contained in a comprehensive market report.