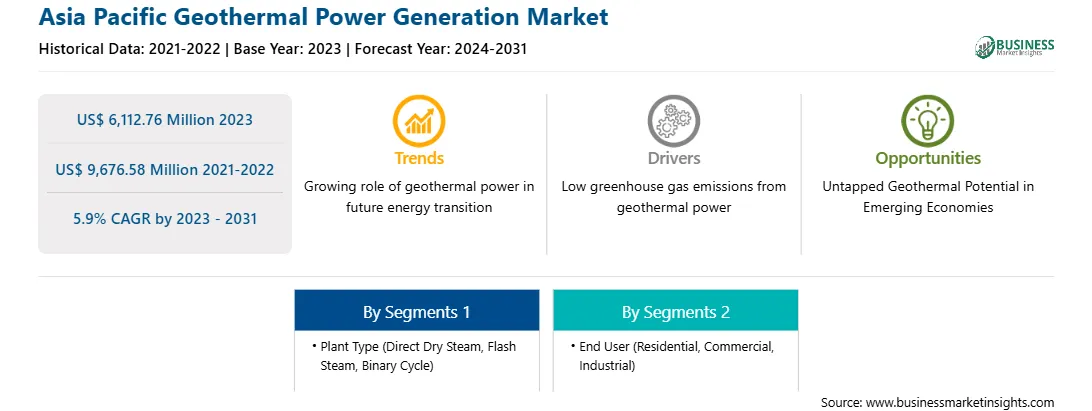

The Asia Pacific geothermal power generation market was valued at US$ 6,112.76 million in 2023 and is expected to reach US$ 9,676.58 million by 2031; it is estimated to register a CAGR of 5.9% from 2023 to 2031.

Heat flows from the Earth's interior that covers twice the global energy demand. To harness this heat, there is a requirement to drill deep underground and convert that heat into a usable form of energy. Another main advantage of geothermal energy is that it can provide baseload capacity, which is the minimum amount of electricity that must be available on the grid at any given time. While solar and wind output fluctuates seasonally and throughout the day, geothermal generation can be adjusted in the same way that a fossil fuel power plant can increase or decrease output. In addition, the government initiatives toward exploring the untapped geothermal potential globally. For instance, to help countries unlock the untapped potential of geothermal energy and promote its widespread use, the International Renewable Energy Agency (IRENA) established the Global Geothermal Alliance (GGA) in 2015 as a platform to improve dialogue, collaboration, and coordinated action to increase the share of geothermal power installed as well as heat generation worldwide. Moreover, Indonesia, Turkey, and Kenya are key economies expected to lead in geothermal electricity generation by the end of 2030. Thus, exploring the untapped geothermal potential in emerging economies is expected to create several opportunities for the geothermal power generation market growth during the forecast period.

The Asia Pacific geothermal power generation market is segmented into Japan, Indonesia, New Zealand, the Philippines, and the Rest of Asia Pacific. In 2023, Asia Pacific held the largest geothermal power generation market share of ~39.6% in the geothermal power generation market worldwide and is expected to record a CAGR of 5.9% from 2023 to 2031. This is owing to the presence of geothermal power-generating countries, including Indonesia, the Philippines, New Zealand, and Japan. The demand for power in Asia Pacific continues to increase owing to rapid industrialization across the region, which has further led to increased generation of sustainable electricity. Moreover, increasing government initiatives and funding toward the construction of geothermal power plants in the region is projected to fuel the geothermal power generation market growth in the coming years.

Strategic insights for the Asia Pacific Geothermal Power Generation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 6,112.76 Million |

| Market Size by 2031 | US$ 9,676.58 Million |

| Global CAGR (2023 - 2031) | 5.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Plant Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Geothermal Power Generation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific geothermal power generation market is categorized into plant type, end user, and country.

Based on plant type, the Asia Pacific geothermal power generation market is segmented into direct dry steam, flash steam, and binary cycle. The flash steam segment held the largest market share in 2023.

In terms of end user, the Asia Pacific geothermal power generation market is categorized into residential, commercial, and industrial. The industrial segment held the largest market share in 2023.

By country, the Asia Pacific geothermal power generation market is segmented into Japan, Indonesia, Philippines, New Zealand, and the Rest of Asia Pacific. Indonesia dominated the Asia Pacific geothermal power generation market share in 2023.

Turboden SpA, Toshiba Energy Systems and Solutions Corp, Berkshire Hathaway Inc, NIBE Industrier AB, General Electric Co, Fuji Electric Co Ltd, Carrier Global Corp, and Danfoss AS. are some of the leading companies operating in the Asia Pacific geothermal power generation market.

The Asia Pacific Geothermal Power Generation Market is valued at US$ 6,112.76 Million in 2023, it is projected to reach US$ 9,676.58 Million by 2031.

As per our report Asia Pacific Geothermal Power Generation Market, the market size is valued at US$ 6,112.76 Million in 2023, projecting it to reach US$ 9,676.58 Million by 2031. This translates to a CAGR of approximately 5.9% during the forecast period.

The Asia Pacific Geothermal Power Generation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Geothermal Power Generation Market report:

The Asia Pacific Geothermal Power Generation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Geothermal Power Generation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Geothermal Power Generation Market value chain can benefit from the information contained in a comprehensive market report.