Asia Pacific Data Center Colocation Market

No. of Pages: 129 | Report Code: TIPRE00026087 | Category: Technology, Media and Telecommunications

No. of Pages: 129 | Report Code: TIPRE00026087 | Category: Technology, Media and Telecommunications

The data center colocation market in APAC is segmented into China, India, Japan, Australia, South Korea, and the Rest of APAC. Rise in industrialization, low labor costs, positive economic developments, favorable economic policies, and increase in foreign direct investments (FDIs) make APAC a significant contributor to the region’s economic growth. Governments across the APAC region are establishing initiatives such as Made in China 2025 and Make in India, in order to make the respective countries self-sufficient, which is encouraging the growth of the data center colocation market. Substantial growth in the e-commerce and IT & telecom industries due to increasing population and rising penetration of the internet is also boosting the construction of data center colocation facilities. Traditional retail and wholesale businesses are investing in digital technologies to accelerate their e-commerce business and cross-border trade activities. This, in turn, is propelling the growth of the e-commerce industry in Asia Pacific. The generation of huge volumes of data has accelerated the demand for data center colocation facilities in the region to gain flexible scalability, better uptime reliability, improved resource allocation, and enhanced security and compliance. Developments in edge computing is the major factor driving the growth of the APAC data center colocation market.

According to the Organization for Economic Co-operation and Development (OECD), the pandemic affected the region's major economies, including China, India, South Korea, and Vietnam. These markets have experienced low industrial growth during the first two quarters of 2020. Banking, security, monetary administrations, telecom divisions, and data innovation are most affected by unfavorable economic conditions. The lockdown imposed by the pandemic flare-up imposed stringent limitations on the modern area's operation, disrupting the manufacturing network. In many countries, manufacturing operations were halted. In the tumultuous situation, a few activities remained fractured. In any case, the global data center colocation market continued booming due to the surge in interest in data collection, storage, and analysis, which is propelling the industry forward. In addition, the region is known for its robust industrialization, and many companies from diverse industries came with significant data storage requirements to run their operations virtually. Hence, the COVID-19 pandemic has positively influenced the data center colocation market as the number of data centers increased in the region.

Strategic insights for the Asia Pacific Data Center Colocation provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2021 | US$ 15,551.26 Million |

| Market Size by 2028 | US$ 47,990.75 Million |

| Global CAGR (2021 - 2028) | 17.5% |

| Historical Data | 2019-2020 |

| Forecast period | 2022-2028 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Asia-Pacific

|

| Market leaders and key company profiles |

The geographic scope of the Asia Pacific Data Center Colocation refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

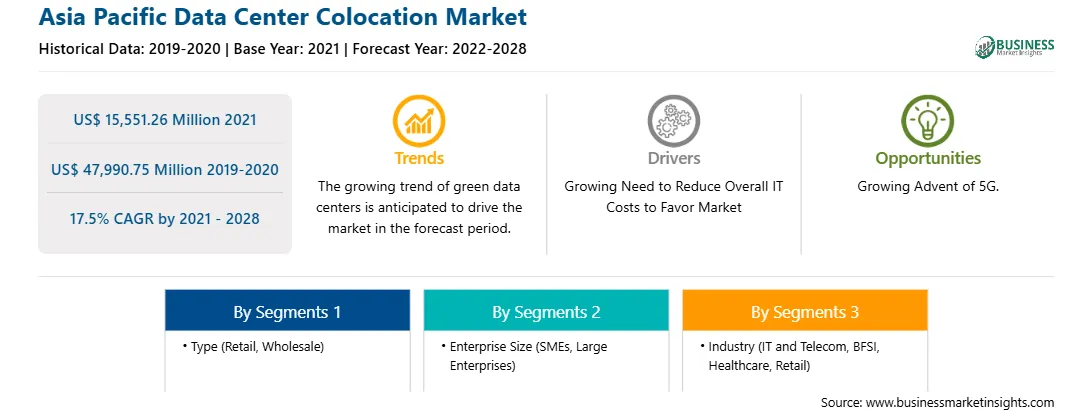

The data center colocation market in APAC is expected to grow from US$ 15,551.26 million in 2021 to US$ 47,990.75 million by 2028; it is estimated to grow at a CAGR of 17.5% from 2021 to 2028. On-site management of data center infrastructure requires highly skilled IT employees. It also incurs infrastructure maintenance and server management expenditures. Moreover, constructing a new data center facility needs high initial investments that increase the overall CAPEX of enterprises. Thus, enterprises are becoming more considerate of the CAPEX spent on constructing mission-critical data centers and seeking several methods to improve return on investment (ROI) and reduce cost. The growing focus on reducing IT costs encourages business owners to explore innovative IT infrastructure options. As a large number of enterprises are shifting their IT infrastructures to the cloud to attain zero downtime and address the need to reduce IT infrastructure expenses, high-power and physical security requirements serve as major elements driving the colocation market. Today, enterprises are switching to data center colocation providers for bandwidth, space, power, and value-added services (VAS), such as internet solutions, interconnection services, and skilled managed IT services depending upon their size and requirement. This, in turn, supports increasing business potential by reducing operational expenditure, thereby maximizing the ability to concentrate on the core business. The rising demand for cloud-based colocation services with the majority of the workforce shifting to remote working is propelling the growth of the data center colocation market.

The APAC data center colocation market is segmented into type, enterprise size, industry, and country. Based on type, the market is segmented into retail and wholesale. The retail segment dominated the market in 2020 and wholesale segment is expected to be the fastest growing during the forecast period. Based on enterprise size, the data center colocation market is divided into SMEs and large enterprises. The large enterprises segment dominated the market in 2020 and SMEs segment is expected to be the fastest growing during the forecast period. Further, based on industry, the market is segmented into IT & Telecom, BFSI, healthcare, retail, and others. The IT & Telecom segment dominated the market in 2020 and BFSI segment is expected to be the fastest growing during the forecast period.

A few major primary and secondary sources referred to for preparing this report on data center colocation market in APAC are company websites, annual reports, financial reports, national government documents, and statistical database, among others. Major companies listed in the report are AT&T Intellectual Property; CyrusOne, Inc.; Cyxtera Technologies, Inc.; Digital Realty Trust LP; Equinix Inc.; Global Switch; NTT Communications Corporation; Telehouse; and Verizon Partner Solutions. are among others.

The Asia Pacific Data Center Colocation Market is valued at US$ 15,551.26 Million in 2021, it is projected to reach US$ 47,990.75 Million by 2028.

As per our report Asia Pacific Data Center Colocation Market, the market size is valued at US$ 15,551.26 Million in 2021, projecting it to reach US$ 47,990.75 Million by 2028. This translates to a CAGR of approximately 17.5% during the forecast period.

The Asia Pacific Data Center Colocation Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Data Center Colocation Market report:

The Asia Pacific Data Center Colocation Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Data Center Colocation Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Data Center Colocation Market value chain can benefit from the information contained in a comprehensive market report.