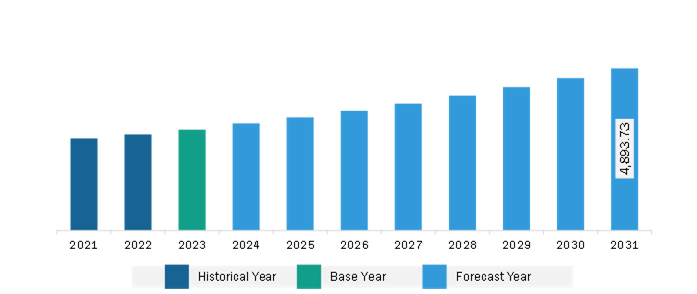

The Asia Pacific explosion proof equipment market was valued at US$ 2,815.21 million in 2023 and is expected to reach US$ 4,892.33 million by 2031; it is estimated to register a CAGR of 7.2% from 2023 to 2031.

As offshore production and exploration activities continue to increase, the requirement for enhanced safety measures becomes critical. The rising number of offshore installations, such as oil rigs and platforms, requires the adoption of explosion-proof equipment to protect workers and assets. The offshore industry is exposed to stringent safety standards and regulations imposed by regulatory bodies. Compliance with these standards is essential, which is driving the demand for explosion-proof equipment that guarantees compliance with hazardous area classification and prevents accidents due to explosions or sparks. Various regions have their regulatory standards. Additionally, several global standards are applied. A few of them are mentioned below:

• IEC/EN 60079-0: For use in explosive gas atmospheres (general rules)

• IEC/EN 60079-1: Explosive atmospheres - Part 1: Equipment protection by flameproof enclosures “d”

• IEC/EN 60079-7: Explosive atmospheres - Part 7: Equipment protection by increased safety “e”

• IEC/EN 60079-31: Explosive atmospheres - Part 31: Equipment protection against ignition of dust by enclosure “t“

With the stringent regulatory standards, industries and businesses will need to upgrade the existing equipment to comply with new safety standards and regulations. This is expected to create a huge demand for explosion-proof equipment in the market.

The explosion-proof equipment market in APAC is segmented into India, Japan, Australia, South Korea, China, and the Rest of APAC. The demand for explosion-proof equipment is growing in the region due to rising projects in the oil & gas sector. For instance, as per the article published in NS Energy, India is anticipated to observe the operational commencement of 647 oil and gas projects between 2021 and 2025 as part of the government plan to create a gas-based economy. Similarly, according to Sinopec, the national oil company, the natural gas demand in China reached 395 bcm in 2022, an increase of 7% from 370 bcm in 2021. The oil & gas industry often requires workers to operate in hazardous locations, including areas where flammable liquids, gas vapors, or combustible dust exist in sufficient quantities; safety is the priority for workers and operators. Thus, explosion-proof equipment manufacturers produce and rigorously test explosion-proof assets to combat the high potential for ignition.

With the evolution of Industry 4.0 in APAC, the oil & gas industry has benefitted in terms of technological enhancements. Automating the oil rigs and smart exploration have been widely observed. Also, companies are significantly adopting technologies such as IoT, AI, advanced analytics, and robotics to enhance operational efficiencies, cut costs, and optimize manual processes. Thus, the growth in Industry 4.0 has positively transformed the oil & gas industry and helped implement explosion-proof equipment in the region. For instance, in January 2022, ABB India launched flameproof low-voltage motors for applications in potentially explosive environments such as the oil & gas industry. The flameproof low-voltage motors offer considerable benefits, comprising low vibration levels with increased reliability for an extended lifetime and reduced maintenance requirements for a lower cost of ownership. Furthermore, in APAC, the use of explosion-proof equipment is high in the water and wastewater industry. The investment in the industry is growing at a fast pace. For instance, according to the Eurasian development bank, Central Asia water and sanitation sector will need an investment of around US$ 12 billion from the year 2025 to 2030, which is US$ 2 billion per year. Water and wastewater treatment plants often have flammable or explosive gases like methane, hydrogen, and other volatile organic compounds. Explosion-proof equipment prevents ignition sources, reducing the risk of explosion in these hazardous environments. Therefore, the evolution of Industry 4.0 is supporting the growth of the explosion-proof equipment market in the region.

Strategic insights for the Asia Pacific Explosion-Proof Equipment provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Explosion-Proof Equipment refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Explosion-Proof Equipment Strategic Insights

Asia Pacific Explosion-Proof Equipment Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,815.21 Million

Market Size by 2031

US$ 4,892.33 Million

Global CAGR (2023 - 2031)

7.2%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Systems

By Protection Method

By Industry

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Explosion-Proof Equipment Regional Insights

The Asia Pacific explosion proof equipment market is categorized into systems, protection method, industry, and country.

Based on systems, the Asia Pacific explosion proof equipment market is segmented into junction boxes and enclosures, lighting system, monitoring system, signaling devices, automation system, cable glands, HVAC systems, and others. the cable glands segment held the largest market share in 2023. The monitoring system segment is further sub segmented into cameras, data loggers, sensors, and others.

In terms of protection method, the Asia Pacific explosion proof equipment market is segmented into explosion prevention, explosion containment, and explosion segregation. The explosion prevention segment held the largest market share in 2023.

By industry, the Asia Pacific explosion proof equipment market is segmented into oil and gas, manufacturing, mining, chemical and petrochemical, energy and power, pharmaceutical, water and wastewater management, and others. The manufacturing segment held the largest market share in 2023.

By country, the Asia Pacific explosion proof equipment market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific explosion proof equipment market share in 2023.

ABB Ltd; Emerson Electric Co; Pepperl+Fuchs SE; Honeywell International Inc; Xylem Inc.; OMEGA Engineering, Inc.; BARTEC Top Holding GmbH; Rockwell Automation Inc; Siemens AG; Schneider Electric SE; and Detector Electronics, LLC. are some of the leading companies operating in the Asia Pacific explosion proof equipment market.

The Asia Pacific Explosion-Proof Equipment Market is valued at US$ 2,815.21 Million in 2023, it is projected to reach US$ 4,892.33 Million by 2031.

As per our report Asia Pacific Explosion-Proof Equipment Market, the market size is valued at US$ 2,815.21 Million in 2023, projecting it to reach US$ 4,892.33 Million by 2031. This translates to a CAGR of approximately 7.2% during the forecast period.

The Asia Pacific Explosion-Proof Equipment Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Explosion-Proof Equipment Market report:

The Asia Pacific Explosion-Proof Equipment Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Explosion-Proof Equipment Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Explosion-Proof Equipment Market value chain can benefit from the information contained in a comprehensive market report.