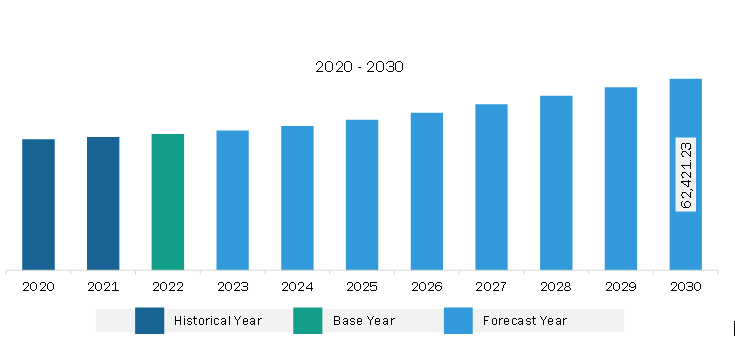

The Asia Pacific electroplating market is expected to grow from US$ 44,378.99 million in 2022 to US$ 62,421.23 million by 2030. It is estimated to grow at a CAGR of 4.4% from 2022 to 2030.

Ongoing Industrialization Fuel Asia Pacific Electroplating Market

Rising industrialization across the globe, along with the increasing disposable income of consumers in developed countries, fuels the demand for electroplating across the electronics, automotive, and jewelry industries. Rising demand for high-performance automobile components with excellent corrosion resistance to enhance the appearance of exterior automobile parts, including hood ornaments, emblems, door handles, and wheel rims, propels the requirement for electroplating solutions owing to the increasing production of automobiles. Opportunities remain promising for service providers in several countries owing to the remarkable growth in the electronics and automotive industries. The zinc-nickel electroplating is considered one of the popular electroplating methods in the automotive industry. The significant growth of the electronics industry across the world, coupled with high demand for electroplating in the manufacturing of various electronic components such as electric transistors, electronic power switches, conductors and semiconductors, connectors, and computer components, is another prominent factor propelling the market growth.

Asia Pacific Electroplating Market Overview

The electroplating market in APAC comprises several developing economies such as China, India, Japan, South Korea, and Australia. These emerging countries are witnessing an upsurge due to growth in urbanization, increasing manufacturing industries coupled with growing industrialization, and the impact of social media, which offers ample opportunities for key market players in the electroplating market. Countries such as Australia, Japan, India, China, South Korea, Singapore, Taiwan, and Indonesia have large metallurgy industries. Global players, such as Cherng Yi Hsing Plastic Plating Factory Co., Ltd., toho Zinc Co., Ltd., Jing Mei Industrial Limited, and others, are marketing their electroplating in these countries. The APAC region encompasses an ample number of opportunities for the growth of electroplating. This region has been noticed as one of the prominent markets for the utilization of electroplating. Asia has ranked highest amongst chemicals producing regions. China is mainly dominating the regional market, followed by other countries such as Japan, Taiwan, Vietnam, Korea, Thailand, Malaysia, and Indonesia. These countries are experiencing rising demand for semiconductors & ICs, LCDs, printed circuit boards, and others. Apart from the electroplating application in the semiconductors industry, electroplating is extensively utilized in wearable devices, smartphones, and other electronic devices. The demand for smartphones and wearable devices, has been increased subsequently with the growth of the electronics industry, coupled with a shift in consumer living standards. This shift has further propelled the growth of the electroplating market in the region. Over the past few years, the manufacturing spending towards the developments of chemicals and electronic industry has grown significantly and is further anticipated to grow at a high rate. Rising foreign direct investments also lead to economic growth in this region. Increasing expenditure towards research and development activities to diversify the application base of electroplating has also led to market growth. Also, the wide use of various types of electroplating in medical instruments, aircraft manufacturing, and automobile parts is contributing to the market growth in this region.

Asia Pacific Electroplating Market Revenue and Forecast to 2030 (US$ Million)

Strategic insights for the Asia Pacific Electroplating provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Electroplating refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Electroplating Strategic Insights

Asia Pacific Electroplating Report Scope

Report Attribute

Details

Market size in 2022

US$ 44,378.99 Million

Market Size by 2030

US$ 62,421.23 Million

Global CAGR (2022 - 2030)

4.4%

Historical Data

2020-2021

Forecast period

2023-2030

Segments Covered

By Metal

By Type

By End-Use Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Electroplating Regional Insights

Asia Pacific Electroplating Market Segmentation

The Asia Pacific electroplating market is segmented into metal, type, end-use industry, and country.

Based on metal, the Asia Pacific electroplating market is segmented into gold, silver, copper, nickel, and others. The nickel segment held the largest share of the Asia Pacific electroplating market in 2022.

In terms of type, the Asia Pacific electroplating market is categorized into barrel plating, rack plating, continuous plating, and line plating. The barrel plating segment held the largest share of the Asia Pacific electroplating market in 2022.

Based on end-use industry, the Asia Pacific electroplating market is segmented into automotive, electrical & electronics, aerospace & defence, medical, and others. The electrical & electronics segment held the largest share of the Asia Pacific electroplating market in 2022.

Based on country, the Asia Pacific electroplating market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific electroplating market in 2022.

Atotech Deutschland GmbH & Co KG, Dr Ing Max Schlotter GmbH & Co KG, Jing Mei Industrial Ltd, Toho Zinc Co Ltd, and Cherng Yi Hsing Plastic Plating Factory Co Ltd are some of the leading companies operating in the Asia Pacific electroplating market

The Asia Pacific Electroplating Market is valued at US$ 44,378.99 Million in 2022, it is projected to reach US$ 62,421.23 Million by 2030.

As per our report Asia Pacific Electroplating Market, the market size is valued at US$ 44,378.99 Million in 2022, projecting it to reach US$ 62,421.23 Million by 2030. This translates to a CAGR of approximately 4.4% during the forecast period.

The Asia Pacific Electroplating Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Electroplating Market report:

The Asia Pacific Electroplating Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Electroplating Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Electroplating Market value chain can benefit from the information contained in a comprehensive market report.