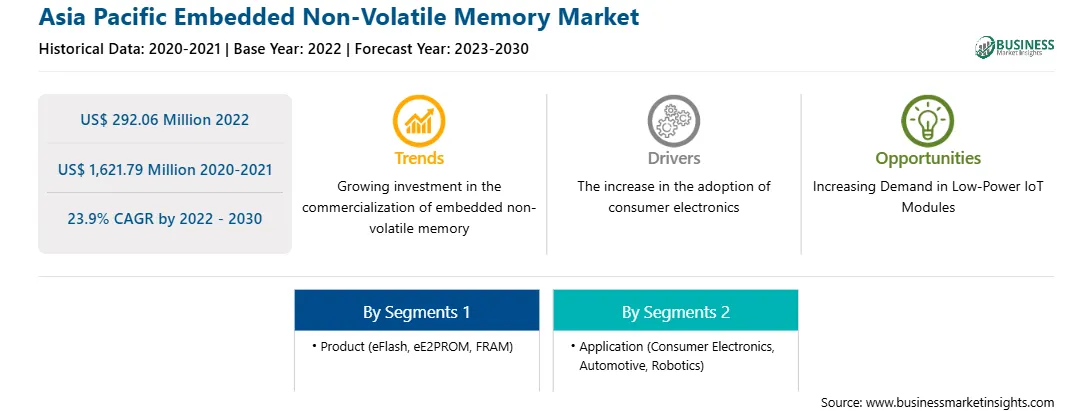

The Asia Pacific embedded non-volatile memory market was valued at US$ 292.06 million in 2022 and is expected to reach US$ 1,621.79 million by 2030; it is estimated to grow at a CAGR of 23.9% from 2022-2030.

Technological giants worldwide are highly focused on research and development of new technologies. IoT is positioned at the core of the next-gen software technologies in the embedded non-volatile memory market. Embedded non-volatile memory has a wide range of applications in the IoT sector. They are used to collect and store data to help users perform future decision-making activities. An embedded non-volatile memory is capable of supporting low-power IoT modules. The growing shipment of IoT modules is fueling the embedded non-volatile memory market. For instance, in the first quarter of 2023, companies such as Telit Cinterion, Quectel, and Fibocom increased the shipment of low-power NB-IoT and LTE-M (Cat-M) modules. Embedded non-volatile memory supports IoT modules by saving additional space and cost by reducing the need for on- and off-chip to regulate the voltage of the modules. IoT modules are most commonly used in IoT edge or endpoint devices for solving challenges related to ultra-low power operation and shrinking size. IoT modules can connect to the cloud, exchange data packets, and download firmware in batches while operating independently. These modules require high energy and power to perform operations, which increases the demand for embedded non-volatile memory among users. Furthermore, the growing demand for ultra-low power consumption IoT modules encourages market players to develop new innovative embedded non-volatile memory that requires low power to perform operations. For instance, in June 2022, STMicroelectronics launched the Electrically Erasable Programmable Read-Only Memory (EEPROM) series. The EEPROM series is a new high-density, all-in-one embedded non-volatile memory family that supports embedded systems and tiny IoT modules to operate effectively in low-power energy. The EEPROM series offers several benefits to the user, including efficient data logging, fast upload/download, and ultra-low power for enhancing module efficiency while minimizing power dissipation. The extensive adoption of IoT is fueling the market growth. For instance, according to the Cisco Visual Networking Index, in 2022, there were more than 28 billion network devices enabled with embedded systems and powered by IoT. The network devices help users improve connectivity and security and reduce additional operational costs for the business. The integration of embedded systems with IoT devices and platforms is enabling new applications and services in areas such as smart homes, smart cities, and industrial IoT. Also, the expansion of smart cities and smart home projects is anticipated to increase the demand for embedded non-volatile memory in IoT-based embedded systems, thereby providing opportunities for the market growth.

