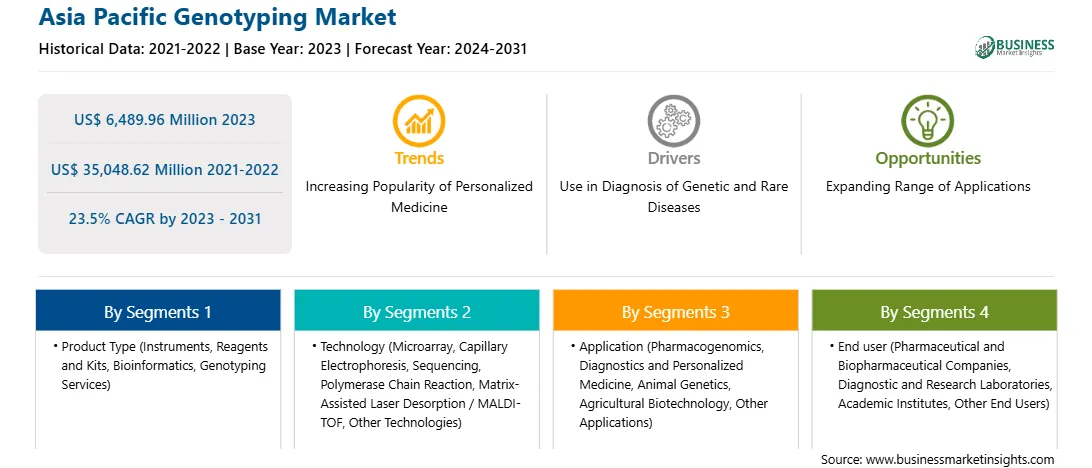

The Asia Pacific genotyping market was valued at US$ 6,489.96 million in 2023 and is expected to reach US$ 35,048.62 million by 2031; it is estimated to record a CAGR of 23.5% from 2023 to 2031.

Expanding Range of Applications Boosts Asia Pacific Genotyping Market

Genotyping holds potential applications in diagnostic research, pharmacogenomics, and agricultural biotechnology. Moreover, this technique is suitable for a variety of plant breeding, forensic, and environmental testing procedures. Pharmaceutical companies are profiting from the availability of polygenic risk scores, substantial genetic databases linked to patient health information, and the sequencing data of clinical trial participants, among other advancements. The Industry Pharmacogenomics Working Group (I-PWG), an association of pharmaceutical companies, is actively involved in pharmacogenomic research. The I-PWG comprises 26member companies that undertake numerous clinical trials annually, collecting DNA samples of study subjects as part of the protocol. With its focus on clinical pharmacogenomics, the I-PWG aims to generate opportunities for pharmaceutical companies in the coming years. In addition to its most frequent use in oncology research, it is also used for PGx studies conducted in non-oncology therapeutic areas such as rare diseases, immunology, and cardiology. A more comprehensive study, involving the NGS of clinical trial samples, allows for an elaborate genomic evaluation of trial participants, revealing both common and rare genetic variations. PGx includes the study of polymorphic differences in the determination of genomic-level drug/xenobiotic effects, drug response and disease susceptibility, and genotype/phenotype relationships.

Genotyping-by-sequencing (GBS) is a new method to locate and genotype SNPs in crop genomes and human genome by using NGS methods. GBS is developed and deployed in sequencing multiple samples by incorporating molecular markers in the process to further enhance NGS applications in giant crop genome sequencing, such as maize and wheat. High-throughput SNPs detected by GBS are widely used in genetic diversity analysis, genome-wide association studies (GWAS), QTL mapping, and genome prediction (GP) in many plant species. NGS technology has transformed modern biology with high throughput and low cost. With remarkable advancements unlocked by NGS technologies, whole-genome sequencing provides ultra-throughput sequences that revolutionize plant genotyping and breeding. Sequencing by synthesis (SBS) and multiplexing greatly enhances the efficiency of the sequence.

Therefore, greater adoption of genotyping in various research areas would eventually lead to a rise in the demand for these techniques, creating significant opportunities in the market.

Asia Pacific Genotyping Market Overview

The genotyping market in Asia Pacific is sub-segmented into India, China, Japan, Australia, South Korea, and the Rest of Asia Pacific. An upsurge in technological advancements, decreasing prices of DNA sequencing, the surge in collaborations (for the development of genomic research) among Asian and Western countries, and the rising prevalence of genetic and other target diseases are among the factors propelling the APAC genotyping market.

Asia Pacific Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Asia Pacific Genotyping provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Genotyping refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Genotyping Strategic Insights

Asia Pacific Genotyping Report Scope

Report Attribute

Details

Market size in 2023

US$ 6,489.96 Million

Market Size by 2031

US$ 35,048.62 Million

Global CAGR (2023 - 2031)

23.5%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Product Type

By Technology

By Application

By End user

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Genotyping Regional Insights

Asia Pacific Genotyping Market Segmentation

The Asia Pacific genotyping market is categorized into product type, technology, application, end user, and country.

Based on product type, the Asia Pacific genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Asia Pacific genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Asia Pacific genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Asia Pacific genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Asia Pacific genotyping market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, XCELRIS GENOMICS, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are some of the leading companies operating in the Asia Pacific genotyping market.

The Asia Pacific Genotyping Market is valued at US$ 6,489.96 Million in 2023, it is projected to reach US$ 35,048.62 Million by 2031.

As per our report Asia Pacific Genotyping Market, the market size is valued at US$ 6,489.96 Million in 2023, projecting it to reach US$ 35,048.62 Million by 2031. This translates to a CAGR of approximately 23.5% during the forecast period.

The Asia Pacific Genotyping Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Genotyping Market report:

The Asia Pacific Genotyping Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Genotyping Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Genotyping Market value chain can benefit from the information contained in a comprehensive market report.