Asia-Pacific Debt Collection Software Market

No. of Pages: 122 | Report Code: BMIRE00028210 | Category: Technology, Media and Telecommunications

No. of Pages: 122 | Report Code: BMIRE00028210 | Category: Technology, Media and Telecommunications

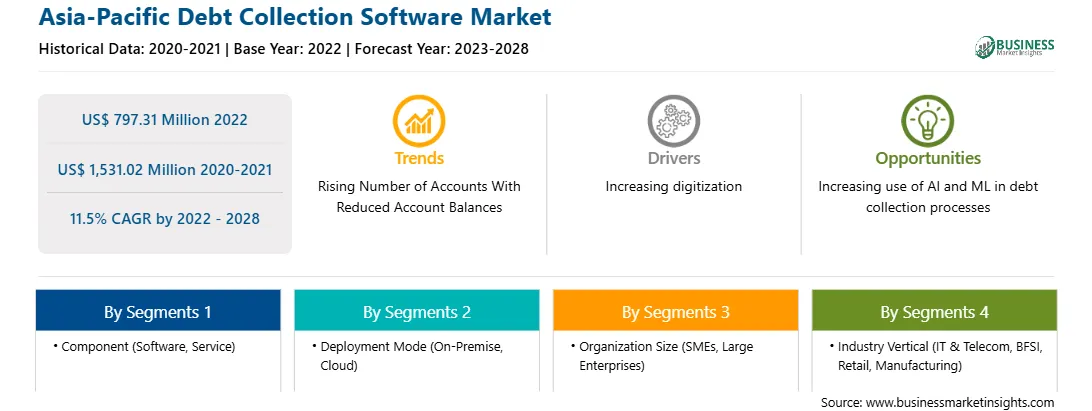

Emerging Trend of Digital Multi-channel Communications & Customer Centric Approach in Asia-Pacific Debt Collection Software Market

Businesses communicate with their customers through multiple digital channels such as SMS, email, IVR, and WhatsApp. Financial institutions must understand this and develop a communication strategy for each channel. Customers should experience the same high level of service regardless of the communication channel. This multi-channel approach greatly extends to collection spaces where customers prefer to be contacted by SMS or email rather than by phone or letter. The debt collection process should include a multi-channel approach to reach customers according to their channel preferences. Furthermore, Customers are accustomed to personalizing services and offers when accessing products and services. A one-size-fits-all approach is no longer optimal and can alienate potential customers. Additionally, it is important to offer customers self-service options. Customer self-service options and empathy are paramount when designing a customer-centric process for collection. Defaulting borrowers can use their channel of choice to settle their debt problems. Thus, the emerging trend of digital multi-channel communications & a customer-centric approach will drive the debt collection software demand in the market during the forecast period.

Asia-Pacific Debt Collection Software Market Overview

China, India, South Korea, Japan, New Zealand, and Australia are the key economies in APAC. Factors such as rising omnichannel collection models, increasing need to minimize bad debt and improve cash flow, and growing adoption of automation in the accounts receivable process are driving the debt collection software market in the region. In April 2021, the Australian Competition and Consumer Commission (ACCC) and the Australian Securities and Investments Commission (ASIC) implemented commonwealth consumer protection laws, including laws relevant to debt collection. The ACCC and ASIC have jointly produced this guideline which aims to assist creditors, collectors, and debtors in understanding their rights and obligations and ensure that debt collection activity is undertaken in a consistent manner while complying with consumer protection laws. Moreover, debt collection software providers are investing significantly to set up their infrastructure and focusing on banks, FinTech, Micro Finance Companies (MFCs), and digital lending firms—providing digital-first and analytics-based approaches for debt collections. Businesses in Asia Pacific are more open to various debt collection methods than other regions, as massive export trading is conducted, and dealers are concerned about the complexity of payment procedures and debt collections. Therefore, companies are willing to buy debt collection software to recover their amount.

Strategic insights for the Asia-Pacific Debt Collection Software provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia-Pacific Debt Collection Software refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia-Pacific Debt Collection Software Strategic Insights

Asia-Pacific Debt Collection Software Report Scope

Report Attribute

Details

Market size in 2022

US$ 797.31 Million

Market Size by 2028

US$ 1,531.02 Million

Global CAGR (2022 - 2028)

11.5%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Component

By Deployment Mode

By Organization Size

By Industry Vertical

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia-Pacific Debt Collection Software Regional Insights

Asia-Pacific Debt Collection Software market Segmentation

The Asia-Pacific debt collection software market is segmented on the basis of component, deployment type, organization size, industry vertical, and country. Based on component, the debt collection software market is segmented into software and service. The software segment registered a larger market share in 2022.

Based on deployment type, the Asia-Pacific debt collection software market is bifurcated into on-premise and cloud. The cloud segment registered a larger market share in 2022.

Based on organization size the Asia-Pacific debt collection software market is segmented into small and medium enterprises (SMEs) and large enterprises. The large enterprises segment registered a larger market share in 2022.

Based on verticals, the Asia-Pacific debt collection software market is segmented into IT & Telecom, BFSI, manufacturing, retail, and others. The BFSI segment registered the largest market share in 2022.

Based on country, the Asia-Pacific debt collection software market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia-Pacific. China dominated the market share in 2022.

CGI INC.; Chetu, Inc.; Experian Information Solutions, Inc.; Exus; FICO; FIS; Loxon Solutions; and Pegasystems Inc. are the leading companies operating in the Asia-Pacific debt collection software market.

The Asia-Pacific Debt Collection Software Market is valued at US$ 797.31 Million in 2022, it is projected to reach US$ 1,531.02 Million by 2028.

As per our report Asia-Pacific Debt Collection Software Market, the market size is valued at US$ 797.31 Million in 2022, projecting it to reach US$ 1,531.02 Million by 2028. This translates to a CAGR of approximately 11.5% during the forecast period.

The Asia-Pacific Debt Collection Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia-Pacific Debt Collection Software Market report:

The Asia-Pacific Debt Collection Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia-Pacific Debt Collection Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia-Pacific Debt Collection Software Market value chain can benefit from the information contained in a comprehensive market report.