A transmission system is considered as one of the most essential parts of any automobile, which is developing from manual to the automated mechanism for boosting the fuel economy and power requirements of the vehicles. The major advantages of dual clutch transmission (DCTs) include lower power loss, faster transmission, and greater fuel economy, compared to other transmission types available in the market. The former technology is limited to be used in sports cars, race cars, and subsequently in passenger vehicles. The technology is subjected to robust research by established automakers to develop DCT systems such as DSG in Volkswagen and PDK from Porsche.

Strategic insights for the Asia Pacific Dual Clutch Transmission provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ Million |

| Market Size by 2028 | US$ 5,592.70 Million |

| Global CAGR (2021 - 2028) | 5.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Vehicle Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Dual Clutch Transmission refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

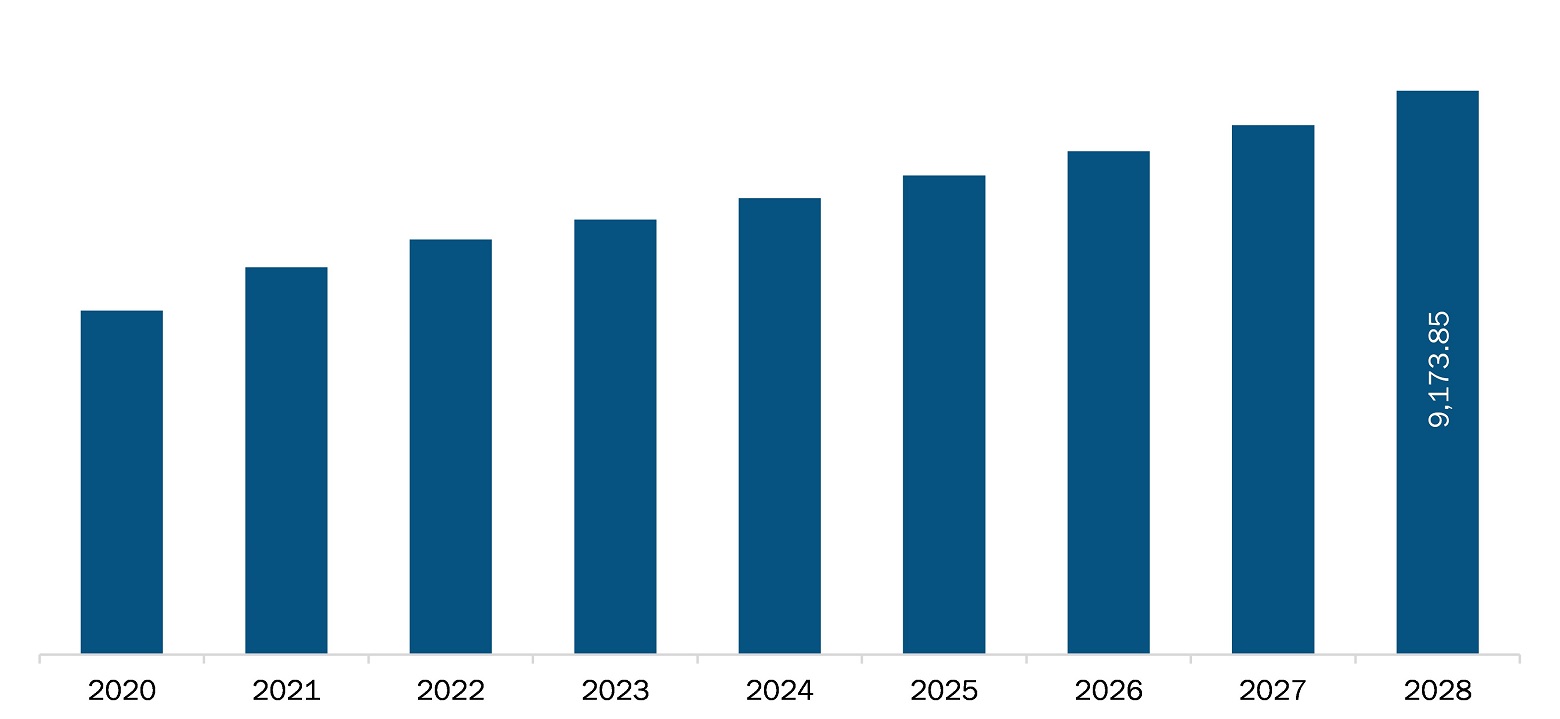

The Asia Pacific dual clutch transmission market is expected to reach US$ 5,592.70 million by 2028 from an estimated value of US$ million in 2021; it is likely to grow at a CAGR of 5.5% from 2021 to 2028. The factors driving the market's growth are the increasing demand for hybrids and DCT in Heavy Commercial Vehicle (HCVs) and the mounting demand for class A/B vehicles. However, the growing adoption of electric vehicles and their high costs may hamper the growth of the Asia Pacific dual clutch transmission market during the forecast period.

