Asia Pacific Digital banking platform Market

No. of Pages: 130 | Report Code: TIPRE00006480 | Category: Banking, Financial Services, and Insurance

No. of Pages: 130 | Report Code: TIPRE00006480 | Category: Banking, Financial Services, and Insurance

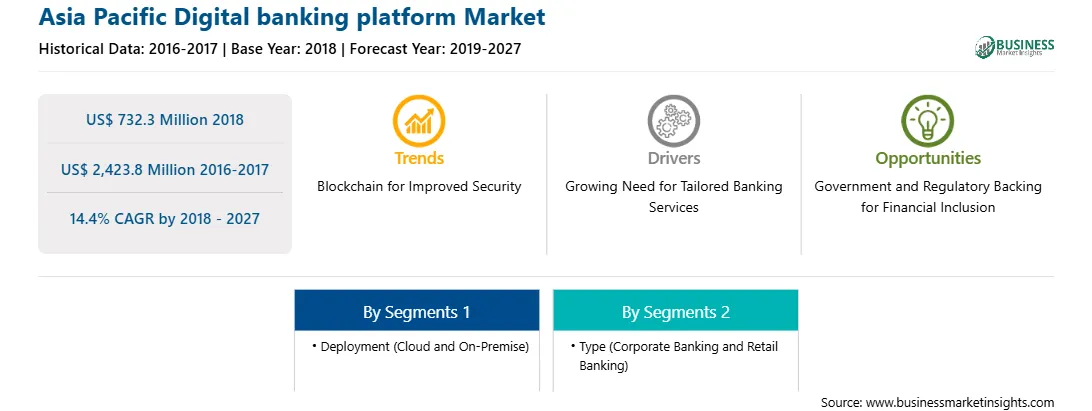

Digital transformation or digitization of businesses refers to the integration of digital technology in various business processes, organizational activities and business models. End-to-end business process optimization, increased operational efficiency, improved customer experience, and reduced costs are few of the factors driving the digital transformation in banking industry. The increasing digital transformation revolution in banking industry presents a massive opportunity for digital banking platform providers as they enable banks to launch digital services faster and enhance customer experience. In addition to this, the proliferation of smart devices, easy availability of internet, advancement of IoT, and artificial intelligence have been increasing exponentially which is further leading to the increasing need of mobile/digital-first strategy among banks. The paradigm shift of banks from traditional channels to digital and automated channels results in multiple benefits ranging from improved efficiency to reduced cost and increased revenue opportunities. In addition to this, the rising technological advancements in cloud computing and storage technology, the power of cloud based digital banking platforms has increased multi-fold during the past few years. This has further created opportunities for players operating in digital banking platform market. Hence, the rising trend of digital transformation in the banking industry is expected to fuel the adoption of digital banking platforms among banks, during the forecast period from 2019 to 2027.

Currently, China is dominating in the Asia-Pacific digital banking platform market owing to the high rate of adoption of new technologies in the region. Factors such as growing digitization across BFSI sector and rising demand for mobile banking solutions are contributing substantially towards the growth of digital banking platform market in Asia-Pacific. The figure given below highlights the revenue share of rest of Asia-Pacific in the Asia-Pacific digital banking platform market in the forecast period:

Strategic insights for the Asia Pacific Digital banking platform provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2018 | US$ 732.3 Million |

| Market Size by 2027 | US$ 2,423.8 Million |

| Global CAGR (2018 - 2027) | 14.4% |

| Historical Data | 2016-2017 |

| Forecast period | 2019-2027 |

| Segments Covered |

By Deployment

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Digital banking platform refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The List of Companies

The Asia Pacific Digital banking platform Market is valued at US$ 732.3 Million in 2018, it is projected to reach US$ 2,423.8 Million by 2027.

As per our report Asia Pacific Digital banking platform Market, the market size is valued at US$ 732.3 Million in 2018, projecting it to reach US$ 2,423.8 Million by 2027. This translates to a CAGR of approximately 14.4% during the forecast period.

The Asia Pacific Digital banking platform Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Digital banking platform Market report:

The Asia Pacific Digital banking platform Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Digital banking platform Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Digital banking platform Market value chain can benefit from the information contained in a comprehensive market report.