The embedded non-volatile memory market in APAC is segmented into China, India, Australia, Japan, South Korea, and the Rest of APAC. Vast industrialization, low labor cost, favorable economic policies, positive economic development, and an increase in foreign direct investments (FDIs) and foreign institutional investments (FIIs), among others, contribute to the growth of the APAC embedded non-volatile memory market. Taiwan and China are the leading semiconductor manufacturing countries in APAC. The governments of emerging economies have been taking strategic initiatives, such as Made in China 2025 and make in India, to promote the growth of the domestic manufacturing sectors for making the respective countries capable of meeting the native demands and exporting surplus goods. Moreover, the rising GDP per capita in developing countries, such as India and China, leads to a large client base for high-tech consumer electronics such as smart wearables, appliances, electric vehicles, and smartphones. Many Asian economies are characterized by the mass production of electronic components or devices required for consumer electronics, telecommunication devices, automotive components, and other industrial machinery. As per the Ericsson Mobility Report, their mobile connections in APAC are expected to rise from ~4 billion to 4.6 billion by the end of 2021. An increase in the adoption of smartphones and other advanced internet-enabled devices is anticipated to boost the demand for embedded non-volatile memory in APAC. Moreover, APAC is the biggest consumer of smartphones, as ~732 million units were bought by consumers in 2019. The telecommunication sector is witnessing strong growth in Asia Pacific mainly due to the positive outlook toward introducing 5G networks and the strong presence of 4G networks. According to Ericsson's mobility report, Western and Northeast Asia would account for 66% share of the total 5G adoption by 2026, while Southeast Asia and Oceania would hold 32% share by 2026; the rest of the shares would be held by the LTE (4G) technology. The region has a robust automotive sector, which is followed by the growing automotive manufacturing industry in countries such as India and South Korea. Countries such as China, India, South Korea, and Japan are among the leading vehicle manufacturing countries worldwide. For instance, India produced 3,394,446 vehicles, of which 2,938,653 were sold in 2020. Also, in 2020, China was the largest vehicle-producing country globally; it produced 25,225,242 vehicles in 2020, of which 25,311,069 were sold. Moreover, the governments in this region are undertaking various initiatives to support the automotive industry's growth. For instance, in 2019, the government of India announced its plan to set up research and development centers worth US$ 388.5 million to enable the automotive sector to meet global standards.

Strategic insights for the Asia Pacific Embedded Non-Volatile Memory provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 292.06 Million |

| Market Size by 2030 | US$ 1,621.79 Million |

| Global CAGR (2022 - 2030) | 23.9% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2030 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Embedded Non-Volatile Memory refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Asia Pacific embedded non-volatile memory market is segmented based on product, application, and country. Based on product, the Asia Pacific embedded non-volatile memory market is categorized into eFlash, eE2PROM, FRAM, and others. The eFlash segment held the largest market share in 2022.

In terms of application, the Asia Pacific embedded non-volatile memory market is categorized into consumer electronics, automotive, robotics, and others. The others segment held the largest market share in 2022.

Based on country, the Asia Pacific embedded non-volatile memory market is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific embedded non-volatile memory market share in 2022.

Microchip Technology Inc, Tower Semiconductor, GlobalFoundries Inc, eMemory Technology Inc, Texas Instruments Inc, Hua Hong Semiconductor Ltd, Taiwan Semiconductor Manufacturing Co Ltd, United Microelectronics Corp, Semiconductor Manufacturing International Corp, and Synopsys Inc are some of the leading companies operating in the Asia Pacific embedded non-volatile memory market.

The Asia Pacific Embedded Non-Volatile Memory Market is valued at US$ 292.06 Million in 2022, it is projected to reach US$ 1,621.79 Million by 2030.

As per our report Asia Pacific Embedded Non-Volatile Memory Market, the market size is valued at US$ 292.06 Million in 2022, projecting it to reach US$ 1,621.79 Million by 2030. This translates to a CAGR of approximately 23.9% during the forecast period.

The Asia Pacific Embedded Non-Volatile Memory Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Embedded Non-Volatile Memory Market report:

The Asia Pacific Embedded Non-Volatile Memory Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Embedded Non-Volatile Memory Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Embedded Non-Volatile Memory Market value chain can benefit from the information contained in a comprehensive market report.