Asia Pacific Digital Twin Market

No. of Pages: 119 | Report Code: BMIRE00030977 | Category: Technology, Media and Telecommunications

No. of Pages: 119 | Report Code: BMIRE00030977 | Category: Technology, Media and Telecommunications

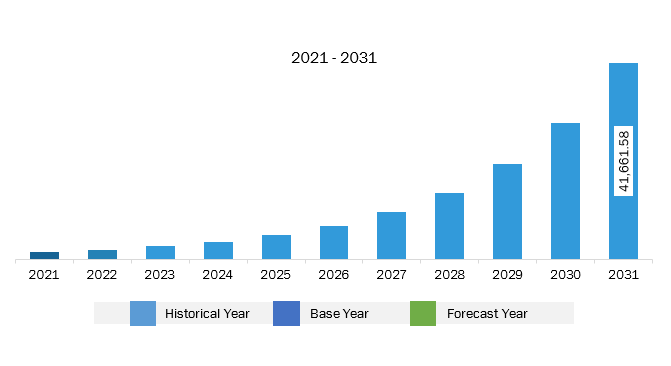

The Asia Pacific digital twin market was valued at US$ 2,725.60 million in 2023 and is expected to reach US$ 41,661.58 million by 2031; it is estimated to register a CAGR of 40.6% from 2023 to 2031. Surging Emphasis on Predictive Maintenance Boosts Asia Pacific Digital Twin Market

Predictive maintenance is perceived as the most advanced means to manage maintenance within manufacturing plants. This maintenance approach is enabled by the implementation of technologies such as AI, ML, the Internet of Things (IoT), and Big Data to monitor equipment and check for part failure. Predictive maintenance helps save maintenance costs by selectively detecting the parts that need attention. It also guides organizations to make small repairs in a timely manner, which aids the extended lifecycle of equipment and helps reduce downtime. A targeted maintenance approach enabled by predictive maintenance reduces unnecessary inspections and repairs and facilitates early intervention to prevent serious and complex problems down the line. Due to such benefits, predictive maintenance has increasingly been used in economically critical industries, such as manufacturing and automotive, in recent years.

Industries increasingly rely on predictive maintenance, as minimizing downtime is a critical aspect of any business. Digital twins operate by continuously gathering data on asset conditions, enabling predictive maintenance solutions to identify patterns and potential failures before they occur. With digital twin technology, maintenance teams can also remotely monitor assets' performance and diagnose issues without physically inspecting them. Thus, a growing focus on predictive maintenance bolsters the digital twin market.Asia Pacific Digital Twin Market Overview

The digital twin market in Asia Pacific is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. The region held the largest digital twin market share in 2023. Enterprises in the region increasingly adopt digital twin solutions. The growing need for digital twin solutions across various industries and the rising focus of organizations on enhancing business sustainability are a few of the factors driving the digital twin market growth in Asia Pacific. According to the Equinix Global Tech Trends Survey 2023, approximately half of IT decision-makers in Asia Pacific are already using digital twins for operational performance optimization and quality control management. Technologies, including AI and digital twins, are gaining huge traction in the region. All such factors boost the digital twin market growth in Asia Pacific.

Enterprises in Asia Pacific are constantly seeking solutions to optimize their business workflow and prevent errors. The enterprises are well aware of the capability of digital twin solutions that help simulate the outcomes of expansion plans and the subsequent results of implementing new strategies prior to execution. The enterprise can mitigate risks that can hamper its business growth. Thus, rising awareness regarding the benefits of digital twins leads to its adoption and fuels its market growth in Asia Pacific.

According to HIMSS23 APAC takeaways, the digital twin technology is widely used in the healthcare industry in Asia Pacific. iMEDWAY, Singapore General Hospital, and Johns Hopkins All Children's Hospital are among the health institutions that have adopted digital twin technology. The proliferation of digital twins in the healthcare industry fuels the Asia Pacific digital twin market share.

Asia Pacific Digital Twin Market Revenue and Forecast to 2031 (US$ Million)

Strategic insights for the Asia Pacific Digital Twin provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific Digital Twin refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

Asia Pacific Digital Twin Strategic Insights

Asia Pacific Digital Twin Report Scope

Report Attribute

Details

Market size in 2023

US$ 2,725.60 Million

Market Size by 2031

US$ 41,661.58 Million

Global CAGR (2023 - 2031)

40.6%

Historical Data

2021-2022

Forecast period

2024-2031

Segments Covered

By Type

By Enterprise Size

By End User

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific Digital Twin Regional Insights

Asia Pacific Digital Twin Market Segmentation

The Asia Pacific digital twin market is categorized into type, enterprise size, end user, and country.

Based on type, the Asia Pacific digital twin market is segmented into asset twin, system twin, process twin, and parts/component twin. The asset twin segment held the largest share of Asia Pacific digital twin market share in 2023.

In terms of enterprise size, the Asia Pacific digital twin market is bifurcated into large enterprises & SMES. The large enterprises segment held a larger share of Asia Pacific digital twin market in 2023.

Based on end user, the Asia Pacific digital twin market is categorized into manufacturing, automotive, aerospace & defense, healthcare, retail, and others. The manufacturing segment held the largest share of Asia Pacific digital twin market in 2023.

By country, the Asia Pacific digital twin market is segmented into China, Japan, South Korea, India, Australia, and the Rest of Asia Pacific. China dominated the Asia Pacific digital twin market share in 2023.

General Electric Co; Microsoft Corp; Siemens AG; Dassault Systemes SE; PTC Inc.; Robert Bosch GmbH; International Business Machines Corp; Oracle Corp; Ansys, Inc.; and Autodesk, Inc. are some of the leading companies operating in the Asia Pacific digital twin market.

The Asia Pacific Digital Twin Market is valued at US$ 2,725.60 Million in 2023, it is projected to reach US$ 41,661.58 Million by 2031.

As per our report Asia Pacific Digital Twin Market, the market size is valued at US$ 2,725.60 Million in 2023, projecting it to reach US$ 41,661.58 Million by 2031. This translates to a CAGR of approximately 40.6% during the forecast period.

The Asia Pacific Digital Twin Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Digital Twin Market report:

The Asia Pacific Digital Twin Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Digital Twin Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Digital Twin Market value chain can benefit from the information contained in a comprehensive market report.