Edge computing is a crucial part of the 5G platform. The 5G connectivity is enabling an era of user-centric network by bringing in the concept of network slicing and composable networking. The network service providers are ideally positioned to deliver intelligent traffic routing from the mobile network to the optimal location which is escalating the need for faster network capability enhancing the market outlook. However, the evolution of distributed cloud computing enables the providers to move beyond traditional connectivity-service models and open new doors to adjacent industries. The Communication Service Providers (CSP) are looking for new revenue sources to grow their businesses. Thus, with the introduction of 5G and edge computing, the CSPs are now in a better position to provide new offerings. The 5G can enhance edge computing applications by reducing latency, improvising application response times, and enhancing the ability of enterprises to collect and process data. It also helps the enterprises collect and process massive volumes of real-time data to optimize various operational systems and improve productivity and customer experiences. 5G network infrastructure can support and enable the increasing complexity and specialization of edge computing to deliver instant communication experience. Thus, the introduction of 5G with an edge messaging system brings the connectivity at a higher speed and delivers near-instant communication experiences. Therefore, the rising trend of the adoption of 5G network across the world is expected to augment the demand for edge computing during the forecast period.

China, India, and Japan are the dominating countries in the edge computing market in Asia Pacific. The region has a strong manufacturing base, which continues to be a strong adopter of the IoT. In recent years, the manufacturing sector has begun transforming its operations by embracing digitalization and IoT. As per the Microsoft IoT Signals report study of over 3,000 business decision-makers (BDMs), developers, and internet technology decision-makers (ITDMs) across 10 countries—including Australia, China, and Japan—indicates the continuation of the adoption of IoT in a range of applications. Increasing government focus on smart city initiatives is driving demand for digital IoT solutions in e-government, smart traffic management, and smart power grid applications. Thus, such large-scale adoption of IoT technologies across various sectors is creating a huge demand for edge computing solutions.

According to the GSM Association, Asia Pacific is expected to have more than 400 million 5G subscriptions by 2025, representing 14% of overall mobile subscriptions, while 4G would continue to be a dominant technology. In 5G pioneer markets, including China and South Korea, operators have seen rapid acceptance after the launch. Meanwhile, the total revenues of telecom operators are projected to rise from US$ 210 million in 2021 to US$ 224 million by 2025. Thus, such growth factors in the 5G network wherein high bands (wave frequencies above 24 GHz) will support ultra-high capacity, low latency bandwidth applications, further accelerates the adoption of edge computing which helps drive the market growth in the Asia Pacific region over the forecast period.

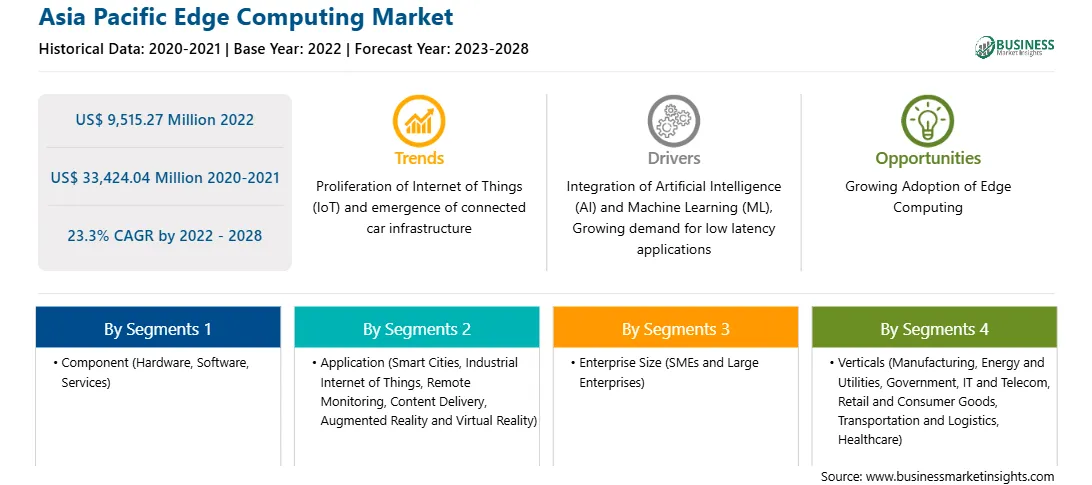

Strategic insights for the Asia Pacific Edge Computing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Edge Computing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific Edge Computing Strategic Insights

Asia Pacific Edge Computing Report Scope

Report Attribute

Details

Market size in 2022

US$ 9,515.27 Million

Market Size by 2028

US$ 33,424.04 Million

Global CAGR (2022 - 2028)

23.3%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Application

By Enterprise Size

By Verticals

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Edge Computing Regional Insights

Asia Pacific Edge Computing Market Segmentation

The Asia Pacific edge computing market is segmented into component, applications, enterprise size, verticals, and country.

Based on component, the Asia Pacific edge computing market is segmented into hardware, software, and services. The hardware segment registered the largest Asia Pacific edge computing market share in 2022.

Based on organization Size, the Asia Pacific edge computing market is segmented into SMEs and large enterprises. The large enterprises segment held a larger Asia Pacific edge computing market share in 2022.

Based on application, the Asia Pacific edge computing market is segmented into smart cities, industrial internet of things (IIOT), remote monitoring, content delivery, augmented reality and virtual reality, and others. The smart cities segment held the largest Asia Pacific edge computing market share in 2022.

Based on verticals, the Asia Pacific edge computing market is segmented into manufacturing, energy and utilities, government, IT and telecom, retail and consumer goods, transportation and logistics, healthcare, and others. The IT and telecom segment held the largest Asia Pacific edge computing market share in 2022.

Based on country, the Asia Pacific edge computing market has been categorized into the China, Japan, India, Australia, South Korea and the Rest of Asia Pacific. China dominated the Asia Pacific edge computing market share in 2022.

ADLINK Technology Inc.; Amazon Web Services; Dell Technologies; EdgeConnex Inc.; Hewlett Packard Enterprise Development LP (HPE); IBM Corporation; Litmus Automation, Inc.; and Microsoft Corporation are the leading companies operating in the Asia Pacific edge computing market.

The Asia Pacific Edge Computing Market is valued at US$ 9,515.27 Million in 2022, it is projected to reach US$ 33,424.04 Million by 2028.

As per our report Asia Pacific Edge Computing Market, the market size is valued at US$ 9,515.27 Million in 2022, projecting it to reach US$ 33,424.04 Million by 2028. This translates to a CAGR of approximately 23.3% during the forecast period.

The Asia Pacific Edge Computing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Edge Computing Market report:

The Asia Pacific Edge Computing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Edge Computing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Edge Computing Market value chain can benefit from the information contained in a comprehensive market report.