Asia Pacific Graphite Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 150 | Report Code: BMIRE00031231 | Category: Chemicals and Materials

No. of Pages: 150 | Report Code: BMIRE00031231 | Category: Chemicals and Materials

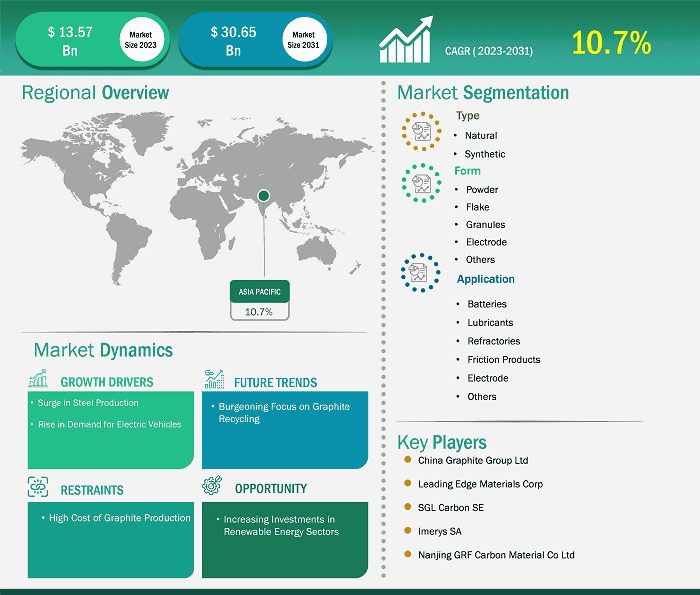

The Asia Pacific Graphite Market size is expected to reach US$ 30.65 billion by 2031 from US$ 13.57 billion in 2024. The market is estimated to record a CAGR of 10.7 % from 2024 to 2031.

Advanced manufacturing capabilities, rapid technological advancements, and extensive investments in infrastructure development bolster the graphite market in Asia Pacific. The region has also solidified its position in the global graphite market, largely due to the overwhelming influence of China. As the leading producer and consumer of graphite, China significantly contributes to the substantial market share in the region. The region's emphasis on electric vehicles (EVs), energy storage, and consumer electronics propels graphite demand, particularly in applications such as lithium-ion batteries, lubricants, refractories, and friction products. Thus, Asia Pacific continues to experience rapid industrial growth, particularly in sectors such as automotive and energy & power.

Key segments that contributed to the derivation of the Asia Pacific graphite market analysis are type and application.

Companies in the graphite market in Asia Pacific increasingly focus on the development of advanced, sustainable technologies to stay ahead of competitors while ensuring a reliable supply of this critical material. Additionally, they are leveraging various strategies to maintain their competitive edge, including innovations in product offerings, expanding production capacities, and forging strategic partnerships and alliances. For example, in June 2022, Mitsubishi Chemical Holdings Group (MCHG) enhanced its production capacity of natural graphite anode materials at its subsidiaries—Qingdao Lingda Kasei and Qingdao Anode Kasei—China. The production capacity was increased from 2,000 tons to 12,000 tons per year, with the expected commencement of operations of the new production line in the first half of the 2024 fiscal year. This expansion reflects the growing demand for high-quality graphite in the region.

The graphite market in the region is characterized by both production and imports. In 2022, Australia imported a total of US$ 919,000 worth of graphite, with the majority coming from China, which accounted for approximately ~US$ 305,000 of the imports. Other significant sources include Germany (US$ 243,000), Sri Lanka (US$ 166,000), the US (US$ 137,000), and New Zealand (US$ 25,900). This diverse range of import origins reflects Australia's reliance on varied suppliers to meet its graphite demands. Domestic graphite manufacturing is expected to grow further with the surging focusing on sustainable mining practices and expanding production initiatives to meet the increasing demand for battery-grade materials. The region's stable regulatory environment and advanced infrastructure further support its role as a key player in the global graphite market.

Based on region, the Asia Pacific graphite market is further segmented into Indonesia, Malaysia, Philippines, Singapore, Thailand, India, China, South Korea, Japan, Australia, Taiwan, Bangladesh, Vietnam, and New Zealand. China held the largest share in 2024.

According to the Center for Strategic & International Studies, China is the number one graphite producer in the world; it recorded an output of 850,000 tonnes in 2022 and accounted for two-thirds of the global mine supply. This dominant position is attributed to its vast graphite reserves, concentrated mainly in Heilongjiang, Jilin, and Shandong provinces. The country's graphite industry is driven by strong demand from the steel, automotive, and renewable energy sectors, which rely heavily on graphite-based products such as electrodes, refractories, and lithium-ion batteries. Additionally, the Chinese government's ambitious plans to promote clean energy and reduce carbon emissions have further boosted the demand for graphite. As the global graphite market continues to evolve, China is expected to reinforce its position as the leading graphite producer in the future.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 13.57 Billion |

| Market Size by 2031 | US$ 30.65 Billion |

| Global CAGR (2025 - 2031) | 10.7 % |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia Pacific

|

| Market leaders and key company profiles |

GES Europe GmbH, Graphit Kropfmühl GmbH, Pingdingshan Wanhui Graphite Co., Ltd, China Graphite Group Limited, Leading Edge Materials Corp, SGL Carbon SE, Ceylon Graphite Corp, Imerys SA, Graphite Central, and Nanjing GRF Carbon Material Co., Ltd. are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note:

All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Asia Pacific Graphite Market is valued at US$ 13.57 Billion in 2024, it is projected to reach US$ 30.65 Billion by 2031.

As per our report Asia Pacific Graphite Market, the market size is valued at US$ 13.57 Billion in 2024, projecting it to reach US$ 30.65 Billion by 2031. This translates to a CAGR of approximately 10.7 % during the forecast period.

The Asia Pacific Graphite Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Graphite Market report:

The Asia Pacific Graphite Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Graphite Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Graphite Market value chain can benefit from the information contained in a comprehensive market report.