APAC includes various well-established economies such as China, India, Japan, Australia, and South Korea. APAC is the major market for electric insulators because of increasing urbanization, growing population, and rising industrial sector in countries such as China and India. The governments of countries in APAC are planning to invest in the development of electric grids and power generation, which would further boost the demand for insulators in the region. For instance, with the revolving Industry 4.0, the industrial sector is also boosting due to the integration of production machines, wireless connectivity, sensors, and other advanced technologies such as artificial intelligence and the internet of things. Thus, with the growth in the industrial sector, the use of electric insulators in transformers, switchgear, electric cables, protection devices, is also increasing. Further, the multiple transmission and distribution line projects help in the growth of the electric insulator market. For instance, in July 2021, Turkmenenergo started a project transmission infrastructure ring comprising 1,000 km line and two 500 kV and two 220 kV substations in Turkmenistan. It is aimed at increasing the production of electricity, improving the quality of energy-saving, and significantly increasing the electricity export potential. This project is funded by Asian Development Bank. Secondly, in June 2021, a 500 kV TAP power interconnection project started, which is one of the most important regional energy projects and will enable power trade among the three countries of Turkmenistan, Afghanistan, and Pakistan. Therefore, multiple transmission and distribution line projects are increasing the demand for electric insulators in the region.

In case of COVID-19, APAC is highly affected specially India. The COVID-19 that emerged in China has affected several neighboring countries such as India, South Korea, and Japan, among others. China and India are the most prominent manufacturing hub in the region and have an enhanced focus on industrialization. The growth of the manufacturing industry has been hampered due to lockdown but soon expected to recover the development by enhancing the production capabilities in the second half of the year 2021. The imposition of a ban on commercial activities has disrupted the industrial supply chains in APAC region, leading to raw material shortages. Further, due to COVID-19 outbreak, the demand of electricity in the region falls in 2020. However, with uplifting of lockdown in 2021, the electricity demand and production both increasing due to the working of industrial and commercial sector. Therefore, with growing electricity demand, the need for electric insulator is also rising.

Strategic insights for the Asia-Pacific Electric Insulator provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