The application of dual-clutch transmission is efficiently boosting the driving experience as it improves acceleration and offers smooth gear shifting. Hence, DCT is gradually being used in vehicles across developing economies like China, India, and South Korea. Furthermore, the rising adoption of hybrid vehicles across the globe, coupled with the increasing integration of DCT, is creating attractive sales opportunities. Hybrid vehicles are designed for better fuel efficiency, minimum CO2 emissions, and more power. The HCVs obtain electrical energy generated from different sources, such as dual clutch transmission systems. Thus, it can conserve energy by shutting down the engine when the car is parked, idle, or when the electric motor's energy is sufficient to drive the vehicle without assistance from the ICE. The integration of DCTs in vehicles tends to offer better fuel economy than automatic transmissions and smoother performance than manual transmissions. As the DCTs shift smoothly and with a high degree of precision, they have often been preferred in the arena of performance, and therefore, they are being integrated with HCVs. This is creating a huge opportunity for DCT manufacturers to design efficient DCTs. The main benefits of dual-clutch transmissions (DCTs) are a higher energy efficiency than automatic transmission systems with torque converters and the capability to fill the torque gap during gear shifts to allow seamless longitudinal acceleration profiles. Therefore, DCTs are viable alternatives to automated manual transmissions (AMTs).

For vehicles equipped with engines that can generate considerable torque, significant clutch-slip energy losses occur during power-on gear shifts. As a result, DCTs need wet clutches for effective heat dissipation. However, with the rising demand for low-end cars such as hatchbacks, the market for the hot hatch is gaining traction. Hot hatches generate a considerable amount of power compared to their standard version cars and are the OEMs transmission of choice are DCTs. So, the concept of hot hatches is consistently rising, and so is the demand for faster shifting transmissions. Torque converters are a great choice with less space; however, enthusiasts in this category are demanding much faster-shifting DCTs. Thus, it is expected that with the rise in demand for hot hatches in the future, the demand for DCTs is also set to increase.

COVID-19 that emerged in China has affected several neighboring countries such as India, South Korea, and Japan. The governments in Asia Pacific are taking possible steps to reduce novel coronavirus effects by announcing lockdowns, which is impacting the revenue generated by the market. China and India are among the leading manufacturing sectors in the region and the most affected countries in the Asia Pacific region. Several markets have witnessed negative growth trends in the first half of 2020, and the lockdown has severely impacted the automotive sector across the region. In Japan, the vehicle sales crossed 326,000 units in August 2020, declining 16% on a Y-o-Y basis.

Similarly, in South Korea, the new vehicles sales in the country from the top five automakers—Hyundai, Kia, SsangYong Motor, Renault, and General Motors—have declined close to 6%, reaching around 112,000 units. Thus, with the declining vehicle sales in Asia Pacific, the demand for dual clutch transmission was decreased in 2020. However, in 2021, with the relaxation of lockdown measures and the beginning of the vaccination process, the manufacturing of passenger cars and commercial cars has started again. Therefore, this will lead to the growth of the dual clutch transmission market in the region.

Based on vehicle type, the APAC dual clutch transmission market is segmented into passenger cars and commercial vehicle. The passenger car segment led the dual clutch transmission market in 2021, and the same segment is expected to account for a larger market share by 2021–2028.

In terms of propulsion, the APAC dual clutch transmission market is classified into internal combustion engine (ICE) and hybrid. In 2021, the ICE segment held a larger market share; however, the hybrid segment is expected to grow faster in the coming years.

Based on vehicle segment, the APAC dual clutch transmission market is classified into A/B, C, D, E and above, and SUV. The SUV segment led the largest share of the dual clutch transmission market in 2021, and the same segment is expected to account for the largest market share by 2021–2028.

Based on forward gear, the APAC dual clutch transmission market is classified into 6 and below, 7, and 8 and above. The 7 segment led the dual clutch transmission market with the highest market share in 2021, and the same segment is expected to account for the largest share of the market during the forecast period.

The primary and secondary sources associated with this report on the Asia Pacific dual clutch transmission market include the National Automotive Supply Chain Association (ACMA) and Environmental Protection Agency (EPA).

The Asia Pacific Dual Clutch Transmission Market is valued at US$ Million in 2021, it is projected to reach US$ 5,592.70 Million by 2028.

As per our report Asia Pacific Dual Clutch Transmission Market, the market size is valued at US$ Million in 2021, projecting it to reach US$ 5,592.70 Million by 2028. This translates to a CAGR of approximately 5.5% during the forecast period.

The Asia Pacific Dual Clutch Transmission Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Dual Clutch Transmission Market report:

The Asia Pacific Dual Clutch Transmission Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Dual Clutch Transmission Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Dual Clutch Transmission Market value chain can benefit from the information contained in a comprehensive market report.