In recent years, various measures and efforts have been taken to create awareness and educate people regarding eye diseases, prompting patients to access suitable medications and treatments.

Sightsavers—an international nongovernmental organization—works in developing countries to treat and prevent eye diseases. A large population in India resides in rural areas with limited or no awareness of eye ailments. Sightsavers aims to create awareness with its Rural Eye Health Programme, provide high-quality eye health services, and eradicate avoidable blindness in the rural population. In addition, in 2019, the WHO launched the Universal Health Coverage and Eye Care: Promoting Country Action, an event to provide practical, step-by-step guidance to support Member States of WHO in planning and implementing the recommendations of the WHO's World Report on vision. The WHO launched this event to provide integrated people-centered eye care services. Further, the India–US Collaborative Vision Research Program 2020 focuses on advancing science and technology crucial to understand, prevent, and treat blinding eye diseases, visual disorders, and associated complications. The Indian Department of Biotechnology and the US NEI fund this research program.

In December 2021, NIH-funded projects supported the partnership between Kellogg Eye Center and Aravind Eye Hospital (India) to develop a clinical research training program for eyecare specialists. Such training programs are meant to develop the eyecare field in India. Thus, increasing funds for eyecare research will likely offer growth opportunities to the eye drop market players.

The Asia Pacific eye drops market is sub segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. Asia Pacific is expected to register the fastest CAGR during the forecast period. The growth of the market in Asia Pacific is attributed to the growing prevalence of dry eye diseases in countries such as Australia, and India. Additionally, the growing geriatric population, developing healthcare infrastructure, and increasing investments to boost research activities are projected to drive the Asia Pacific eye drops market during the forecast period. In China, every year about 20–30% of people are diagnosed with dry eye conditions. Major factors causing dry eye condition include long spending hours in front of computers, laptops, and mobile phones. Moreover, high air pollution level is another leading cause of dry eye condition in the country. The country records the highest incidences of diabetes and glaucoma in Asia Pacific, which may lead to a dry eye condition. China is also the largest market for API manufacturing and generic pharmaceuticals. Various companies in the country are involved in the production of ophthalmic products. In April 2023, Ocumension Therapeutics submitted a new drug application (NDA) for approval to commercialize Zerviate 0.24% (cetirizine) ophthalmic solution in China. This solution is majorly used to reduce ocular itching associated with allergic conjunctivitis.

The Asia Pacific eye drops market in China is quite competitive, with the presence of both domestic and international pharmaceutical companies. A few of the well-known domestic eye drop brands in the country are Santen, Novartis, Alcon, Allergan, and Baush + Lomb, which offer a range of eye care products, including prescription-based eye drops and over the counter (OTC) solutions. The distribution channels for eye drops in China include hospitals, clinics, pharmacies, and e-commerce platforms. Hospitals and clinics are commonly preferred as distributors by companies offering prescription-based eye drops, while OTC eye drops are readily available in pharmacies and online platforms.

Strategic insights for the Asia Pacific Eye Drops provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Eye Drops refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Eye Drops Strategic Insights

Asia Pacific Eye Drops Report Scope

Report Attribute

Details

Market size in 2022

US$ 2,823.84 Million

Market Size by 2030

US$ 4,386.59 Million

Global CAGR (2022 - 2030)

5.7%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Type

By Application

By Purchase Mode

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Eye Drops Regional Insights

Asia Pacific Eye Drops Market Segmentation

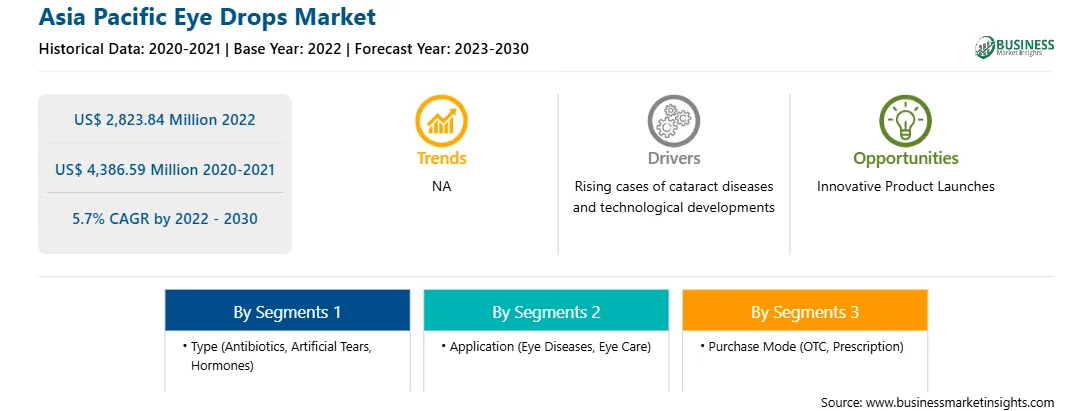

The Asia Pacific eye drops market is segmented into type, application, purchase mode, and country.

Based on type, the Asia Pacific eye drops market is segmented into antibiotics, artificial tears, hormones, and others. The antibiotics segment held the largest share of the Asia Pacific eye drops market in 2022.

Based on application, the Asia Pacific eye drops market is segmented into eye diseases, eye care, and others. The eye diseases segment held the largest share of the Asia Pacific eye drops market in 2022. The eye diseases segment is further segmented into dry eye, glaucoma, cataract, and others.

Based on purchase mode, the Asia Pacific eye drops market is segmented into OTC and prescription. The prescription segment held a larger share of the Asia Pacific eye drops market in 2022.

Based on country, the Asia Pacific eye drops market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific eye drops market in 2022.

AbbVie Inc, Alcon AG, Bausch & Lomb Inc, Biomedica Pvt Ltd, Pfizer Inc, Prestige Consumer Healthcare Inc., and Rohto Pharmaceutical Co Ltd are some of the leading companies operating in the Asia Pacific eye drops market.

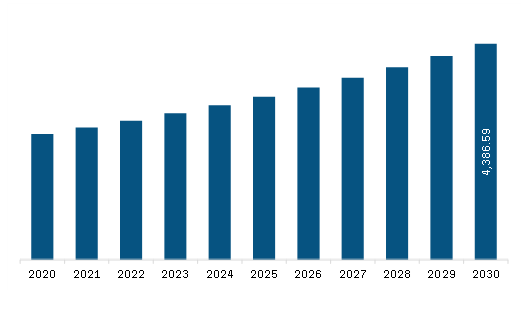

The Asia Pacific Eye Drops Market is valued at US$ 2,823.84 Million in 2022, it is projected to reach US$ 4,386.59 Million by 2030.

As per our report Asia Pacific Eye Drops Market, the market size is valued at US$ 2,823.84 Million in 2022, projecting it to reach US$ 4,386.59 Million by 2030. This translates to a CAGR of approximately 5.7% during the forecast period.

The Asia Pacific Eye Drops Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Eye Drops Market report:

The Asia Pacific Eye Drops Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Eye Drops Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Eye Drops Market value chain can benefit from the information contained in a comprehensive market report.