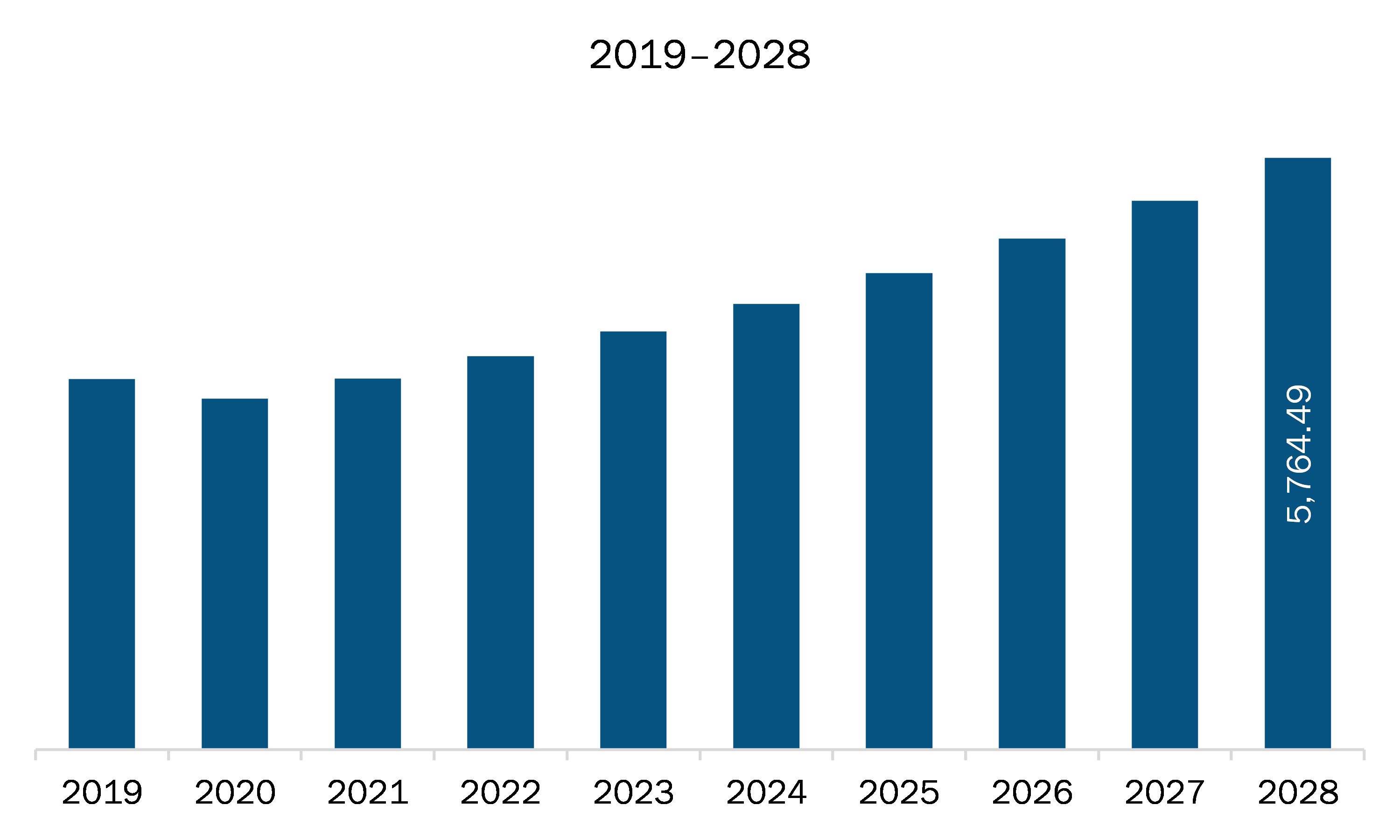

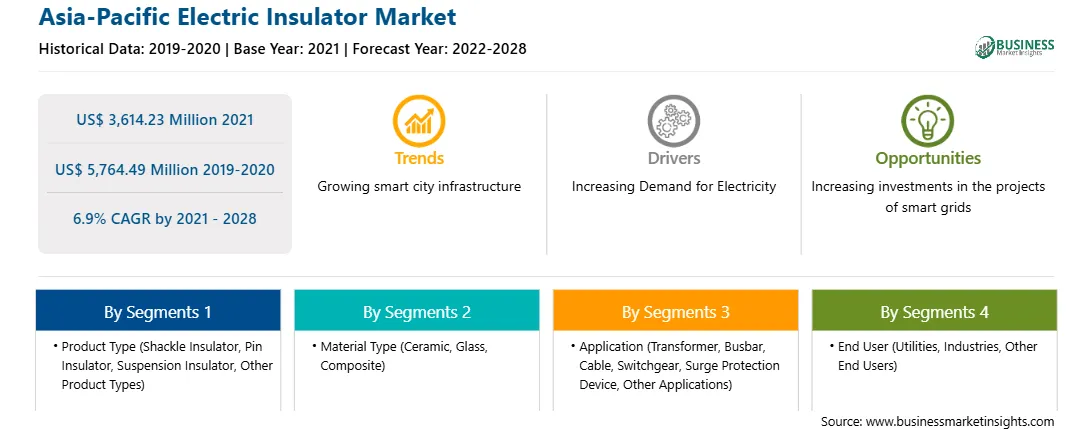

| Market size in 2021 | US$ 3,614.23 Million |

| Market Size by 2028 | US$ 5,764.49 Million |

| Global CAGR (2021 - 2028) | 6.9% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia-Pacific Electric Insulator refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The APAC electric insulator market is expected to grow from US$ 3,614.23 million in 2021 to US$ 5,764.49 million by 2028; it is estimated to grow at a CAGR of 6.9% from 2021 to 2028. Rising railway infrastructure development is expected to surge the market growth in coming years. With the growing railway lines and seaports construction, the demand for electric insulators increases as it is used for electrification in railway lines and seaports. For instance, as of Statista data of 2020, countries such as India has more than 1,100 km length of only high-speed railway network. Further, several ongoing projects are running in the railway sector in India. For instance, a contract was assigned to railway authorities for the construction of the high-speed railway. Therefore, with the expansion of seaports and railway tracks, the demand for electric insulators is expected to increase across APAC region.

In terms of product type, the pin insulator segment accounted for the largest share of the APAC electric insulator market in 2020. In terms of material type, the ceramic segment held a larger market share of the APAC electric insulator market in 2020. In terms of application, the transformer segment held a larger market share of the APAC electric insulator market in 2020. Further, the utilities segment held a larger share of the APAC electric insulator market based on end user in 2020.

A few major primary and secondary sources referred to for preparing this report on the APAC electric insulator market are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are Aditya Birla Insulators; General Electric Company; Hitachi ABB Power Grids Group; Hubbell Incorporated; MacLean-Fogg Company; NGK Insulators, Ltd.; PFISTERER Holding AG; SEVES Group; Siemens AG; and TE Connectivity Ltd.

The Asia-Pacific Electric Insulator Market is valued at US$ 3,614.23 Million in 2021, it is projected to reach US$ 5,764.49 Million by 2028.

As per our report Asia-Pacific Electric Insulator Market, the market size is valued at US$ 3,614.23 Million in 2021, projecting it to reach US$ 5,764.49 Million by 2028. This translates to a CAGR of approximately 6.9% during the forecast period.

The Asia-Pacific Electric Insulator Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Electric Insulator Market report:

The Asia-Pacific Electric Insulator Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Electric Insulator Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Electric Insulator Market value chain can benefit from the information contained in a comprehensive market report.