Rise in Government Support for Strengthening Manufacturing Sector

Government bodies are taking necessary steps to strengthen their industrial sector. Countries are experiencing government support in the form of investment for strengthening the manufacturing sector. For instance:

• “Made in China 2025” is a strategy introduced in 2015 to encourage Chinese technological manufacturers instead of dependency on international technology in the global marketplace. The country is planning to accomplish this objective by 2025. The strategy aims to drive manufacturing in automated machine tools and robotics; advanced information technology; aerospace and aeronautical equipment; modern rail transport; medical devices; and many more. The factors mentioned above related to government investment and deals inked for strengthening the manufacturing sector are projected to create a demand for products used in the component fabrication process. This will fuel the need for EDM wires.

Market Overview

Australia, China, India, Japan, South Korea, and rest of APAC are the key contributors to the EDM wire market in the Asia Pacific. The electronics industry accounts for 20–50% of Asia's total value of exports. The growing demand for smartphones, tablets, PCs, laptops, and other consumer electronics in Asian countries favors the growth of the Asia Pacific EDM wire market. China is the world's largest maker of electronic appliances, including TVs, DVDs, and cell phones. According to Nikkei Inc., the Chinese government will be working on various plans with an investment of US$ 327 billion till 2023 to expand the country's domestic electronic market. Indian government is also working on the expansion of the electronics industry in the country. According to the Ministry of Electronics & IT, the domestic production of electronic goods in India reached the revenue value of US$ 74.7 billion in 2020, a CAGR of 17.9%, owing to the initiatives taken by the government and the efforts of the industry. A few of the government policies related to electronics manufacturing include the Production Linked Incentive (PLI) Schemes, Scheme for Promotion of Electronic Components and Semiconductors Promotion and Modified Electronics Manufacturing Cluster (EMC 2.0) Scheme. Countries in the Association of Southeast Asian Nations (ASEAN) export televisions, radios, computers, cellular phones, and many other consumer electronics goods. They account for more than 80% of the hard drives manufactured in the world. Thailand has one of the largest electronics assembly bases in Southeastern Asia, comprising more than 2,300 companies. The country has the largest production base for the electrical appliances sector in the ASEAN region, which is the second-largest producer of air-conditioning units and the fourth-largest producer of refrigerators. Further, the electronic and electric industry in Malaysia has expanded to more than 1,695 companies, with an investment of ~US$ 35.5 billion. Thus, the huge presence of electronics and electrical industries contributes to a high demand for EDM wires in Asia Pacific.

Strategic insights for the Asia Pacific EDM Wire provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific EDM Wire refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific EDM Wire Strategic Insights

Asia Pacific EDM Wire Report Scope

Report Attribute

Details

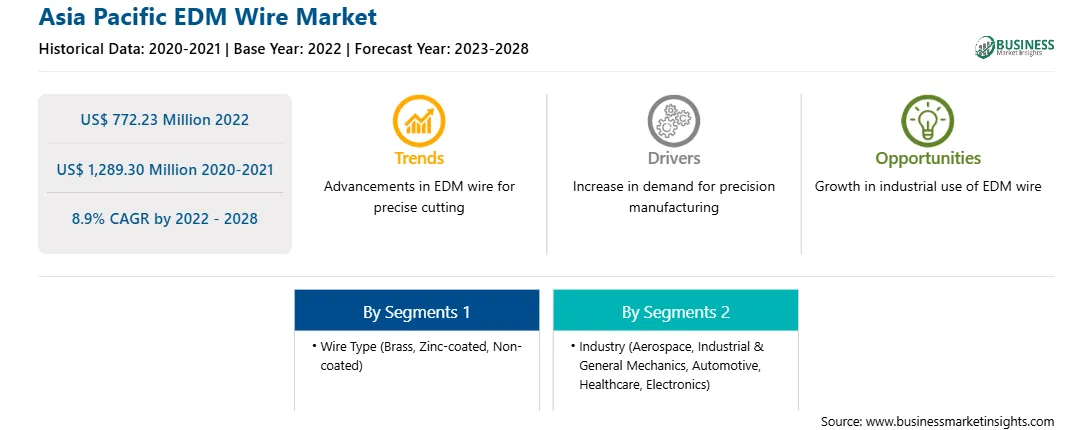

Market size in 2022

US$ 772.23 Million

Market Size by 2028

US$ 1,289.30 Million

Global CAGR (2022 - 2028)

8.9%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Wire Type

By Industry

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific EDM Wire Regional Insights

Asia Pacific EDM Wire Market Segmentation

The Asia Pacific EDM wire market is segmented into wire type, industry, and country.

Based on wire type, the market is segmented into brass, zinc-coated, and non-coated. The brass segment registered the largest market share in 2022.

Based on industry, the market is segmented into aerospace, industrial & general mechanics, automotive, healthcare, electronics, and others. The automotive segment held the largest market share in 2022.

Based on country, the market is segmented into Australia, China, India, Japan, South Korea, and rest of APAC. China dominated the market share in 2022.

Berkenhoff GmbH; Hitachi Metals Ltd; Sumitomo Electric Industries, Ltd; Novotec; Opecmade, Inc; OKI Electric Cable Co., Ltd; Thermo Compact; Ningbo kangqiang Micro-Electronics Technology Co., Ltd. JIA BAO Metal Co., Ltd; boway Group; and Yuang Hsian Metal Industrial Corporation are the leading companies operating in the Asia Pacific EDM wire market in the region.

Asia Pacific EDM Wire Market Revenue and Forecast to 2028 (US$ Million)

The Asia Pacific EDM Wire Market is valued at US$ 772.23 Million in 2022, it is projected to reach US$ 1,289.30 Million by 2028.

As per our report Asia Pacific EDM Wire Market, the market size is valued at US$ 772.23 Million in 2022, projecting it to reach US$ 1,289.30 Million by 2028. This translates to a CAGR of approximately 8.9% during the forecast period.

The Asia Pacific EDM Wire Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific EDM Wire Market report:

The Asia Pacific EDM Wire Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific EDM Wire Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific EDM Wire Market value chain can benefit from the information contained in a comprehensive market report.